Legendary investor John Templeton is credited with the first observation that believing ‘This Time Is Different’ will be costly in investing. In his 1933 book, 16 Rules for Investment Success, he wrote:

“The investor who says, ‘This time is different’ when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most-costly words in the annals of investing.”

It has become a timeless reference, with the warning commonly used by financial analysts who prefer to draw on the history of stockmarkets, economic cycles and long-term company valuation metrics. It’s a way of saying, “We’ve seen it all before” ... the manias, the over-pricing, the FOMO. The argument that circumstances are now unique is often rejected using a version of Winston Churchill’s phrase that:

"Those that fail to learn from history are doomed to repeat it.”

In which case, many of our respondents are in for a shock because a high percentage believe investing has fundamentally changed.

The Firstlinks Survey results

The Firstlinks audience is generally older and more experienced in investing than the readers of most newsletters, based on our past surveys. For example, three-quarters of our readers in over 2,000 responses reported they are over 55.

So it was expected that they would overwhelmingly vote ’No’, that this time is not different, as they have seen markets rise and fall in many economic cycles, and the current high valuations and record stockmarket levels are yet another top in a long history of market over-reactions.

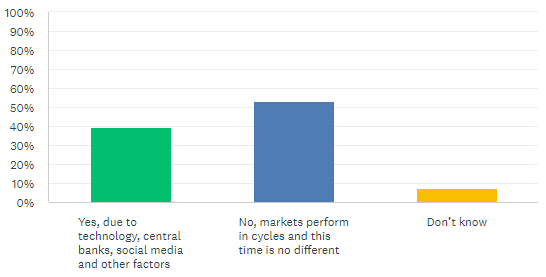

Yet almost 40% believe This Time Is Different, and with over 7% in the ‘Don’t Know’ camp, that leaves slightly over half falling back to a more traditional view on market ups and downs.

Q. Do you think investing has fundamentally changed in the last 5-10 years?

We have compiled many of the hundreds of comments into the attached report as they are too long to publish in an article, but here are selected highlights from both sides. And for those who are bemused, take comfort from this reality check:

“I’m a veteran of 30 years in the industry and I’m paralysed. I’ve got no idea any more.”

Yes, this time is different

*Definitely. Young investors are thinking: ethical, sustainable, climate crisis. What's the point in having a pack of money in the future when the world is caving in due to our warming climate.

*Everyone now has access to the same information, almost as soon as it’s available. So no one has an “edge” in the market, it’s completely democratised.

*On-line brokers have made it so much easier to invest and to follow your investments. Also, one can "invest" in quality on-line commentary like Eureka Report and Firstlinks.

*Three reasons. A. Interest rates effectively zero. B. Central banks creating wealth from thin air, printing money. C. Simple and straight forward access to investments, historically people either didn’t know how to invest or were put off by the ‘suits’.

*The massive reach and world wide scalability of the big tech companies is something quite different in the last 20 years.

*Exponential technology has made it easier for businesses to grow quicker.

*yes things have changed. Everyone is an investor. The money has to go somewhere. But valuations are made on profits. The pigeons will come home to roost and many people will be affected. But its hard to stay out while the party is still going.

*Tech expansion provides a level of scalability at margins unseen in previous generations. In the ‘olden days’ you could basically only sell one copy of what you made (eg a car, a barrel of oil) and rely on capital intensive distribution channels (eg ships/trucks/dealers, oil rigs/tankers/petrol stations) and analogue marketing (eg TV, newspapers, magazines) to sell the one unit. Now you can build various levels of technology/apps in your garage, advertise it free of charge to multiple social media channels that can generate high volumes of highly targeted views and create sales/ subscriptions with limited costs. Build one app, but sell it 50 million times over. This type of business model transformation clearly does not apply to every sector, however the hyper inflated PE of many tech stocks is seemingly lifting the assessment of worth of some ‘traditional’ companies. A current 25 - 35 year does not know any different from the world they have grown up in. This is all normal. Crypto, FAANG, Elon, Melanie Perkins etc - what is their to be scared of? …… So, I’d suggest it is ‘different’ but that doesn’t make it wrong. Understanding the difference is the key.

*I believe that, as a wise American observed, that the media has become the message, thanks to influencers and an emerging preference for a less rigorous examination, if at all, of fundamentals. A glitzy presentation, not on Powerpoint, wins over the gullible. Hard facts are too hard and inconvenient truths.

No, this time is not different

*Humans haven't changed. We are (on average) still greedy, biased, over confident and love to follow the crowd. Until human kind changes, nothing else will. We are in a bubble, and the more retail investors who start trading like we have see during covid, the bigger the pop will be. The question is who long will it take to recover when it does pop. Will people be scared off, or will the craze of 'stocks only go up' flood more people in to buy cheap.

*It is undeniable that markets go through cycles - periodic bouts of extreme irrationality, be it be pessimism or optimism. They spend the time in between these two extremes fluctuating in a band that we might for want of a better term call "fair value". Of course, innumerable factors exert their influence throughout these cycles and act to either exacerbate or moderate these cycles, but one should not confuse cause with effect. The cycle will always exist; the factors that amplify its effects will come and go according to fad and fashion.

*When central banks print unlimited amounts of money and drop interest rates to zero, the discount rate on future earnings also approach zero and valuations of everything go through the roof. We are in for an all mighty crash when central banks reverse their policies.

*I have been investing (and a financial adviser) for 20 years - same old - biggest bubble i've seen though (other than US real estate in 2007)

*Bubbles burst, and huge bubbles burst more catastrophically. I've been a professional investor since 1986 and the simple reality is always true - an asset only provides long term worth if it can throw off cash and you did not pay too much for the free cashflow.

*The twelve most dangerous words in investing are: "The four most dangerous words in investing are, it's different this time."

*Every cyclical episode is, in fact, different in some respect. But the key drivers - especially behavioural factors such as fear, greed, over-confidence and certain cognitive baises -remain essentially unchanged.

*I have heard the comment “This time it is different” multiple times in my 40 years of investing only to find out it wasn’t. Fundamentals always matter.

* In every boom we hear the note: This time it is different. It is only different until things fall apart. When the interest rates are finally start rising and maybe even rising quickly to catch up with inflation, we might see that this time is no different. Surely Tesla and others that are extremely overvalued will be crumbling at some stage. It can't go on forever.