This article includes a summary by Graham Hand, and an opinion piece by Jonathan Rochford. We both made submissions to Treasury's review of the commissions policy which will be publicly released soon.

Treasury and the Coalition Government have finally banned commissions paid to brokers and advisers on Listed Investment Companies (LICs) and Listed Investment Trusts (LITs), bringing an end to a strange exemption granted in 2014.

Firstlinks has published extensively on the issue of conflicted remuneration on LICs and LITs, such as:

Fixed interest LIT carnage makes stamping fees worse and

Regulator reveals disquiet over LIC fees

In brief, the Future of Financial Advice (FoFA) laws introduced in 2012 prevented advisers from receiving a commission from product manufacturers such as fund managers for placing clients into products, particlarly managed funds and ETFs. However, under lobbying pressure, in 2014, the Coalition granted an exemption for LICs and LITs, which allowed fund managers to pay advisers and brokers a 'stamping fee'.

It was a primary driver of success for many fund managers who would otherwise struggle to attract large amounts from retail investors. The poor consequence came to a head in 2019 and 2020 when many transactions performed poorly, most trading at significant discounts to their net tangible asset (NTA) value. At one stage, as calculated in the first article above, losses on eight LITs totalled over $1 billion.

Last week, when Treasurer Josh Frydenberg announced the ban on conflicted remuneration for LICs and LITs, he left the door open on transactions in the 'real' economy. It's a somewhat arbitrary distinction which allows commissions to be paid on transactions such as hybrids and property trusts (A-REITs). The announcement said:

"Extending the ban on conflicted remuneration to LICs will address risks associated with the potential mis-selling of these products to retail consumers, improve competitive neutrality in the funds management industry and provide long term certainty so that this segment of Australia’s capital markets can continue to operate effectively and provide investors with opportunities to diversify their investments.

The treatment of equity and debt securities in trading companies (including hybrids), real estate investment trusts (REITs), and listed infrastructure investments will not be impacted by these changes. Maintaining the existing treatment for these investments is designed to ensure that direct capital raising activities which support the economic activity of companies in the real economy are not impacted by these changes. Persons providing personal advice to a retail client in relation to these products will continue to be legally required to act in that client’s best interests."

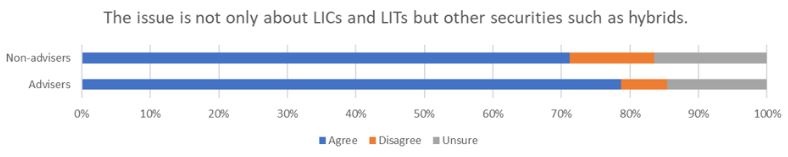

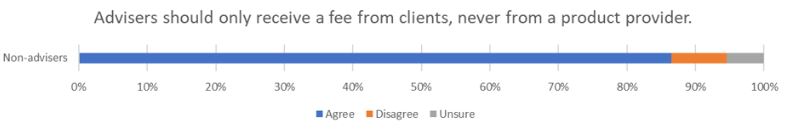

Firstlinks conducted a Reader Survey in February 2020 on this issue, which we have been told was influential in Treasury's final decision. However, our readers generally thought the ban should extend beyond the limited carve out announced, and that advisers should not receive any payments from product manufacturers:

Repeating what I wrote in this article:

"With a LIC or LIT, the fund manager can accept every dollar offered and then simply buy more assets. There is an enormous incentive to ‘back up the truck’, as L1 Capital did with its $1.3 billion raise and KKR did with its $925 million issue. Both then struggled in the secondary market under the weight of supply and traded at discounts to NTA.

Yet financial advisers and brokers put $2.2 billion into these two issues, readily accepting the stamping fees, even after the originally-advised minimum transaction amounts were massively exceeded, with the inevitable oversupply issues.

How can an advice licensee assessing whether an adviser’s action was motivated by the selling fee argue that a LIC or LIT that trades at a discount is in the best interests of the client?"

Neither L1 Capital nor KKR was a retail name, and there are plenty of unlisted bond funds which are far better known and longer established in Australia that do not receive much adviser or broker support. While most advisers did the right thing, some issuers, brokers and advisers only have themselves to blame for losing the commissions as they over-egged the pudding.

Graham Hand is Managing Editor of Firstlinks.

The Federal Government tacitly approves conflicted financial advice

Jonathan Rochford

The announcement by Josh Frydenberg that commissions for selling listed investment funds (commonly LICs or LITs) will be banned is being spun as a win for consumers seeking independent financial advice. Whilst that is superficially true, this is yet another case of vested interests in the financial industry being prioritised over consumers. The Federal Government has deliberately chosen to ignore the obvious conflict created by commissions being paid to advisers who sell debt, hybrid and equity securities to their clients. Despite these commissions being known to distort investments decisions, the Federal Government has given clear approval for these commissions to continue.

ASIC advised a broader ban

The debate over commissions has raged for many years, with the Federal Government previously ignoring department advice to ban all conflicted remuneration. The flurry of new debt- and equity-focussed listed vehicles in recent years has antagonised many, who rightly pointed out that without commissions these vehicles either wouldn’t have existed or would have raised far less. This created an imbalance where some listed funds paid commissions to raise capital, whilst unlisted funds didn’t. Clearly something had to be done.

In January, the Federal Government called for a rapid consultation with submissions requested. I made a submission and all submissions should be available for review soon. It is unclear what happened after this, as I and those I know did not receive any meaningful correspondence seeking further information. The unwillingness to talk through the issues with those holding different opinions and making different suggestions was not a good sign.

A wide consultation on confliction remuneration was necessary as the rorts had taken hold long before the wave of listed funds started. A small minority of advisers has long implemented a portfolio churning strategy with hybrids, always buying the new securities to replace existing holdings. This earns the adviser a regular stream of additional income, but the new hybrid often isn’t the best investment available. Older hybrids sometimes offer a better margin or shorter term, which an unconflicted adviser would choose.

Similar experiences with corporate bonds

Similarly, advisers who purchased Axsesstoday or Virgin Australia debt securities for their clients have almost certainly caused their clients to suffer substantial losses. If bought at issue and held to default, the losses are expected to be more than 50 times the usual commission paid to advisors. It would be naive to think the same behaviours seen with debt and hybrid securities aren’t occurring with equity securities.

The Treasurer’s announcement leaves unanswered many questions those focussed on the best interests of consumers are still asking including;

- Why are conflicted commissions still allowed on debt, hybrid, REIT and equity raisings?

- Does the Federal Government think that the minority of advisers that were improperly influenced to sell listed funds won’t switch to selling other commission-linked products?

- What clear warnings will be required when brokers or advisers are spruiking commission-linked securities to their clients?

- Why are commissions required to sell listed securities when the unlisted bond market doesn’t require these?

- Doesn’t the fact that a commission is required to sell a product indicate that it is lacking sufficient features to be attractive on a standalone basis?

Footnote: in giving a brickbat to the Federal Government for poor consultation processes it would be unfair to not give a bouquet to a recent example of excellent process. In developing initiatives to support competition in lending from the securitisation sector, the politicians and public servants involved have conducted open consultations that deliberately sought out a broad spectrum of industry feedback. This is to be commended, particularly the work of the AOFM in very trying times.

Jonathan Rochford, CFA, is Portfolio Manager for Narrow Road Capital. This article is for educational purposes and is not a substitute for professional and tailored financial advice. This article expresses the views of the author at a point in time, which may change in the future with no obligation on Narrow Road Capital or the author to publicly update these views.