There are many factors that help explain why Listed Investment Companies (LICs) and Listed Investment Trusts (LITs) share prices diverge from pre-tax Net Tangible Asset (NTA) values. These include, but are not limited to:

- Portfolio performance

- Portfolio size (many subscale LICs/LITs trade at discounts)

- Marketing and communication efforts by the manager

- Investor preferences

- Overall share market sentiment

- Relative interest rate and yield differentials with competing investment opportunities.

Discounts and premiums can change over time, although some LICs/LITs may always trade at a discount for a variety of reasons including ongoing underperformance and subscale issues.

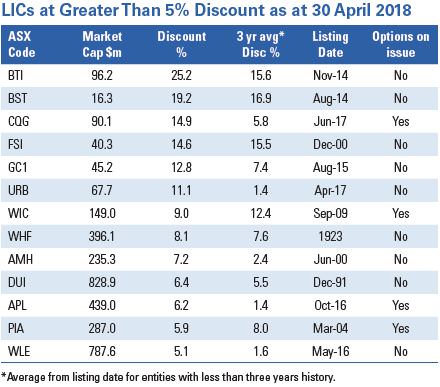

In the table below we show all LICs/LITs in our coverage with a discount greater than 5% and also compare the April discount with the three-year average. There are no LITs, only LICs on the list.

LICs at Discount

There are two things that stand out from the above table.

Firstly, the LICs with the six largest discounts all have market capitalisations under $100 million. In our view, it is difficult for small scale LICs to generate the same level of interest as larger LICs and they are likely to have poor market liquidity.

Secondly, four of the LICs have options on issue. Unexercised options can be a drag on LIC share prices until after the options are exercised. Options may be dilutive, as there is the possibility they may be exercised at a price lower than NTA. Before investing in LICs with outstanding options it is a good idea to calculate the diluted NTA.

Here are some explanations why specific LICs are trading at a discount.

Bailador Technology Investments (ASX:BTI) is trading at the largest discount to NTA, a material 25.2%. We believe a number of initial investors in the LIC have lost patience given a couple of major writedowns in individual portfolio holdings and the long lead time for realisations on individual investments. Private equity style investing requires patience and cashflows can be lumpy. Investors also need to understand that, in a portfolio of 10 private equity investments, it is not unusual for one or two investments to not perform to initial expectations. BTI continues to expect a number of realisations over the next 12 months with the potential to substantially increase NTA. The shares look cheap, but the discount may take some time to correct with the market waiting for further evidence of the realisations.

Barrack St Investments (ASX:BST), Flagship Investments (ASX:FSI) and Glennon Capital (ASX:GC1) are all examples of LICs that we consider subscale. BST and GC1 have both been in existence for relatively short periods. We expect the discounts to remain in place until these LICs can establish a consistent track record. FSI has a longer track record and the portfolio has performed relatively well. We highlighted FSI in our April LMI Monthly and noted that whilst liquidity is restricted, increased marketing and communications might help with elimination of the discount over time.

We currently see Contango Global Growth (ASX:CQG), trading at a 10% discount to options diluted pre-tax NTA, as a good opportunity for investors looking for international exposure. We also see URB Investments (ASX:URB), at an 11.1% discount to pre-tax NTA, as a good opportunity to invest in the urban renewal theme. We believe the market is not valuing the upside in some of the LIC’s direct property assets. Refer to our March 2018 LMI Monthly Update for more details on URB.

Amongst the larger cap LICs in the table, three stand out in particular, Whitefield (ASX:WHF), AMCIL (ASX:AMH) and Diversified United Investment (ASX:DUI). All are trading at discounts to pre-tax NTA, yet they are the top three performing LICs (with an Australian large cap focus) over the past five years (per the above performance table). All except WHF, which has slightly underperformed, have exceeded their portfolio benchmarks over the five-year period. We note that all three LICs have historically traded at discounts, but the discounts are currently above their three-year averages.

WAM Leaders (ASX:WLE) also stands out at a 5.1% discount to pre-tax NTA. Interestingly, it is the only Wilson Asset Management Fund to trade at a discount to pre-tax NTA. WLE has only been around for two years and is yet to establish a track record but, based on the Managers data, the underlying portfolio has performed well since inception generating outperformance of 2.6% p.a. before expenses, fees and taxes. However, on a pre-tax NTA basis WLE has underperformed the S&P/ASX 200 Accumulation Index with performance impacted by the exercise of options in 2017. If WLE can build a sustained track record of outperformance (although for a large-cap fund this is likely to be harder to achieve) then perhaps its shares could at some stage also trade at a premium to pre-tax NTA.

Important: Please note that our commentary above is based on pre-tax NTA and market prices at 30 April 2018. Discounts will change on a daily basis with share price movements and movements in NTA.

Peter Rae is Supervisory Analyst at Independent Investment Research. This article is general information and does not consider the circumstances of any individual.