As the dust begins to settle on the MySuper product landscape (albeit with more rolled out until the end of the year), many have adopted a lifecycle strategy. And while retail groups seem to have dominated the push down this path they are not alone, with both corporate and industry funds using a lifecycle approach. However, not all lifecycle funds have been created equal. There are a number of key features which distinguish the different lifecycle offerings and they can have a significant impact on member outcomes.

Previously I have been a well-informed fence sitter on lifecycle funds (see “Are lifecycle funds appropriate for MySuper products?”). If pushed harder and given only a strict choice of whether or not to take a member’s age into account when designing their underlying investment exposure, I would side on doing so. My greatest reservation remains that there are so many other personal factors to consider that lifecycle funds could be the intermediate technology before we develop a superior approach (some groups are already well down this approach which I call ‘mass personalisation’, particularly overseas). Undoubtedly, good advice based on someone’s detailed personal situation usurps all systematic approaches, but is not a realistic proposition for the entire working population.

Here is a guide to the ‘Big 4’ differences and their impact. These issues are not isolated to Australia – these differences also occur in the US where lifecycle funds have greater prevalence:

1. The shape of the glidepath

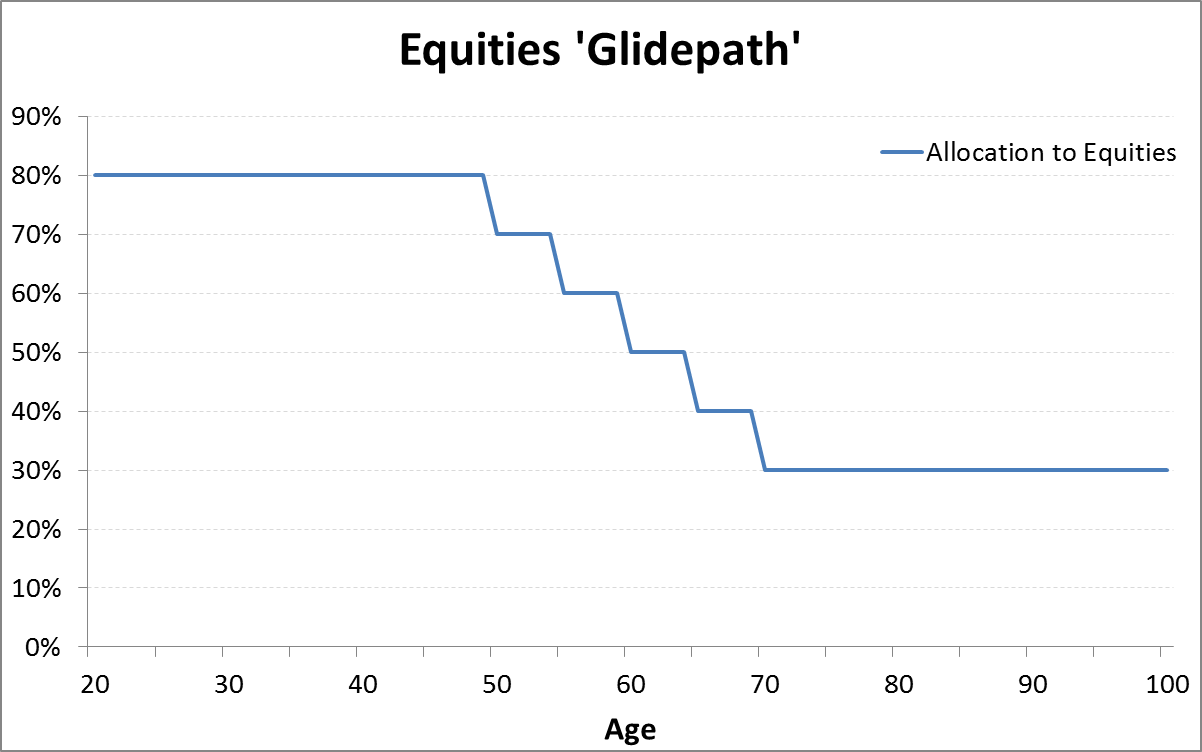

The ‘glidepath’ is a simplified summary of the asset allocation through time. A glidepath is generally presented in terms of exposure to growth assets given age and typically steps down as retirement approaches, as shown in Diagram 1 below. The timing and size of the reductions vary, and as a result, these products will produce different lifecycle outcomes for their members. There is no exact answer on what is the optimal glidepath. All we can do is assess the research and reasoning that has gone into the design of specific products. One specific issue is whether the product is designed with an accumulation objective in mind or whether it is designed to roll into a specific allocated pension product with a complementary asset allocation – this is known as the ‘to versus through’ debate.

Diagram 1: Example of a glidepath.

2. Age cohorts (buckets) or personal administration

There are two options to administer the glidepath asset allocation. One is to group people into age buckets; each member of that cohort will have identical asset allocation. This is the most common approach, for example those born in the 1970’s, 1980’s, 1990’s, 2000’s etc. An alternative is to administer the lifecycle approach to each member individually. The latter approach has benefits – specifically, it avoids giving people at the extremes of a cohort group the same asset allocation. For example, in some products you may have a scenario where someone aged 51 and 60 have the same asset allocation. There is a risk that cohort or bucket administrative approaches dilute much of the complex calculations that have gone into the glidepath design.

3. Glidepath smoothness

Some glidepaths will make many small re-allocations over time while others may take a smaller number of large steps. This latter approach makes a sizable asset allocation switch regardless of the market fundamentals. Imagine a scenario where shares have fallen heavily and now look attractive but concurrently a lifecycle fund glidepath may reduce exposure to growth assets, locking in losses and removing the ability to participate fully in a recovery. This issue interacts somewhat with (2). A cohort approach with large steps can have a greater impact on lifecycle outcomes than a personally-administered approach with small increments.

4. Active asset allocation

Active asset allocation has become more prominent among super funds, particularly post-GFC where it became obvious that active management within underlying funds provided only a small buffer in difficult market environments. We can see the merit of active allocations in a lifecycle strategy where, as described in (3), transitions may occur at inappropriate times. Of course there is no guarantee that such an approach will work – not all active asset allocation capabilities are created equally either!

These are the Big 4 issues, but there other differences are emerging. Some groups are already considering how best to structure exposure to underlying asset classes through the lifecycle. Again the US provides good guidance to latest market trends. The design of lifecycle funds could be based on administrative capabilities (personally administered approaches likely cost more than a cohort approach), cost, research resources, and even a desire to keep it simple so that underlying members understand what is going on.

Difficult to compare and rate funds

The design of a MySuper fund, where we have balanced funds and a range of different lifecycle fund designs, is a difficult area for an individual to assess. In front of each product there will be smart marketing messages. It is important that those groups who rate super funds are well-equipped to assess different super fund designs. They face a big challenge. Previously they compared funds, the large majority of which adopted a balanced fund approach, and this made for relatively easy performance comparisons. Now there is an extra dimension – fund design and member outcomes. Will these groups perform a deep assessment of the fund design, perhaps using proprietary tools to enable an objective comparison (and cut through the marketing materials), or will they just assess the high level issues considered in the design?

With MySuper we move into an age where the lifecycle approach is more prominent. Be aware that not all lifecycle funds have been created equal. It will be fascinating to watch advancements in this space, and how the groups which rate super funds adapt to the new environment.