On Sunday 27 September 2020, sections of the media received an invitation to a 'summit' the next day, as if a crisis needed immediate attention. Indeed, the Australian Council of Trade Unions (ACTU) arranged an ‘Emergency Superannuation Summit’ because “We are at a major crossroads on the future of superannuation in Australia.” The focus was “on highlighting the economic benefits of superannuation and the impact that scrapping the increase will have on the Australian people, now and into the future.”

The esteemed panel included Bill Kelty (former ACTU Secretary and with Paul Keating considered the fathers of the super system), John Hewson (former Liberal Leader), Heather Ridout (former Chair of Australian Super), Emma Dawson (Executive Director, Per Capita), Sheree Clarke (aged care nurse) and Michele O’Neil (ACTU President).

This extract focusses on the introduction by Michele O’Neil, and the comments by Bill Kelty as an insight into where our superannuation system came from.

The full recording of the Summit is linked here.

There was nobody representing the ‘other side’ with arguments to delay the increase in the Superannuation Guarantee (SG), such as The Grattan Institute or the Productivity Commission. Validation for those pushing Scott Morrison to abandon his election commitment to honour the SG increase recently came from Reserve Bank Governor, Philip Lowe, who told a Parliamentary Hearing:

“The evidence is that increases of this form do get offset by lower wage growth over time. If this increase goes ahead, I would expect wage growth to be even lower than it otherwise would be. There will be less current income and if there is less income, there may be less spending, and if there is less spending, there may be less jobs.”

Every person on the panel rejected this claim, as they argued not only for the legislated move to 10%, but 12% by July 2025.

What’s happening with superannuation?

Despite the system being widely regarded as one of the best retirement policies in the world, super comes under continuous attack. Paul Keating even argues that the Coalition wants to end compulsory super:

“Not take a chink out of it, but to actually destroy it. They intend to do this in two ways. That is, they want to drain money out of the bottom of the system, and stop money coming into the top of the system ... This malarky they talk of, ‘if they take it in super, they won’t get it in wages’, there’s been no wages growth for eight years and there’s not going to be."

Some of its current headwinds include:

- Early withdrawals of $34 billion from 3.2 million applications under COVID-19 relief, and while much of the money was urgently needed, billions were also spent on wants rather than needs. Across the entire super system, total benefit payments (ie withdrawals) to 30 June 2020 totaled $100 billion versus only $76 billion the year before, a rise of 31%. This meant that net contributions fell from $38 billion to $23 billion.

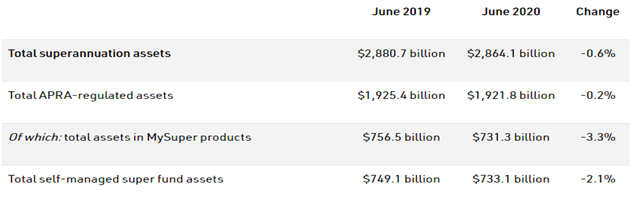

- Markets struggling to deliver the numbers assumed in most superannuation modelling, with bond rates below 1% and future returns from equity markets hit by recessions and expensive valuations. There is a strong case that performance will not be as good as in the past, as explained here. As shown in the table below, superannuation assets fell in the year to 30 June 2020 despite the mandated flows.

- Doubts whether the Government will allow the legislated move from 9.5% to 10% on 1 July 2021 and then on to 12%. The Assistant Minister for Superannuation, Financial Services and Financial Technology, Jane Hume, recently told ABC Radio that she was ‘ambivalent’ to it.

- The major banks have significantly exited not only financial advice but also wealth management, which were once considered jewels in the crown for the future growth of finance. There is now a shortage of business voices defending the super system.

- Continuing criticism that the major benefits from superannuation go to the highest-paid workers, who are able to take advantage of tax benefits.

Superannuation statistics as at 30 June 2020 (Source, APRA)

O’Neil and Kelty on the social covenant of super

Here are some key statements made by Michele O’Neil and Bill Kelty at the Summit aimed at protecting superannuation and ensuring the 0.5% increase proceeds on the way to 12%. The discussion should be read in the context of the union movement’s close relationship with industry funds and the increasingly political battleground between Liberal opponents and Labor supporters of super, but also a genuine desire by unions to protect workers' rights.

Michele O’Neil (ACTU President)

“When it comes to the retirement prospects of Australian workers, there is no more important issue than protecting the retirement saving system from attack. At a time of great uncertainty, the Morrison Government and sections of big business have thrown back into question the legislated increase to the superannuation guarantee, and the fundamentals of the system itself. This does nothing but generate further concern and anxiety for working people …

Today, the average Australian will run out of retirement savings 10 years before they die. Over 70% of women have estimated balances under $150,000, and over a quarter of women have balances of less than $50,000. This has them retiring with half as much superannuation as men, which is one of the reasons why older women are the fastest growing group amongst homeless Australians.

The cost of delaying the legislated increase to the superannuation guarantee will be enormous. A typical nurse will be more than $120,000 worse off at their retirement, and a typical early educator would be more than $80,000 worse off on retirement. This shortfall only gets covered by people working longer into their retirement or having to rely on an inadequate pension to survive in old age. For many Australians the notion of working into their 70s is a frightening reality.

In 2014, Tony Abbott convinced the Parliament to delay the increase in superannuation from 9.5% to 12%. Like today, the delay was justified on the basis of promised wage increases. There was no mechanism set up by the Government to deliver that, no requirement on business to pay people more. The Government simply said it would happen, as if by magic. The problem is that higher wage growth did not eventuate … Even before the pandemic hit, our wage growth was anaemic with no growth in real terms since the super freeze started … super increases were delayed in 2014 and almost immediately we saw wages dive and profits soar.”

Bill Kelty (former ACTU Secretary)

“When we devised the system, we didn't have a minor objective. We wanted to develop the best retirement system in the world, or at least one of those, because the nation was aging, the pension system was inadequate, and too many people were falling off the edge as they got to retirement … The three premises were superannuation, the pension system and individual contributions, reflecting a social base, a pluralist structure and individual choice.

An Australian way of doing things.

How was it to be paid for was essentially out of the increasing productivity and economic capacity of the nation and wealth, and part of that wealth would be distributed into the retirement system. This was part of a widespread safety net system of high minimum wages, retirement systems, Medicare, and the right to education - four fundamental safety nets underpinning a market-based system. That's what set us apart.

We said then that if it comes out of the productive capacity of the nation, then you can make some judgments about what will happen. First of all, less people will be reliant upon the pension therefore we will be able to increase the pension in real terms. Secondly, because it's essentially capital for a long period, it will improve the capital base of the country, and therefore will reduce or remove the premium which existed in terms of equity for Australian shares. Thirdly, it will change the balance of payments in respect of its current deficit. We will move out of that dependency and move to a surplus.

Unheard of things, yet all of those things have occurred. That's the test. But most importantly, of course, the superannuation balances have increased and we have a decent retirement system with high levels of dignity. Now that means workers have choices when they retire, to buy a car or go take an overseas trip or to support the family. Increased dignity and capacity when they needed it most.

And in doing so, superannuation helped create new industries, in the finance industry, in infrastructure across Australia, the leisure and retirement industries that are part of the economic capacity for the nation. So that's how it's funded and that's why it occurred … When we introduced the SGC, in the first eight years, wages increased by an average of 3.5% and superannuation increased from 3% to 9%. In the last eight years, the SGC has increased by half a percent and wages have only changed 2%. So there's simply no basis for it.

In conclusion, the last point is why the 12%? Well, the 12% was a commitment. People frame their expectations and their obligations around the 12%. Companies went out and negotiated in advance of that, increasing superannuation from 9% to 12% on the basis that there was an expectation and a covenant with the Australian people that superannuation would be increased to 12. To my knowledge, not one candidate in this country said that they opposed superannuation going to 12%. Not one, and certainly the government did not. So it’s a covenant.

But most importantly, it is the extra dignity that is required in the generations ahead. It's the extra two or three years of retirement. The extra two or three years of security for people that is at stake here. It is the inequality that is removed for those people dependent on the SGC. The higher paid people are fine. They'll take it up to $25,000, they'll take their tax break, but those dependent upon the SGC are the vulnerable people who need it now and they will need it then. They are the vulnerable people. If you don't increase it, then they're at risk. It is their two or three years of extra dignity.

The best system was the system we were going to put in place. So you go to 15% and you allocate 3% of that for the extra aging, the people over 75 to 80, that was the best system … so we've got to increase the pension and increase super to 12%. I think that progressively over the next decade or more, as people realise they are living into the 80s and 90s, people will regret not going to 15%. People are already starting to regret not having the best health care system in terms of the recent crisis. That's what the best system looks like as part of a safety net, in which wages are adjusted regularly, superannuation is available and the Medicare system works. You have on display right now in the United States, the worst of a developed country. No decent national health care system, no retirement systems and an inadequate social security system.

We should aim for the best.”

(Editor’s note: Britannica defines a Covenant as 'a binding promise of far-reaching importance in the relations between individuals, groups, and nations'.)

Michele O'Neil summarised the Summit as follows, making it clear the battle lines have been drawn:

"I want you to know from the Australian trade union movement. This is a fight that we are not giving up. We understand that this is a critical issue we are not going to allow the government to remove those increases that are scheduled and legislated and in fact promised. We will be campaigning to ensure that we finish the job of building an adequate, fair, equitable retirement saving system for every Australian. So join with us in that, we'll be continuing this campaign."

The Retirement Income Review final report of over 600 pages was delivered to Treasurer Josh Frydenberg on 24 July 2020. He has yet to release it publicly, but look for the Review's stance on whether increasing SG comes with a wages tradeoff.

Graham Hand is Managing Editor of Firstlinks. Parts of the transcript are slightly paraphrased without changing the meaning.