One of the important principles of Cuffelinks is that we don’t promote specific investment products. However, I am going to break that rule and talk about Third Link Growth Fund (‘Third Link’), in recognition of its five year track record. Third Link is a managed investment scheme which I created and manage on an ongoing basis. I am confident that after reading this article you will feel it is less about a product promotion and more about an innovative community service.

What is Third Link?

Third Link invests in Australian shares. It is what is known as a ‘fund of funds’ in that it invests primarily in other Australian share funds managed by professional investors. I select and monitor these managers and decide how much to invest with each. My aim for Third Link is to outperform the S&P/ASX300 Accumulation Index after fees over rolling five year periods.

Third Link commenced in 2008 and currently has around $55 million under management. It is open to anyone (minimum $20,000) and many of the investors are SMSFs. Investors pay a management fee of 1.4% per annum. Third Link’s website (www.thirdlink.com.au) explains all aspects of the Fund and contains the legally required Product Disclosure Statement and application form.

Well, you may think that so far this is a blatant product promotion and hardly conforms to the independent nature of Cuffelinks. But here is the twist. The 1.4% management fees generated for my management company, less costs incurred in running the Fund (which are minimal), are donated to charity. And obviously, the more Third Link grows in size from either new applications or growth in the market value of its assets, the greater are the regular contributions to the supported charities. In its five year history the Fund has generated nearly $2,000,000 for the charitable sector, with the monthly amount donated exceeding $50,000 and growing. Not a bad regular annuity stream!

The theme of the charitable giving is helping children and young people thrive. Third Link now supports the following not-for-profit groups:

- Australian Indigenous Mentoring Experience (AIME), whose mission is education equality, where indigenous students perform and finish school at the same rate as every Australian child

- Batyr, whose mission is ‘giving a voice to the elephant in the room’, bringing young people’s social and mental health issues out in the open

- Beacon Foundation, whose mission is to influence the attitudes and culture of Australians so that each young person develops an independent will to achieve personal success through gainful activities for themselves and their community

- The REAPing Rewards Program, to benefit early childhood learning establishments in Australia’s regional, rural and remote communities with infrastructure and resourcing needs

- National Centre for Childhood Grief (NCCG), who provide loving professional support and guidance in a safe place where children grieving a death of a parent can share their experience as they learn to live with the impact on their lives and

- Outward Bound Australia (OBA), who provide challenging outdoor experiences that help young people to discover, develop and achieve their full potential.

More information on each of these groups can be found on the Third Link website.

How is money managed?

So Third Link is a winner for the charitable sector, but what’s in it for investors? I believe there are multiple advantages.

Firstly, through a single investment in Third Link, investors get exposure to a range of underlying Australian share portfolios of different investment managers. These managers include Aberdeen Standard Investments (formerly Aberdeen Asset Management), Bennelong Funds Management, Colonial First State Global Asset Management, Cooper Investors, Eley Griffiths Group, Goldman Sachs Asset Management, JBWere, Montgomery Investment Management, Paradice Investment Management, Pengana Capital, and Greencape Capital. The particular fund of these managers that Third Link invests in is listed on the website.

Secondly, each of the underlying managers waives its fees (both management fees and performance fees, if applicable). This ensures my costs of managing Third Link are kept to a minimum, meaning more is donated to charity. Since the underlying managers forgo the normal performance fees they may receive, the total 1.4% fee that investors pay makes the Fund good value. If you invested in these managers directly in the same proportion as Third Link, then for most periods, the fees would be materially more compared to accessing them via Third Link.

Thirdly, I have been in the investment management industry for nearly three decades (and have the grey hair to prove it!), which means Third Link investors have access to my considerable professional experience in selecting and monitoring the underlying managers.

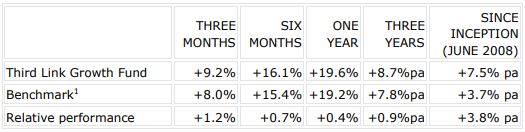

And finally, the investment performance of Third Link has added value, as shown in the table below, which shows the Fund performance (after fees and assuming income distributions were reinvested) as at the end of March 2013 (the most recent quarterly figures available):

1 Since February 2012 the benchmark has been the S&P/ASX 300 Accumulation Index. Before that it was the Morningstar Multi-Sector Growth Market Index. Returns greater than 1 year are expressed as annual compound returns. Past performance is not indicative of future performance. Returns can be volatile.

'Fund of funds' management

Most investment managers crow about good performance when they have achieved it, so I’m not going to be the exception. Generally, over the history of the investment management industry, fund of funds structures such as Third Link often underperform their benchmark. Why is this? My theory is that ‘investment technicians’ who construct fund of fund portfolios fail to appreciate that good investment management is more about art than science, and more prone to fear and greed rather than logic. Others construct a portfolio of managers in a very ‘scientific’ way, combining value and growth managers with small cap and large cap managers, etc etc … and the end result is often a defacto replication of the benchmark they are trying to beat. After they subtract their management fees, they naturally underperform.

For me, picking good investment managers is about taking a long-term view of how they manage money and what their results have been over long periods of time and in different environments. I don’t get obsessed about their particular style of management or the volatility of their portfolios over short periods of time. I just want to be convinced that they have the ability to significantly outperform the market they operate in. I need to be convinced they don’t hug benchmarks and they must think independently of the herd. Not many do this but they are out there. Great investment managers, like great artists or musicians or craftsman, often have an innate ability that is impossible to obtain from a text book.

While I have the microphone, it would be remiss of me not to acknowledge the many other service providers who do pro bono work for Third Link. Because they waive their fees, the costs of administering Third Link are kept to a minimum meaning more is donated to charity. This list includes Treasury Group Investment Services Limited (the responsible entity), RBC Investor Services Limited (the custodian and administrator), Minter Ellison (legal work in connection with the Fund), BlueChip Communication Group (communications & PR strategy), Ernst & Young (auditors of the Fund and the investment manager), Deloitte (tax advisers to the Fund), Nexia Australia (tax advisers to the investment manager), CompliSpace (risk management tool provider), Gallagher Broking Services (insurance broking service provider), DUAL Australia (insurance provider), BT Financial Group (administrative platform for superannuation investing), Mercer (Investment data and analytics provider), Zenith Investment Partners (investment research provider) and Vince Sorrenti (MC and entertainer at Third Link thank you events).

Conclusion

I conclude from the above (and I hope you do too) that Third Link Growth Fund is a win win for both the charitable sector and investors. It also demonstrates the generosity of many players in the financial services industry.

And I’ll finish with a favourite quote from Woodrow Wilson, the 28th President of the United States (1913–1921):

“You are not here to merely make a living. You are here in order to enable the world to live more amply, with greater vision, with a finer spirit of hope and achievement. You are here to enrich the world, and you impoverish yourself if you forget the errand.”

(Treasury Group Investment Services Limited (TIS; AFSL 227326) is the responsible entity and issuer of the Third Link Growth Fund (Fund). Third Link Investment Managers Pty Limited (Third Link; AFSL 321611) has been appointed by TIS to invest and manage the investments of the Fund. Applications can only be made on the form in the current PDS, dated 20 February 2012. You should consider the PDS before deciding to invest or continuing to invest.)