“Time is more valuable than money. You can get more money, but you cannot get more time.”

Jim Rohn, American entrepreneur and author

As we age, the value of time becomes more significant to us. What are you doing with your time? Are you spending your life well? Waking up in the morning feeling as though you can’t wait to get going into the day is energising, renewing and brings out the best. The mantra in our business is, “Do what you love and love what you do.”

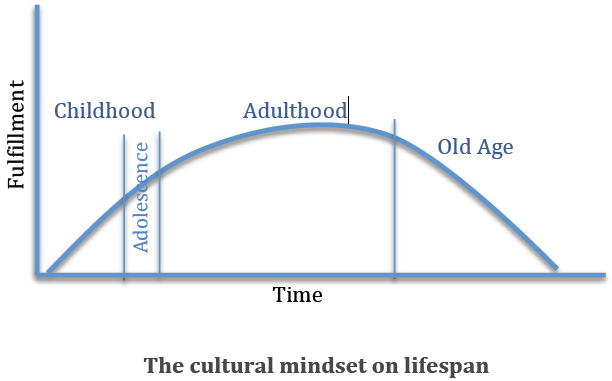

We don’t need to peak in Adulthood

It doesn’t stop there, though, because most Elders (over 55’s) want to have purpose as a key part of loving what they do. Beyond the youthful days of just having fun they want to make a positive contribution as well. In fact, Ben Horowitz of VC firm Andreessen Horowitz says, “… Don’t follow your passion”, advising instead to find the thing you’re great at. This can be tricky.

If we do something that lacks purpose and conviction that has no spirit, gusto or depth, then it’s compromising our selves, whatever money is earned. Under certain circumstances we may choose compromise for a limited time, to help someone out for instance. But to live without commitment and purpose undermines our potential and dignity. Especially over 55.

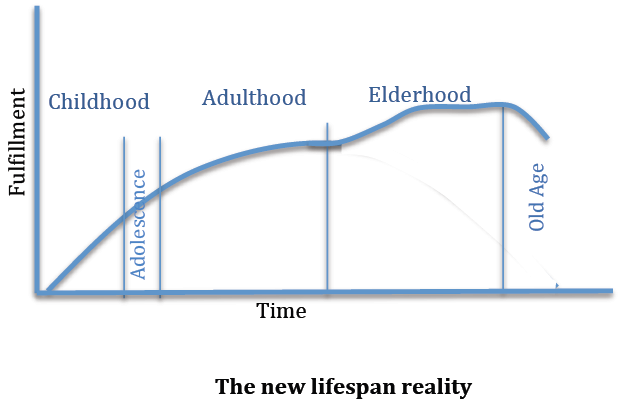

Elderhood is the last of three major chunks of life – the first is Childhood followed by Adulthood. Each of these chunks has its own cycles, challenges, developmental tasks and mythology. Some of these myths and beliefs are right out of date.

The old cultural belief about lifespan isn’t relevant anymore. It needs updating. Most of us believe that Adulthood predominates in life and is the time that we reach our peak. That was the pattern for hundreds of years but life has changed. (It is only 100 years ago that the average life expectancy was 47 years; today we are just halfway at 47.)

It is not a case of doubling the length of Adulthood, because as we age our physiology changes. We are no longer equipped with the same stamina or motivators. Instead it’s a matter of redefining the life stage that comes after the adult years.

Life in three chunks

Following Adulthood is the vital life-stage of Elderhood with its own distinctive challenges, tasks and purpose. Elderhood builds on and exceeds the previous life stages.

Because it is the last major life stage, when we enter it we are paying attention to time and to our life. This is a great advantage.

During Elderhood we have the time, opportunity and relative freedom to do what we love and find what we’re great at now. Childhood is spent learning, exploring and being socialized into the culture. In Adulthood we make our way as contemporary warriors and providers, most of us caught in traps of consumerism to some degree, if not by ourselves then by what our children want. By the time we reach Elderhood we are pretty well ready for a more authentic life that expresses our true value.

This is the time to re-discover our core purpose – what lights us up and feels compelling. Yes, our purpose expresses our values and talents plus sets a captivating challenge.

For some it may be an audacious goal in the public eye. For others a quiet reflective purpose behind the scenes is ideal – or anything else from wildly disruptive to lyrically synchronized, large or small scale. The spirit soars and you are on a journey, because what we are talking about is vocation.

Vocation

Finding your Elder-vocation takes time, although some people just ‘know’. They have always known but not dared to do it before. Whether you know or need to go on an inner search, being open to opportunity is part of the process. However, (1) opportunity is not the only part. The real source is you. The opportunities in your environment are only resonating with what was already there for you. (2) What you envisage may not exactly match the reality as it unfolds; the reality that eventuates often turns out to be better.

Ralph was an engineer joining the family-owned business as a young graduate. He really wanted to be a counsellor but was under pressure to conform in the family. Eventually he became Managing Director of the business, which had grown to 360 employees with a revenue of $183 million. He retired at 65, still yearning to work closely with people to help them with life. When Ralph was watching his grandson play a basketball match, the penny dropped. Seeing the way the coach interacted with the boys, Ralph knew he had found his thing. He felt clarity and enormous energy, like his spirit rising. He saw himself coaching disadvantaged boys, teaching them about life through playing the game and giving them a positive human experience that would change their lives. And that is precisely what he did in multiple suburbs and country regions.

The third chunk of life

Elderhood is the last third of life. That is precisely what makes it so rich. Conversely, it is also one of the reasons people try to avoid it and hang on to Adulthood. In Elderhood we are undeniably aware that our time is limited.

The notion of purpose and contribution trumps either making money our goal or serial short-term activities that have no lasting meaning. When these activities don’t resonate and renew, they leave us empty. Just something to do to fill in time.

Di Percy is a director of VogelPercy, a corporate mentor and change firm with long experience assisting many of Australia’s top businesses. Their new business arm is Third Chunk of Life, working with over 55’s. See www.thirdchunkoflife.com.