“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” Upton Sinclair, Author and Journalist (1878-1968)

Towers Watson is a global consulting company with over 14,000 associates. A few months ago, they published the results of a survey which had some worrying conclusions. The publication was called ‘Our industry has a problem: the investment industry has been built by the intermediaries for the intermediaries’.

(My interview with the author of the report, Tim Hodgson, appears in the next article in Cuffelinks).

It is worth reading the full report as it is only a few pages, but here are some highlights. To many Australians involved in the superannuation industry with fiduciary obligations of acting as a trustee, the results will be disturbing.

Is the industry for the intermediaries or the end investors?

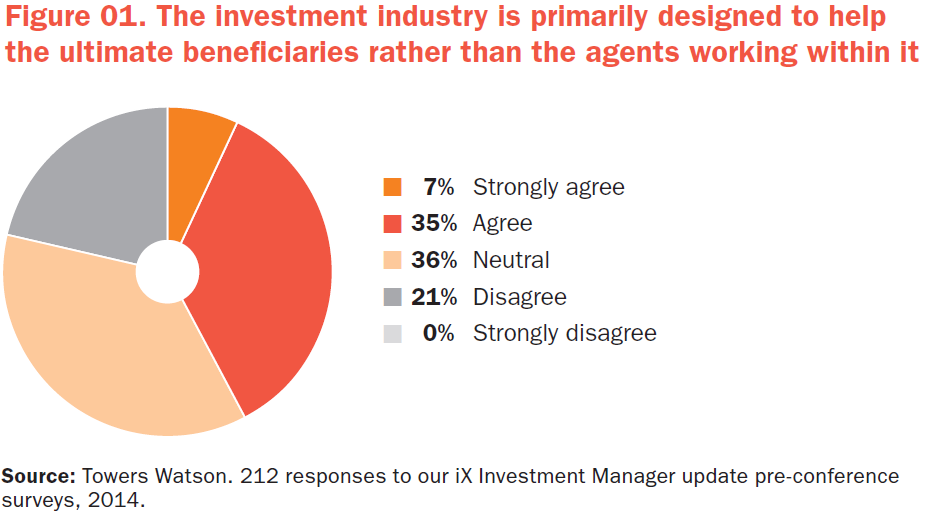

In the survey, the first statement (which is repeated in the poll on our website) was:

These are the responses from 212 employees in UK- and US-based asset management organisations. Amazingly, a minority of only 42% agreed that the investment industry is designed to help the end customers. This low level of agreement is a terrible indictment on the perceptions of certain people in the US and UK, and let’s hope it would be much higher in Australia. As Towers Watson says, other surveys show financial services is the least trusted industry (for example, the 2014 Edelman Trust Barometer), suggesting the end saver knows what the industry thinks of them.

In searching for the reasons the industry has a problem, Towers Watson also asked whether too much effort is spent searching for alpha (performance above the market), and only 18% agreed with this, with 14% neutral.

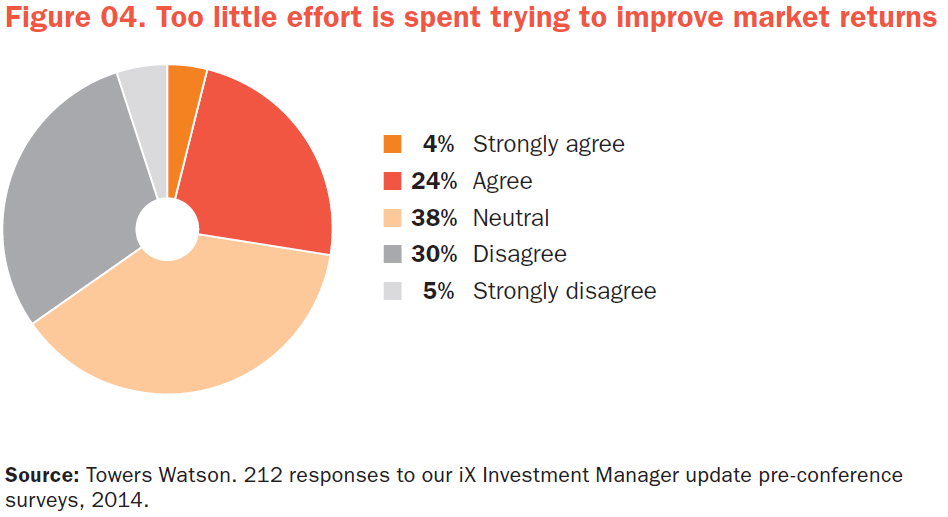

Then an interesting question followed that is not often discussed by the industry:

So 28% agreed the industry does not put effort into improving market returns (not alpha), with a large 38% neutral. That leaves only 35% who disagreed.

This is worth pondering. How could the industry improve market returns (this is not a question on market outperformance)? After all, this is what sustainability and fiduciary responsibilities are supposed to achieve. Some ways to improve market returns include ensuring as much of the market return goes to end investors as possible rather than intermediaries, minimising other leakages such as transaction costs, and greater constructive engagement with corporate management (which might in turn include reducing excessive compensation of executives).

Short-termism

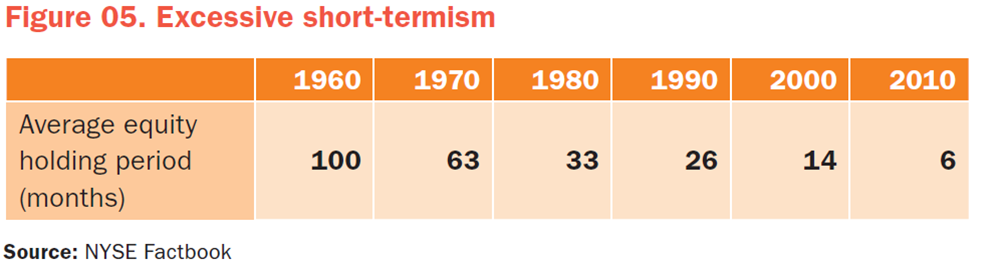

The other reason for the industry’s problems is short-termism, which is value destructive because it leads to higher costs and over-reaction to noise. According to New York Stock Exchange data, the average equity holding period has fallen from 100 months in 1960 to 6 months now.

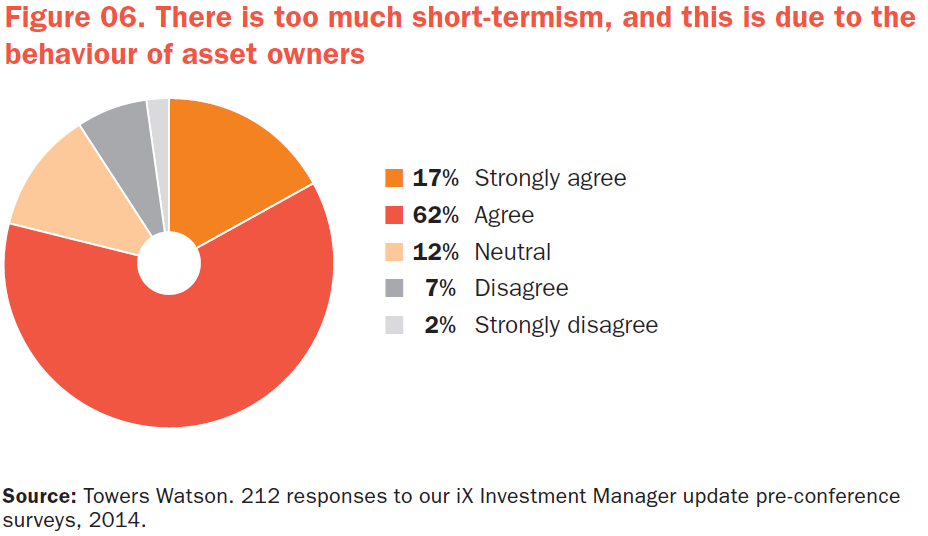

A surprising 79% of responses said there is too much short-termism, but blamed the asset owners (not the asset managers). This might be managers on the receiving end of being fired after a period of poor performance. But it’s interesting to see such a high proportion criticise short-termism, when the daily reporting of prices and immediate market responses is endemic in the industry.

Conclusions

Towers Watson makes a chunk of its living from the investment management business, and yet it reports this most critical and damning of positions:

“In our opinion, the value proposition that customers need is well-structured, fairly priced, and honestly and skilfully delivered investment outcomes. We believe the industry is falling short on all of these aspirations.”

It is not due to one problem. Asset managers work for themselves not their end customers, there’s too much focus on alpha and not enough on improving market returns, and the industry is obsessed with short-termism. We have a lot to answer for while we pay ourselves so well.

Graham Hand was General Manager, Capital Markets at Commonwealth Bank; Deputy Treasurer at State Bank of NSW; Managing Director Treasury at NatWest Markets and General Manager, Funding & Alliances at Colonial First State.