Central to the perpetuation of stock market cycles are emotions: excitement, hope, avarice, perhaps some envy. These are ever-present in our makeup, so they alone cannot explain market cycles. Something needs to catalyse humans to act as a herd in markets. That something is certainty.

It is investors’ certainty that they are in unprecedented times, armed with better information than ever and standing on the cusp of hitherto unseen technological wonders, which leads them into the paradox of cycles.

It is only when investors are certain they are not in a cycle, that truly wild cycles can emerge.

We are witnessing the turning of one of the great cycles of market history at present, with stretched valuations and enormous market capitalisations imploding. At the same time, the ebbing tide of fiscal stimulus likely precipitates significant earnings falls for US companies. Remember though, it was only one year ago, in mid-2021, that investors were certain of the supremacy of US companies, of the benign nature of inflation and the remoteness of the possibility of cycle-killing monetary policy adjustments.

How recently we were enthralled

I spoke at an investor forum for retail investors in mid-2021, where I was one of a panel of three speakers. The other two speakers spoke of wonderful technological disruptors, US listed, trading near their all-time share price highs. When prompted, they dismissed the likelihood of any serious inflationary cycle and denigrated concerns about valuation. The future was obviously bright for these tech titans.

I chose to make a point by speaking about the absolute opposite of such tech wizards – a Chinese property developer. Since the forum, the obvious has happened. The lauded tech firms are down roughly 80%, while China Resources Land – a holding in our Asian and global funds – is up 15% and has paid us 4% in dividends.

It is the certainty of investors that upstart tech firms are the future that allows them to bid the share prices to ridiculous levels. And it is the doubt and perplexity surrounding a name like China Resources Land that allows its price to appreciate even amid a property slowdown in China and implosion of equity markets globally.

It was ever thus: the 1970 ‘tech wreck’

It is useful to refer to past cycles rather than simply assert that current events constitute a cycle that is ending badly. Helpfully, case studies from the past illustrate points that are obvious to readers decades after the events described. Unhelpfully, it is difficult to empathise with people paying high prices for the darlings of prior cycles … of course, they were silly to do so. We must try to remember that the excitement of prior cycles was not felt in black and white. It was as real and as vivid as any contemporary lust for profit.

In the 1960s, a series of emerging tech giants, IBM and EDS chief among them, had enormous growth runways ahead as they embarked on digitising all corporate and government information in existence. Every pay cheque, every Medicare bill, and every management memo would soon be recorded on a computer. What a story!

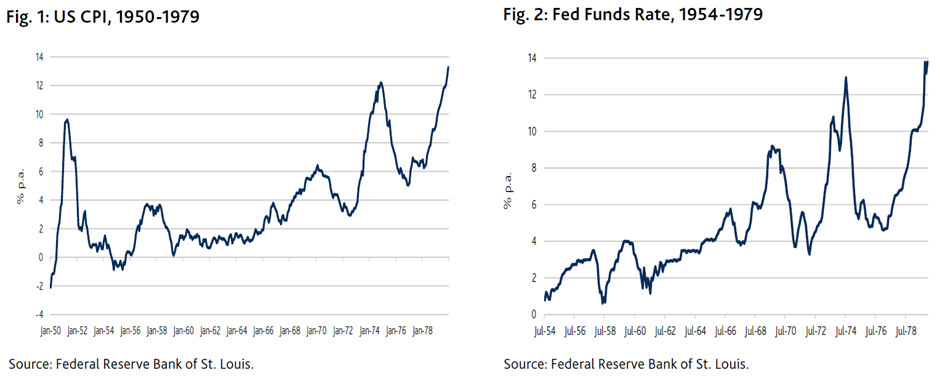

The 1960s saw a series of certainties entrench themselves. There was mild inflation in the system, and interest rates were low. Indeed, no investor had seen short-term rates above 4% since 1929, nor had inflation risen above 4% apart from brief spikes in the late 1940s. Amid benign inflation, low rates for decades and a staggering growth story, a colossal growth stock bubble duly emerged.

IBM was the era’s tech behemoth, but it had competition. In 1962, a star computer salesman at IBM, a young Texan by the name of Ross Perot, became fed up with a lack of advancement within the IBM machine and set out with a couple of colleagues to found a computing upstart with only US$1,000 in capital: Electronic Data Systems, or EDS. Times were lean for EDS in its early years until federal Medicare legislation was passed in 1965, and EDS won a contract to develop a computerised system for paying Medicare bills. EDS soon had contracts in 11 states and by 1968 had US$10 million in assets generating US$1.5 million in profits and a stupendous growth trajectory. The time was ripe for an initial public offering (IPO) for EDS, and a largely unknown Karl Langone won the deal by promising a valuation of over 100 times 1968 earnings. EDS listed at US$16.50 per share, at a price-earnings multiple of 118 times. This was just the start. By early 1970, EDS went on to trade at nearly 10 times its offer price, at US$160 per share.[2]

However, the certainties of the 1960s had eroded. Inflation surged over the course of the decade, which prompted a response from the US Federal Reserve, driving up short-term rates from 1967 to early 1970 from 4% to 6% in the Fed Funds market, before racing higher to 9% in mid-1970. Despite robust earnings growth in many cases, computer share prices were crushed. EDS fell from a peak of US$162 to US$24 per share in May 1970. The average computer stock of the day fell 80%.

How can this happen, repeatedly?

Again, we would point to certainty. Investors abandon scepticism. They know that inflation will remain benign, or will be transitory, or will be permitted by monetary officials. They know that fast growth deserves a colossal multiple, or that multiples don’t matter, or that a multiple of sales is appropriate to “value” a stock.

This certainty is seductive … and fatal for returns for those who believe unto the end.

[1] Source: FactSet Research Systems, in local currency, annual return to 30 June 2022.

[2] See John Brooks, The Go-Go Years; The Drama and Crashing Finale of Wall Street’s Bullish 60s, Allworth Press, 1973, pp14-24

Julian McCormack is an Investment Specialist (Retail) at Platinum Asset Management, a sponsor of Firstlinks. For more articles and papers by Platinum click here.

View Disclaimer: This information has been prepared by Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management (“Platinum”). While the information in this article has been prepared in good faith and with reasonable care, no representation or warranty, express or implied, is made as to the accuracy, adequacy or reliability of any statements, estimates, opinions or other information contained in the articles, and to the extent permitted by law, no liability is accepted by any company of the Platinum Group or their directors, officers or employees for any loss or damage as a result of any reliance on this information. Commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. Commentary may also contain forward looking statements. These forward-looking statements have been made based upon Platinum’s expectations and beliefs. No assurance is given that future developments will be in accordance with Platinum’s expectations. Actual outcomes could differ materially from those expected by Platinum. The information presented in this article is general information only and not intended to be financial product advice. It has not been prepared taking into account any particular investor’s or class of investors’ investment objectives, financial situation or needs, and should not be used as the basis for making investment, financial or other decisions. You should obtain professional advice prior to making any investment decision. You should also read the relevant product disclosure statement and target market determination before making any decision to acquire units in the fund, copies of which are available at www.platinum.com.au/Investing-with-Us/New-Investors.