SMSFs are the largest and fastest growing part of the superannuation sector in both number and asset size, accounting for almost one-third of total superannuation assets in Australia. The primary drivers for setting up an SMSF are the increased control and ability to make active investment decisions, so it is not surprising that a large proportion of investors in this sector do not seek professional investment advice.

Why is this important? According to APRA’s 2013 Superannuation Bulletin and ATO’s 2013 Statistical Report, SMSFs invest a far higher proportion of their assets in Australian equities than do large default investment strategies. The rise in domestic equities-heavy SMSF strategies may be a cause for concern and poses the question: Are SMSF portfolios adequately diversified?

Look beyond the mega caps

With investors gravitating towards household names, it is not surprising that the S&P/ASX 20 Index is one of the most widely held and researched indices in Australia.

Analysis by CBA shows that the top 20 stocks are held by approx 8.3 million individual shareholders compared to the broader S&P/ASX ex20 segment held by 5.7 million individual shareholders. This represents an average shareholder base per company of 417,000 across the top 20 stocks, some 20 times larger in volume than the shareholder base of the S&P/ASX ex20, at 21,000.

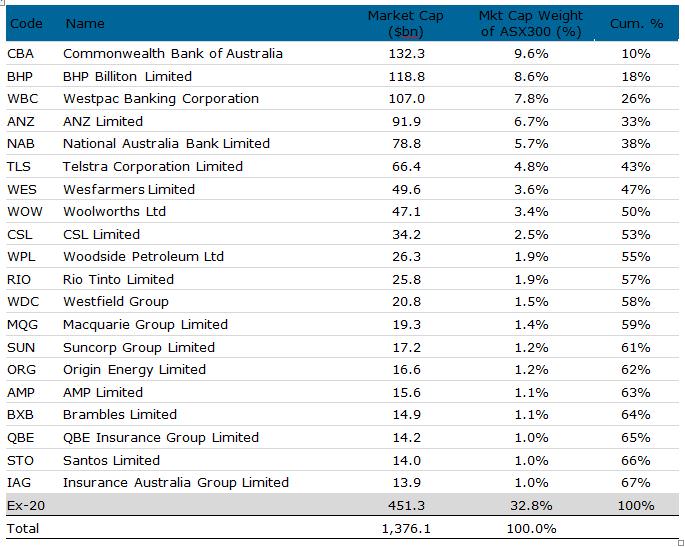

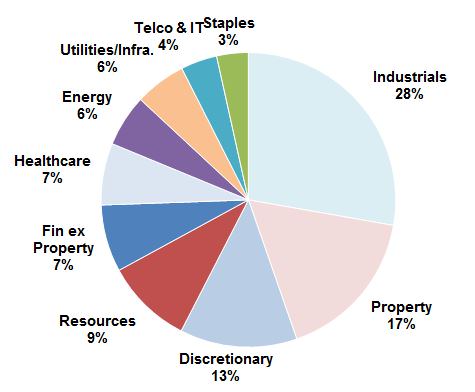

Consequently, direct investment activity is highly concentrated in nature with the top 20 ‘mega cap’ entities listed on the ASX accounting for approximately two-thirds of the S&P/ASX 300 index. The top eight securities - CBA, BHP, WBC, ANZ, NAB, TLS, WES and WOW – cumulatively make up 50% of the S&P/ASX 300 index and the S&P/ASX 20 is heavily concentrated by industry sector, with 69% dominated by the financial and resources sectors as at 30 May 2014.

It follows that many typical client portfolios, including SMSFs, would have high levels of concentration risk by being overly exposed to the financial and resources sectors through a handful of big name Australian companies.

Potential for future market leaders

In comparison, the S&P/ASX Ex20 offers more diverse entities in terms of market capitalisation and industry sectors, providing investors with a far greater breadth of investment opportunities. With the largest individual stock representing less than 3.0% of the Ex20 segment, a portfolio of securities outside the S&P/ASX 20 Index can provide an investor with valuable diversification to their direct holdings and provide some balance to the current concentration.

In addition, while Ex20 securities are not as widely held or researched as the top 20 securities, they can still be leaders in their field with competitive advantages over their peers and strong recurring and predictable earnings.

Diversification through quality Ex20 securities

Making a sound investment decision is about establishing if the company has the following four quality characteristics:

- a competitive advantage over its peers

- recurring, predictable earnings

- a capable management team

- the ability to grow over time.

A portfolio based on these key principles with a prudent investment style and a long-termfocus can achieve consistent returns for its clients. Sonic Health Care is a good example of an Ex20 stock that fits the above criteria. With a market cap of $7.3 billion, it is one of the world's leading medical diagnostic companies, providing laboratory and radiology services to medical practitioners, hospitals, community health services, governments and industries. Sonic is the largest pathology player in Australia, Germany, Switzerland and Belgium as well as number three in the US. Listed since 1987, Sonic benefits from a long standing, very capable management team that differentiates themselves from competitors through a strong medical culture as well as superior service. Operating in an industry which favours scale players, Sonic is able to grow earnings through accretive acquisitions around the globe.

With many portfolios overly concentrated within the top 20 ‘blue chip’ stocks, looking beyond this space provides investors with a key to diversification as well as enhanced growth opportunities for direct equity portfolios. By establishing a portfolio of high quality stocks with sound growth and dividend prospects outside of the top 20, an investor can complement their direct holdings, generating a diversification solution, and managing downside risk.

Anton Tagliaferro is the Investment Director of Investors Mutual Limited, a leading Australian value manager. He is also the Investment Manager for QV Equities Limited, a newly incorporated Listed Investment Company with a diversified portfolio of entities outside the S&P/ASX 20 Index. This article is general in nature and readers should seek their own advice before making any financial decisions.