Hybrid securities have gained popularity among Australian retail investors over many years, though that was shaken when the AT1 hybrids of Credit Suisse were wiped out in March 2023. What's been overlooked though is that the Credit Suisse tier 2 (T2) bonds were not written down. And that strengthens the investment case for the superior quality of Australian bank T2 (subordinated) securities.

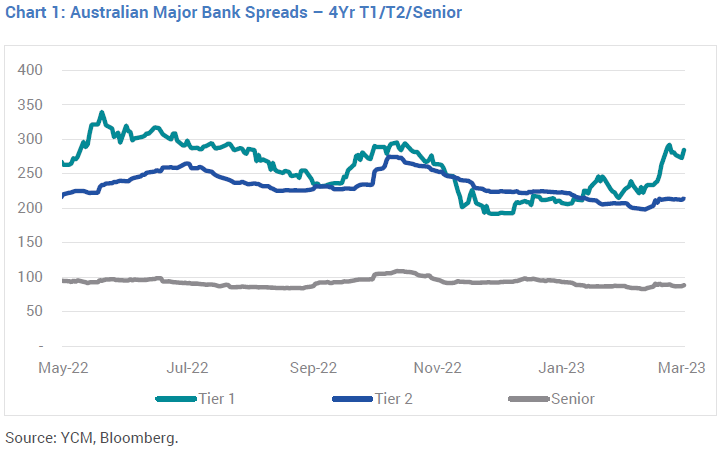

Since the forced merger of Credit Suisse and UBS, and the subsequent full write downs of Credit Suisse’s AT1 hybrid securities, market volatility has settled. However, while $A major bank AT1 spreads have pushed out by about 0.5% (50bps), they still appear expensive compared to their USD and EUR denominated equivalents.

Moreover, $A, AT1 hybrids are also expensive compared to their T2 subordinated debt counterparts, with only about 0.5% (50bps) in additional margin (refer Chart 1), offering poor compensation for inferior credit quality and, no matter how implausible in Australia, the higher probability of impairment in a non-viability scenario.

Recall that AT1 is lower in the repayment waterfall than T2 and investors should be compensated for the higher risk. The more appropriate AT1 spread for the additional risk remains roughly twice that of T2, akin to where offshore AT1s currently trade.

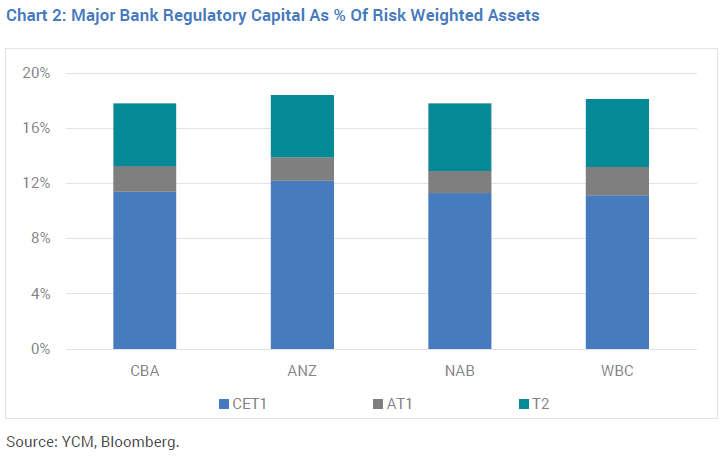

It’s worth providing a reminder of exactly what happened to Credit Suisse debtholders. While the Credit Suisse AT1s were zeroed, their T2 securities were protected and rolled into the newly merged Credit Suisse/UBS entity at par. This distinction is incredibly important, since Australian major bank T2 securities sit at the top of a large regulatory capital structure, protected from impairment by Common equity tier 1 (CET1 ~11-12%) capital and AT1 (~1.5-2%) capital (refer Chart 2).

From a capital perspective, T2s have been de-risked in recent years, with total Tier 1 capital (CET1 + AT1) increasing by ~4% since the GFC. When we include the ~1-2% of earnings buffers which can be redirected to capital replenishment, T2 securities look safe today from impairment, given they are protected by ~14.5-15.5% in subordinated capital and earnings.

With their current ~6.0% yields, Australian major bank T2 securities remain important overweights across all our diversified Australian credit portfolios. Not only are they contributing significantly to income levels, but they are also well placed to provide capital growth opportunities when spreads eventually contract from current high levels.

Call risk has diminished for bank T2

Finally, we see the latest volatility as having positive implications for T2s, with call risk now significantly diminished from what the market speculated a mere six months ago.

Investors may recall APRA stating its desire for financial institutions to consider not calling T2 securities due to credit spreads being wider than historical levels. Not calling T2 securities would generally extend their life for a further five years and lower valuations.

After the recent bank failures in the US and the Credit Suisse/UBS merger, the argument of whether APRA will or won’t permit T2 calls now seems somewhat redundant. This was further reinforced recently with APRA approving yet another supposed ‘non-economic’ call for BOQ’s T2 securities which is likely to be replaced by a new T2, likely to be ~100bps more expensive.

Not enabling T2 calls on mere higher spreads would risk far greater economic damage in the current environment and appears to be off the table even though, as we noted at the time, APRA’s initial argument held little merit.

Phil Strano is a Senior Portfolio Manager at Yarra Capital Management. This article contains general financial information only. It has been prepared without taking into account your personal objectives, financial situation or particular needs.

Yarra’s overweight positions in T2 underpin the running yields on offer in the Yarra Enhanced Income Fund (5.9%) and Yarra Higher Income Fund (6.8%) portfolios.