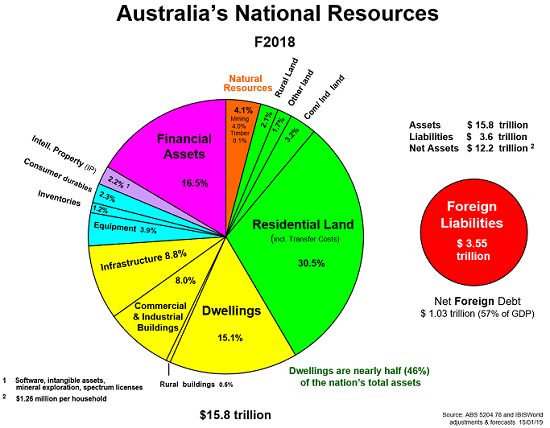

Housing in Australia is the nation’s single most important resource, accounting for 46% of the total $15.8 trillion value of all assets in 2018. So, businesses, governments and householders get nervous when the market becomes discombobulated as it has now been for a year or more, with uncertainty the order-of-the-day.

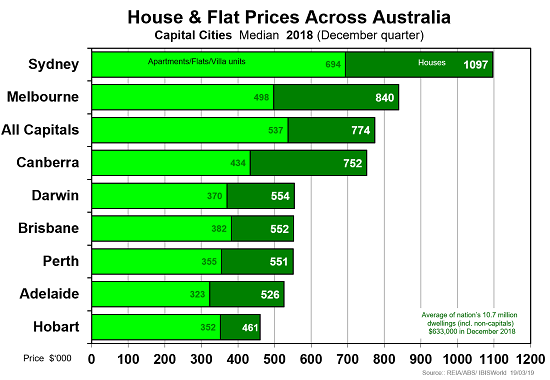

In June 2018, there were 10.6 million dwellings valued at $7.2 trillion, an average value of $680,400. An estimated 9.6 million were occupied, with the balance of nearly 1 million unoccupied (holiday and otherwise being interim or for sale, temporary or long-term vacancies).

Affordability of housing

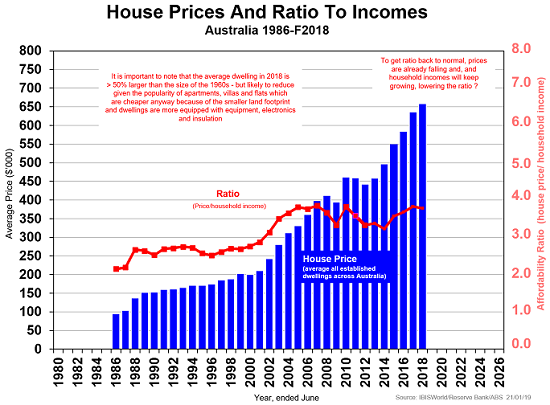

The ratio of dwelling prices (the blue bars below) to disposable household income was 3.98 in 2018, a little higher than the previous record of 2007 and 2010, but now easing down due to falling prices.

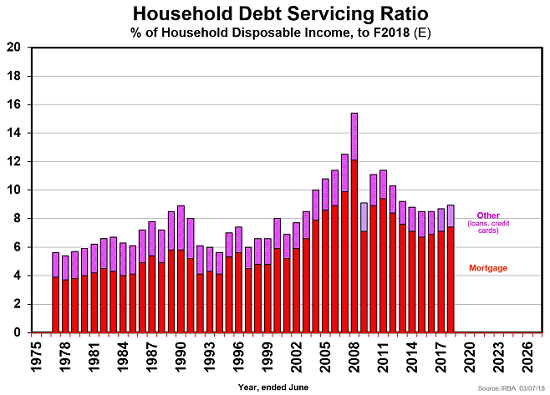

In June 2018, the interest on household debt of mortgages, loans and credit cards as a percentage of total disposable household income was 9.0%, mostly comprising mortgage interest at 7.4%. This was much lower (due to record low interest rates) than the peak of 15.4% some 10 years earlier in 2008 (when mortgage interest was 12.1% of disposable household income).

The continuing low mortgage rates is helping new home owners weather a potential affordability impasse if not disaster, although plunging dwelling prices creates the problem of debt exceeding asset value in many cases. Lenders will need to exercise patience in most of these cases, relying on debt servicing ability more than temporary negative net asset value.

Major city house prices

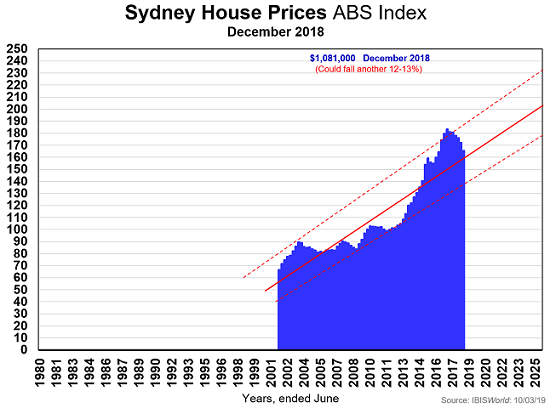

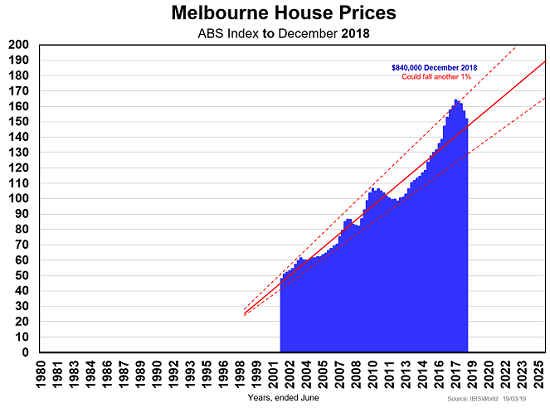

The current dwelling price correction, for the nation’s near-11 million dwellings, is warranted and dramatic, and there is further to go. But only Sydney and Melbourne houses had ‘bubbles’ while other capital cities were over-trend.

In 2019 and possibly 2020, we expect further falls of around 7 to 8% on a national average basis. This converts to a 13% national fall from the peak in December 2017. Sydney houses could fall by up to 22-23% from peak to trough, having been in a bubble. However, continuing low interest rates (eventually rising slowly), rising incomes, government incentives, and lender accommodation could minimise the dangers.

Almost $400 billion was spent on dwelling finance over recent years, of which over a fifth was on new dwellings. This has been crowding out investment in other wealth-producing investments for growth, efficiency and competitiveness.

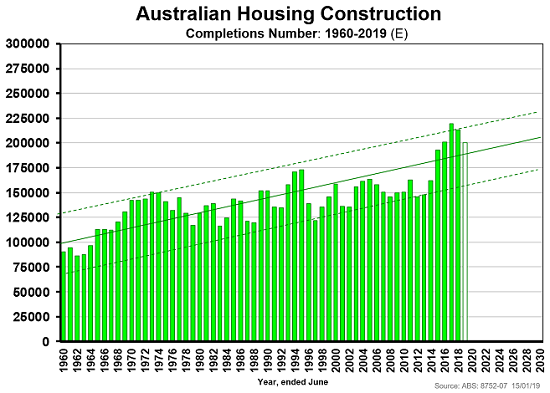

It is astonishing that the nation increased the output of new dwellings by almost 50% from less than 148,000 of 2013 to almost 220,000 in 2017. In just 4 years! A fall of 30% from this peak by FY2022 is now possible. NSW, having had a more spectacular rise, can be expected to have a more spectacular fall.

But by a few years into the 2020s, prices and construction numbers will be on the rise again. We may have a black hole in the interim, but there is always some blue sky above that greets us as we come out of it.

Phil Ruthven is Founder of the Ruthven Institute, Founder of IBISWorld and widely-recognised as Australia’s leading futurist.