While most Australians think of Europe as a great holiday destination, it probably remains under-appreciated as an investment opportunity by many investors. After all, Europe comprises a wide range of countries with differing cultures and business climates. The region’s economy has also struggled in recent years with relatively low growth and stubborn price deflation, and debt problems in countries such as Italy and Greece.

Europe offers a potentially good investment destination and diversifier for Australians. Thanks to the continued growth in the Australian exchange traded fund (ETF) industry, it has never been easier for Australians to get exposure to European companies.

Europe’s equity performance has been surprisingly good over the medium/long-term

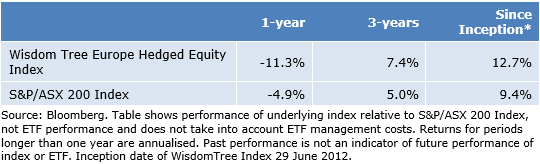

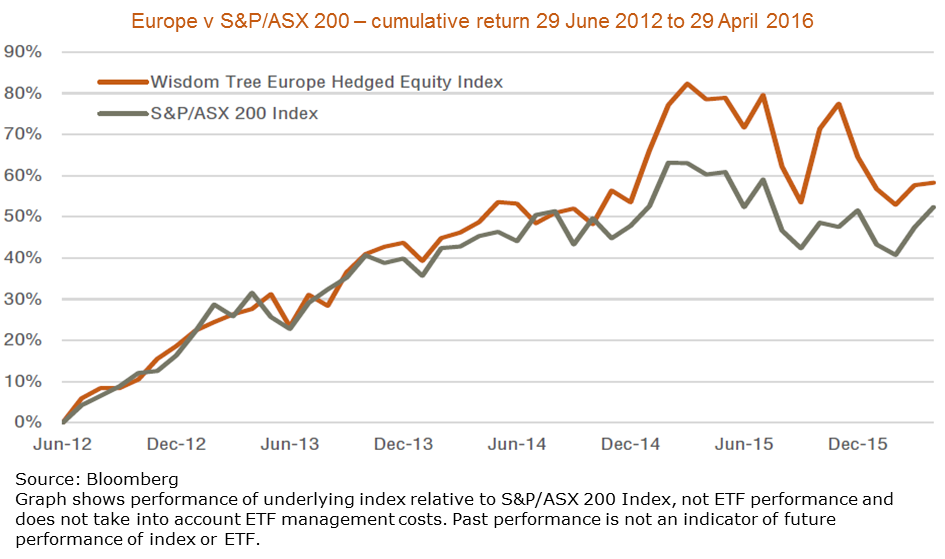

Although its economies have continued to struggle of late and the European equity markets have pulled back over the past year, it has performed relatively well in recent years and its medium-term prospects remain favourable. As seen in the table and chart below, the Wisdom Tree Europe Hedged Equity Index (in local currency terms) has produced annual compound returns of 7.4% p.a. over the three years to April 2016, compared to 5.0% p.a. for the Australian S&P/ASX 200 Index.

Europe v S&P/ASX200 Total Return equity performance to 29 April 2016, local currency

Unlike Australia, Europe is a net commodity importer, meaning it has benefited from the decline in commodity prices in recent years. What’s more, due to low inflation and relatively more spare capacity, the European Central Bank is likely to remain more accommodative than the US Federal Reserve for the foreseeable future, meaning European stocks could benefit from ongoing monetary stimulus and a cheaper and more competitive currency.

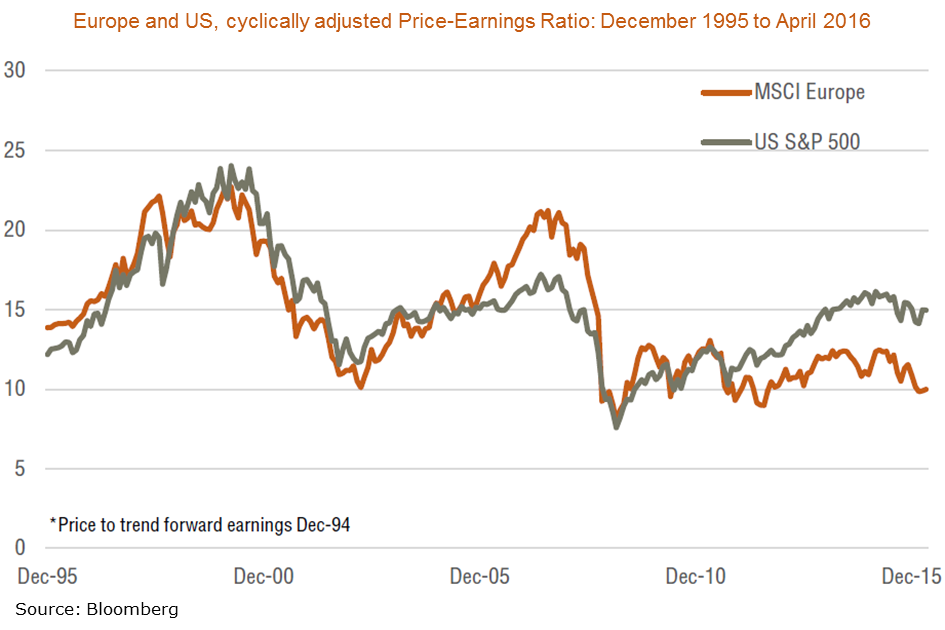

Relative valuations for Europe are relatively attractive

Relative to underlying growth in their respective economies, the European equity market appears to offer comparably good value to that of the United States. As the chart below suggests, although both markets have broadly posted similar performance over past cycles, the US equity market has outperformed that of Europe in recent years. There is catch up potential in Europe should the historical performance similarities return in the future.

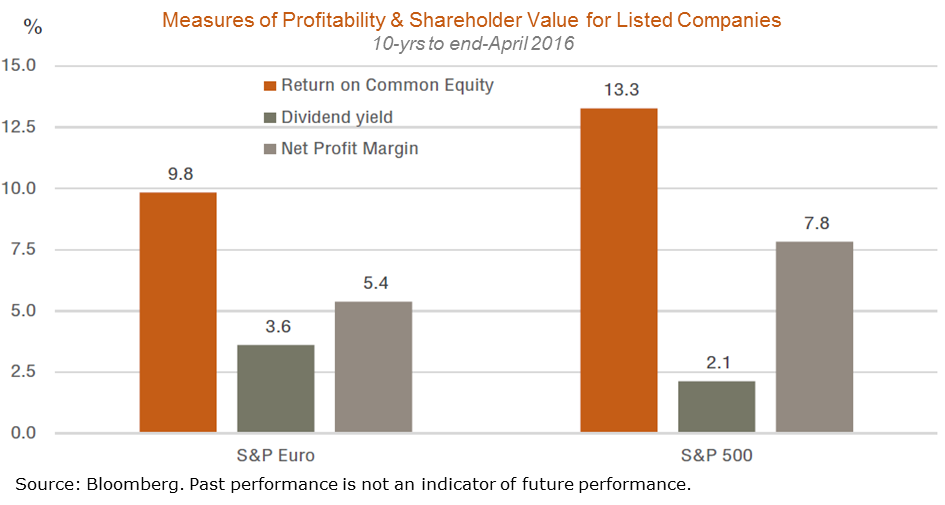

Good dividends and scope for better profitability in Europe

Another feature of European equities is that companies in the region tend to pay out higher dividends than their US counterparts, meaning they offer one of the better sources of income potential for Australian investors seeking international equity exposure. On some profitability measures – such as return on equity and profit margins - European companies still tend to lag US companies, so there’s scope to improve earnings as companies strive to improve shareholder value.

A source of diversity

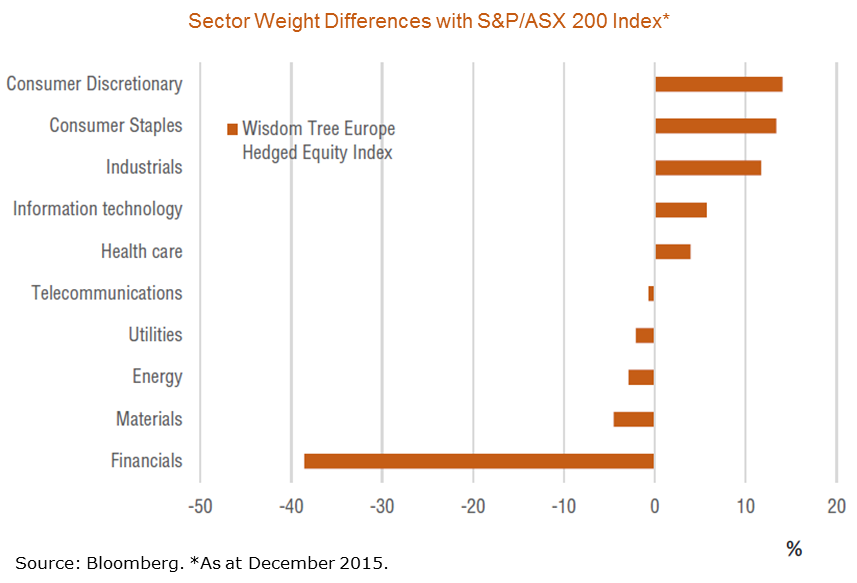

There is value in having a diversified portfolio, and Europe offers different sector exposures from those found in Australia, with notably less weighting to financials, offset by more exposure to the consumer, industrial and technology sectors.

An investment in Europe is easier than ever

The growth of ETFs has made it easier to invest in Europe, with several products available on the ASX providing Australian investors with a diversified exposure to the European equity market in a single, transparent fund with competitive management costs. For example, the ASX-traded ETF, HEUR, aims to track the Wisdom Tree Europe Hedged Equity Index.

When investing internationally, investors have a choice to either hedge or not to hedge currency risk. Not hedging currency risk effectively means investment performance will often reflect two disparate factors: the performance of the international equity market itself, and the performance of that market’s relevant currency. In the case of an unhedged investment in Europe by Australian investors, for example, any returns from the equity market would be offset to the extent the Euro fell against the Australian dollar – though, of course, returns would also be boosted if the Euro rose in value.

Another advantage of currency hedging in Europe with very low (in fact currently negative) overnight interest rates is that it gives Australian investors the ‘carry trade’ (i.e. the relative difference between European interest rates and those in Australia). This carry trade currently provides approximately 2.25% per annum benefit. The interest rate differential boosts returns over time (so long as the interest rate differential remains positive). This is because the process of hedging currency risk is akin to borrowing Euros (at very low rates) – to offset the currency exposure from the investment in European equities – and then using these borrowings to buy Australian dollars which earn a higher interest rate return.

David Bassanese is Chief Economist at BetaShares Capital. This article is general information for educational purposes and does not address the specific needs of any individual investor.