A typical household has two or three sources of income in retirement including the age pension, income from superannuation and income from non-super investments. Running out of savings means living solely on the age pension which is $24,081 per annum for singles or $36,301 per annum for couples.

For those wanting a lifestyle that’s higher than the age pension, a complex balance needs to be met between how much we want to spend now and how we preserve some assets for spending later in life.

Typical use of a retirement account

The superannuation product we typically use today to manage the balance between spending and capital preservation is the Account Based Pension (ABP).

ABPs, and their predecessor the ‘allocated pension’, were designed around 1992, with the purpose of providing an income that is similar to a CPI-linked lifetime pension up to life expectation around age 80. After this they have a declining real income, when greater amounts of the age pension will likely be payable by the Australian Government.

However, it is not usually sufficient to provide a total (ABP plus age pension) income that keeps pace with inflation. Therefore, for many of us, depending on rates of investment return and inflation, an ABP plus age pension may not deliver anything like a CPI-linked income for the whole of our lifetime.

The market risk of an Account Based Pension

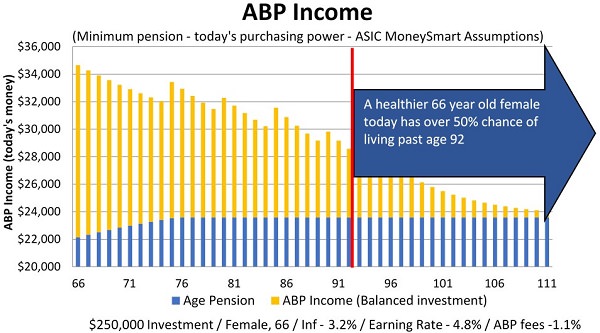

As we saw in the GFC in 2008, investment returns above inflation can be very uncertain. The following chart shows the projected income (in today’s purchasing power) from an ABP invested in a balanced portfolio using the recommended assumptions in ASIC’s MoneySmart retirement calculator. This assumes a rate of return of just 4.8% per annum, less fees of 1.1% per annum and a 3.2% allowance for cost of living increases throughout retirement. Presumably ASIC is being conservative to allow for the fact that ABPs carry significant investment market risks.

You can see from the blue line that in the earlier years of this person’s retirement only a part pension is received (due to means testing). The retiree relies more on consuming their own savings for their income until the full age pension applies from their mid-70’s onward.

By age 95, the spending power of the income from the ABP under this scenario has dropped to around one-third of what it was at age 66. This is a far cry from the product’s objective when it was designed in 1992 – to provide a CPI-linked pension – even if only to life expectation.

Longevity risk is increasing

Longevity is increasing, which is a benefit to each of us, but creates two financing problems:

- Have we each saved enough to avoid poverty in retirement?

- How can we spread our savings over longer periods in retirement?

More of us are living well into our 80’s and 90’s now and are often running low on savings. As an indication, a healthier 65-year-old female today has a 50% chance of dying between age 92 and 110. Taking into account that most retired households have a female member, it’s a fair question to ask: has Australia outlived the ABP?

Making sure your retirement income lasts for life

The options we have for retirement income now include:

- Account Based Pension (ABP)

- Traditional Lifetime Annuity

- Real Lifetime Pension

A Real Lifetime Pension is an investment-linked lifetime income stream that’s guaranteed to last for life but where the payment level is linked to the performance of the professionally-managed investment option selected. It means when you reach age 65, you can secure an income in retirement that, depending on how long you live, is 20% - 30% in aggregate higher than the aggregate account-based pension minimums (with the same investment choice). It removes the worry of running out of savings if markets perform poorly or if you live well beyond your life expectancy, and who doesn’t want to do that?

The Real Lifetime Pension lets superannuation funds insure mortality risk whilst still offering members investment choice, providing the retiree with an income no matter how they long they live. It gives the ability to switch between different investment options and can be offered as both an immediate or deferred pension. In our product, the longevity risk is underwritten by the world’s third-largest reinsurer, Hannover Re.

For those impacted by Centrelink means testing, options (2) and (3) will also result in a higher age pension than option (1) from 1 July 2019.

Trustees must tackle the retirement time bomb

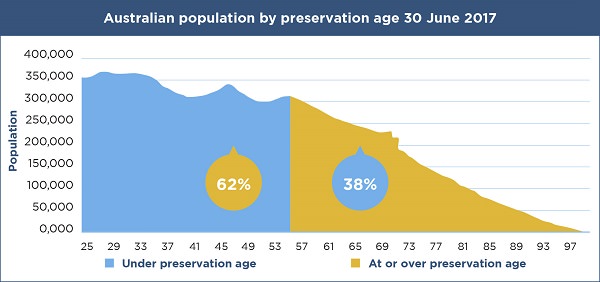

We are able to access our super once we have reached preservation age. Our individual preservation age is between 55 and 60 depending upon our date of birth. The following chart shows how many of us are increasingly approaching preservation age.

Australian population by preservation age, 30 June 2017

Many super funds find it challenging to retain us as members when we retire. Failure to provide effective solutions that are in our best interests as we age may potentially result in a range of challenges for super funds:

- loss of members to other institutions and SMSFs which promise better retirement services and products. This includes pooled lifetime income products which are scheduled to receive preferential Centrelink means testing from 1 July 2019 that will result in higher age pensions for many retirees

- trustees potentially failing to act in the best interests of their retired members. Medical advancements will continue to increase life expectancies. One in three retired households will see at least one spouse live into their late 90s. It could be argued that trustees are negligent if the only retirement product they offer fails to meet its desired outcome for at least one-third of its members

- funds failing to retain adequate amounts of their retirees’ money to remain sustainable and maintain economies of scale

- increased demand on cashflow that causes more assets to be invested in liquid assets that could skew the available investment strategies, potentially reducing returns for all members.

This potential demographic time bomb can severely affect the long-term viability of super funds – and our retirement - and it is already ticking.

For each of us, including SMSF members, the investment linked-lifetime pension option (including a deferred version) can reduce or eliminate longevity risk and still allow the use of professional investment managers and switching between investment options.

David Orford is the Founder and Managing Director of Optimum Pensions. Optimum Pensions was launched in late 2017 with the objective of providing innovative sustainable retirement income solutions.