Using your accumulated superannuation benefits to commence a pension is a common way to generate retirement income. If you have an SMSF, there are a few things to consider when starting a pension.

What is an account-based pension?

An account-based pension is like a personal retirement income account operating in a superannuation fund. You receive regular income payments, while at the same time your account may earn investment income. Any investment income earned in the pension account is generally tax-free. Note that before you can start to receive an account-based pension with your super benefits, you must have met a condition of release.

The most common conditions of release are:

- retirement after reaching preservation age

- attaining age 65, or

- permanent incapacity.

Your preservation age depends on when you were born, starting at age 55 years if you were born before 1 July 1960, and increasing by a year each year until it reaches 60 years-of-age for those born after 30 June 1964.

Your SMSF’s trust deed must allow the payment of an account-based pension. It is a good time for a general review of your trust deed. An update will generally require the services of a legal professional.

Know your limits

From 1 July 2017, a limit (called the transfer balance cap) applies to the amount of your accumulated superannuation benefits that you can use to commence a pension. The transfer balance cap is a lifetime limit that is set at $1.6 million in 2017/18.

This limit applies to account-based pensions, as well as other types of superannuation income streams you might have such as lifetime or life expectancy pensions, market-linked pensions and defined benefit pensions. However, if you have a transition to retirement pension, it will not be counted until you meet a full condition of release such as retirement after reaching preservation age, attaining age 65 or permanent incapacity.

When you start an account-based pension, the starting balance will count towards your transfer balance cap. If you make a lump sum withdrawal from your pension account, the amount counted towards your transfer balance cap will be reduced. However, pension payments and investment earnings in the pension account will not change the amount of your pension that is measured against your transfer balance cap.

Before starting a pension, speak with your financial adviser to ensure you do not go over your transfer balance cap, as penalties may apply if the cap is exceeded. If you receive another superannuation pension, the combined value of your pensions will generally count towards your transfer balance cap.

Certain transactions that impact your transfer balance cap, such as when you commence a pension or make a lump sum withdrawal, will be reportable to the Australian Taxation Office. Your SMSF administrator or accountant may be able to assist you with these reporting requirements.

Consider your fund’s investment strategy

The investment strategy that suited you prior to starting a pension might not continue to be appropriate. One of the objectives of an account-based pension may be that it lasts throughout your lifetime, so it’s important to review your investment strategy when setting up your account-based pension.

Your investment strategy should take into consideration that, in moving to an account-based pension you’ll be drawing down on your capital. Studies show that the impact of negative returns can be greater when you’re drawing down on your capital compared to when you’re adding to it.

Make the minimum payments

When running an account-based pension, one of the key requirements is to ensure you draw at least the minimum pension payment amount each financial year. This is an important requirement for maintaining the tax-free status of earnings in your pension account.

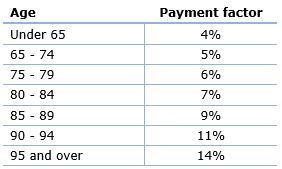

The minimum amount you have to draw each year is calculated by multiplying a percentage factor by your account balance. The minimum percentage factor depends on your age when you start the pension and on 1 July for subsequent years.

If you start your account-based pension part way through the year (prior to June), your minimum pension is calculated in proportion to the number of days remaining in the financial year. If you commence your pension in June, no minimum pension payment is required in that financial year.

When starting a pension, it’s important to get a current market valuation of the assets for each member’s pension account. The value of your account is required to calculate your minimum payment level, for transfer balance cap purposes and to complete your fund’s tax returns. If you don’t meet the minimum payment requirements then the assessable investment earnings for the income year may be taxed at 15%, rather than being tax-free. It’s not enough for your SMSF to simply ‘account’ for the minimum payment through a journal entry. Funds must actually be paid from your pension account and leave your SMSF.

Keep your records safe

SMSF trustees are required by law to keep records of transactions of the fund, including those relating to pension payments. These records will also assist your accountant in substantiating your fund’s tax position. Generally, records relating to pension payments must be kept for a minimum of five years, but note that some records (e.g. minutes of trustee meetings) must be kept for 10 years.

Estate planning

When you commence a pension, the rules of your SMSF may allow you to nominate a dependant (usually your spouse) to continue to receive the pension after your death, often referred to as a reversionary pension.

Alternatively, you may be able to nominate one or more of your dependants, or your legal personal representative (typically referred to as your estate) to receive your remaining account balance after your death. Death benefits can be paid as a lump sum, a pension or a combination of lump sum and pension. However, only certain dependants (such as your spouse or minor children) are eligible to receive your benefits as a pension. If your superannuation benefits are paid to your estate, the proceeds will be distributed according to the terms of your will.

Your account-based pension can be an important part of your estate planning and it may be appropriate to review your estate planning arrangements when you commence your pension.

Matthew King is a Private Wealth Adviser at Macquarie Bank, a sponsor of Cuffelinks. This information is general in nature and does not take into account your objectives, financial situation or needs.