In Part 1, I challenged the conventional notion that diversification is the key to building wealth. In Part 2, I propose that sensible diversification is indeed critical for most investors, but not for ‘building wealth’. Turning wealth accumulated over a working life into reliable, regular, inflation-adjusted cash flows for the rest of a retirement when a person is no longer working is a very different goal to ‘building wealth’.

As demonstrated in Part 1, building a great fortune or even a modest fortune is almost always the result of concentration and focus, not diversification. Even the father of diversified index investing, John Bogle, built his wealth by concentrating all of his time, effort and money into building one great business – Vanguard. Most great wealth comes from building businesses, while more modest wealth generally comes from people’s professions and careers. Either way the wealth is built primarily from ‘human capital’ - the time, skill and expertise of the individual, and by focusing that human capital on a particular business, profession or career.

Building wealth requires taking risks. To build wealth you start young, put everything you have into your specialised business, profession or career. It is high risk but you have plenty of time in front of you, no dependants relying on you, no expensive lifestyle to support, the flexibility to be able to fail a few times, start again and try new things, time to spend a decade or so investing in your skills and expertise to build your chosen business, profession or career. You can afford to take big risks when you are young and just starting out.

Turn what you’ve built into a reliable income stream

However, after having made your money by applying your human capital to your business, profession or career, sooner or later most people want to ‘retire’ (or are required by legal or physical limitations). That means turning what you have built during your working life into reliable, regular, inflation-adjusted cash flows to fund living expenses for yourself and your dependents for perhaps several decades. That is a very different goal to ‘building wealth’, and it does require sensible diversification and disciplined risk management. The role of diversification is primarily to protect the downside and limit losses when you are no longer willing or able to return to work to replenish the losses.

The problem is that many retirees and pre-retirees have a stated goal of ‘building wealth’ – which usually requires a high risk of failure if they take the types of risks they can no longer afford to take.

This perceived need to build wealth often stems from a number of motivations. In many cases their lifestyle aspirations have been set at unrealistically high levels, based on unsustainable boom-time asset prices, salaries and or bonuses. They look at the returns of say 8% per year from diversified portfolios and say, ‘but that won’t get me the 100 foot boat or the beach house in Noosa’. Indeed it won’t, and so they go off chasing then next hot stock, leveraged structured product, or forex trading scheme or scams.

Other people are inspired by stories of vast fortunes built by people such as Warren Buffett, Richard Branson and George Soros and they now want to ‘invest like Buffett’ to build wealth with their retirement nest egg.

Many investors want to get back the wealth they ‘lost’ in the global financial crisis or through other failed investments when they sold out at the bottom or, sadly, in many thousands of cases, were sold out at the bottom by their margin lender or bank. If they lost half or two thirds of their money, they see it as a perfectly reasonable goal to want to double or treble what they have left in a few short years, to ‘get it back’.

Building wealth like this is possible of course but it requires taking concentrated risks they probably can no longer afford to take.

Invest like Buffett using other peoples’ money

People say they aspire to invest like Buffett but let’s see what that actually means. Many books and articles have been written about Buffett, and he has written annual reports to his investors since 1957 (freely available here). Essentially his method boils down to investing in just a few great companies that you analyse and understand in intricate detail, taking controlling stakes, or at least significant minority stakes in them so you can control or influence board decisions, especially CEO remuneration and capital allocation decisions of the company.

Buffett started out in the early years applying the principles of his professor and boss Ben Graham (known as the father of value investing) and other Graham disciples like Walter Schloss. This text-book approach involves diversification across a large number of companies bought below their intrinsic value, with little regard for the quality of management and little interest in understanding each business in detail. But Buffett very quickly switched from broad diversification to focus on a very concentrated portfolio of just a few great businesses he studied and understood inside out and intended to hold forever.

Buffett’s transition from text-book Graham-style diversification to extreme concentration probably came in the late 1960s or early 1970s, marked by the purchases of GEICO (1972) and Washington Post (1973), and most certainly by the late 1970s, with Capital Cities (from 1977). We can see this shift in Buffett’s approach when he quoted Keynes’ view that there are “seldom more than two or three enterprises” worth investing in (1991 Berkshire Hathaway Annual Report p.15).

One extreme illustration of Buffett’s view is his 1992 suggestion that if you were “going away for 10 years and you wanted to make one investment” and “you couldn’t change it while you’re gone”, then you could be confident owning just one stock – Coca-Cola (quoted in Kilpatrick, ‘Warren Buffett: The Good Guy of Wall Street’, 1992, p.123).

That’s all your eggs in one just basket. At that time Coke was 40% of Berkshire’s portfolio and, yes the share price did rise by 130% in the 10 years following 1992. A huge bet but it paid off.

The main influences of this shift to concentration were probably Philip Fisher (one of Buffett’s main mentors who used the ‘put your eggs in one basket’ metaphor repeatedly, and the idea that it is better to own a few excellent businesses you know very well), Bernard Baruch (one cannot possible truly understand more than a small number of businesses), and Keynes (investment success comes from a very small number of great investments).

Another key influence was probably Charlie Munger, who often used the eggs in one basket metaphor and ran a far more concentrated portfolio than even Buffett. The two met in 1960 and Munger joined Berkshire in 1978.

Buffett aimed to make just 10 investment decisions over his entire lifetime (Buffett quoted in Forbes, 25 May 1992, p.298, also M. Buffett, Buffettology, p.174). That really does focus the mind on concentrating on just a few big decisions, as in ‘A few big ideas - small ones just won’t do.’ (Berkshire Hathaway 1984 Annual Report p.1).

A retiree can’t invest like Warren Buffett personally

The various books and articles on Buffett and the annual reports are about Buffett investing Berkshire Hathaway’s funds (and the partnership funds prior to 1969), but Buffett’s experience of investing his personal cash is even more concentrated, and impressive.

After Ben Graham retired and closed down his firm, Buffett went out on his own. He invested just $100 of his own cash at age 25 in 1956 and seven limited partners invested a total of $105,000 in cash into Buffett’s first limited partnership, with Buffett managing the money as the ‘general partner’. He built his stake in the partnership via the fee structure. The fund paid the limited partners 6% interest on their money plus 75% of the profits in excess of 6%, with the other 25% of profits above 6% accruing to Buffett’s stake in the partnership.

When speaking of his and his wife’s wealth in 1964, he said, “all our eggs are in the BPL [Berkshire Partnership Ltd] basket and they will continue to be. I can't promise results but I can promise a common destiny.” (1963 Buffett Limited Partnership Report, 18 January 1964, p.6).

By 1969 his personal share of the partnership equity, by way of the investment management fee structure, had accrued to $25 million. He liquidated the partnership and distributed the assets to the partners. One of the main assets was Berkshire Hathaway, which was transformed into the holding company and he has controlled it ever since via his shareholding. Right from his initial $100 cash investment into the first partnership he re-invested all of his earnings and so all of his personal wealth was concentrated in a single venture (Hagstrom, The Warren Buffett Way, p.3).

So he didn’t ‘invest’ his cash at all (except $100). His wealth was from his human capital. He has invested Berkshire’s funds wonderfully well, but his own personal wealth was built by investing other people’s money – the limited partners’ money in his partnerships; the cash flows from insurance premia provided by the insurance customers of Berkshire’s insurance businesses; and borrowed money. The return on his own $100 cash contribution in 1956 (plus 57 years of his time and energy) has been in the order of 40% pa compound per year. It is a fantastic return over more than half a century, but how relevant this is to the goals and needs of today’s retirees?

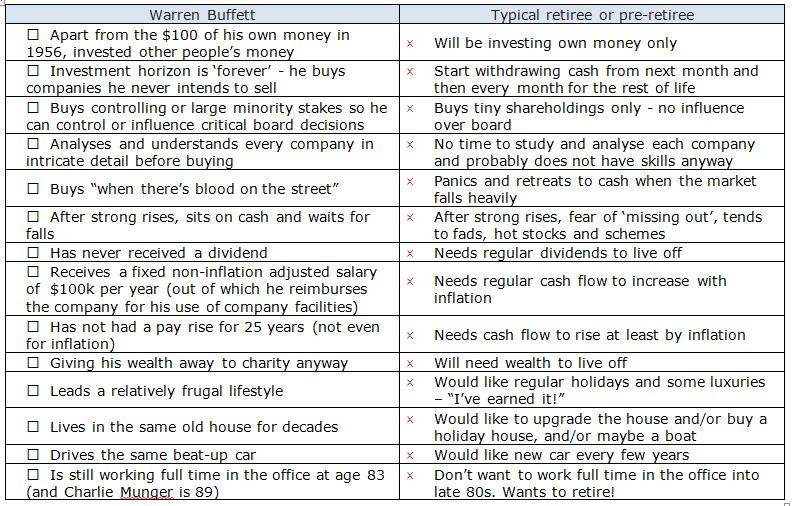

How is Buffett anything like a 60-year-old dentist, plumber, airline pilot or teacher who either cannot or does not want to work full-time anymore? It is the opposite of Buffett’s concentrated approach to investing to build wealth. I thoroughly recommend reading book and articles about Buffett, and in particular the annual reports (and from others like Soros). There are many valuable common sense lessons that can be applied to everyday investing, but it’s important to recognise that we’re talking about completely different goals and expectations.

Building wealth requires concentration and focus and full-time hard work, but turning that wealth into reliable real cash flows for decades in retirement requires sensible diversification and disciplined risk management.

It is all a question of understanding each investor’s individual cash flow requirements, their willingness and ability to bear risks, and then setting realistic goals and expectations about how to invest their money in order to maximise the probability of achieving those goals to provide peace of mind for themselves and their families.

The bottom line is that you can’t invest like Warren Buffett if you want to retire and focus on preservation of capital.

Ashley Owen is Joint Chief Executive Officer of Philo Capital Advisers. Disclosure: the author owns shares in Berkshire Hathaway.