This note is an edited version of a speech given at the Australian Economic Roadshow events in Sydney (17 November) and Melbourne (24 November).

‘Today’s problem' – inflation and policy rates

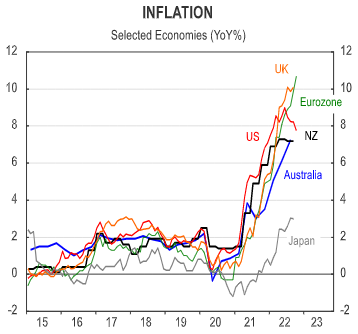

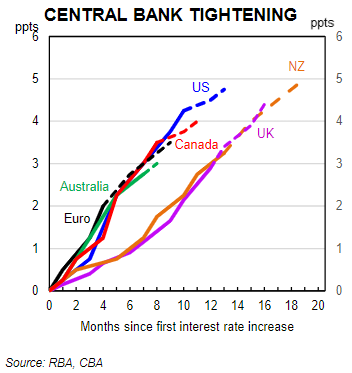

For the world’s major central banks, the second half of 2022 has been dominated by addressing ‘today’s problem’ - high inflation. This has seen significant monetary policy tightening across the US, Canada, New Zealand, UK, Europe and, of course, in Australia.

This tightening cycle has led to a large rise in bond yields across the curve, a widening of credit spreads, and weakness in equity markets.

Despite the recent slightly better news on US inflation, we expect the major central banks will continue to address ‘today’s problem’ in the next 3-6 months. That is, we expect to see further monetary policy tightening from the major central banks, although for some of the pace of tightening to slow.

For the major central banks, we expect the following:

- US Fed: a 50bp rate hike at the 14 December FOMC, followed by 25bp moves in early February and mid-March 2023 to a peak of 4.75%-5%.

- Bank of Canada: 25bp moves over the next two meetings, to a peak of 4.25%.

- Bank of England: 50bp moves in coming months to a peak of 4.5% in Q1 23.

- ECB: a 75bp move on 15 December, followed by a 50bp move in early February and a25bp move in mid-March to a peak of 3% in the Refi rate of 3.0%.

- RBNZ: Our ASB colleagues expect the RBNZ to remain hawkish, taking the OCR to a peak of 5.5% before mid-2023.

As noted, the exception to the ongoing global monetary policy tightening cycle is expected to be the Bank of Japan (BoJ) and People's Bank of China (PBoC). The BoJ is expected to retain its ultra-easy monetary policy settings until Governor Kuroda’s term expires in April 2023.

For the PBoC, after the recent cut to the RRR of 25bp, further monetary policy easing is expected as the Chinese authorities try to support economic growth under the weight of the zero-Covid policies and uncertainties in the property market.

‘Tomorrow’s problem': global growth and unemployment

For 2023, one of the big developments for the global economy and markets will be what we might call 'the pivot'. That is, when central banks feel like they have got on top of inflation, i.e. ‘today’s problem’, and switch to a focus on ‘tomorrow's problem.’

We have already seen some signs of this. The US Fed Chair has talked about slowing the pace of tightening in coming meetings, the BoE Governor has noted that rates in the UK are unlikely to go as high as market pricing, while here in Australia, the last three rate hikes have been a smaller 25bp, rather than the previous 50bp moves from June-September.

Markets initially reacted positively to the lower-than-expected October CPI and core CPI in the US. But as we have seen more recently, central bank rhetoric, including in the US and certainly in New Zealand, remains generally hawkish. However, as we get into 2023, there is likely to be a more concerted pivot in monetary policy.

The first phase will be the slowdown in the pace of tightening, then an end to the tightening cycle and then, eventually, the start of some monetary policy easing.

Our base case is that all of that could happen over the course of 2023, with rate cuts pencilled in before the end of 2023 in the US and in Australia.

The aggressive tightening of monetary policy through 2022 and the early parts of 2023 are likely to lead to a good old fashioned central bank-led economic downturn or recession. And we haven’t seen one of those for several decades.

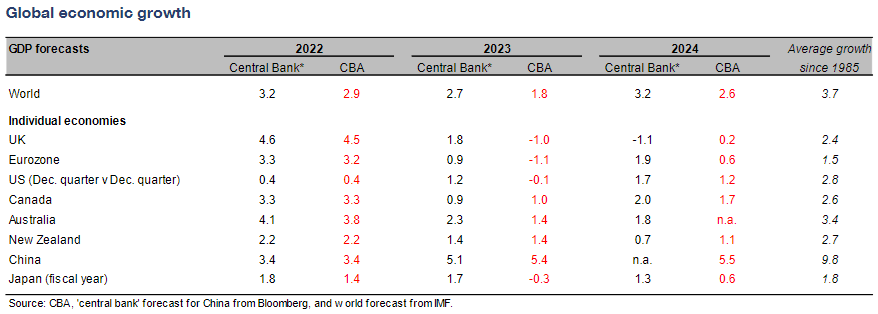

We forecast the world economy will enter a recession in 2023, expanding by just 1.8% - noting that the IMF defines a global recession as growth of less than 2%.

Specifically, we expect to see recessions in the US (2023 economic growth of -0.1%), the UK (-1.0%), the Eurozone (-1.1%) and Japan (-0.3%). Our base case for China is that an eventual easing of the zero-Covid policy and significant policy stimulus will likely see economic growth in China accelerate to 5.4% in 2023.

The pivot

One of the key themes for 2023 is expected to be a pivot in monetary policy. The key for the central banks is that in addition to signs that inflation has peaked and is returning to target, they will also want to see some weakness in both consumer spending and the labour market.

The first sign of ‘the pivot’ will be a slowing in the pace of tightening, but the important phase for markets will be an end to the tightening cycle. For the US, we expect to see the last tightening in March 2023.

Once an end to the tightening cycle is underway, consumer demand is weakening and the unemployment rate is rising, we should see some major economic and market developments in 2023.

As noted, global economic growth could slow markedly, with recessions in a number of key economies.

In addition, global bond yields could fall quite quickly. Indeed, we have both US and Australian 10yr bond yields at 2.8% at the end of 2023, approx. 70bp-80bp lower than current levels. The Australian yield curve should flatten in this process with the Australia/US 10yr spread expected to trade around 0bp to -20bp out to the end of 2023.

In currency markets, despite the recent rally, we still think the risk over the next few months is for further depreciation in the AUD. Or rather, we expect the appreciation of the USD to resume.

Our Australian Economics team has done a great job in calling the Australian economy over a number of very difficult years. Expected key highlights for the year ahead in Australia are:

- Australian economic growth is expected to moderate over 2022 and then shift to below-trend growth in 2023.

- GDP growth is forecast at 2.2%/yr as at Q4 22 (3.8% year average) and then down at 1.4%/yr at Q4 23 (1.3% year average).

- The unemployment rate is forecast to stay around 3½% into year-end 2022 but move higher to 4¼% over H2 2023.

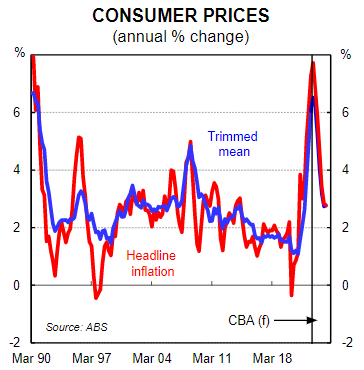

- Headline inflation is expected to peak near 7¾% in Q4 22, but then move lower through 2023 to an estimated 3.4%/yr in Q4 23. Inflation is forecast back within the 2%-3% target range in early 2024.

- Underlying inflation is expected to peak ~6.5% in Q4 22, moderate to 3.2%/yr at Q4 23 and then be back within target in Q1 24. See below for more details on recent trends in inflation.

- Wages growth is expected to peak at ~3½%yr by mid-2023.

- As at November, national dwelling prices are now down 7% from their peak in April this year and are expected to decline by~15%, peak to trough in this cycle. Prices are then expected to towards the end ofH2 2023 and through 2024.

- Key risks for the Australian economy remain around geopolitics, the savings rate, fiscal policy, net overseas migration, international trade and global backdrop.

Inflation

It is well known that inflation has surged higher in Australia, to 7.3% in Q3 22 and is expected to move even higher when the Q4 22 data is released on 25 January 2023.

At face value, this data supports the view expressed by both the RBA Governor and Deputy Governor in recent weeks that the prospects are promising that we may soon be approaching the peak in inflation in Australia.

As noted above, while we expect to see the annual rate of both headline and underlying inflation move higher in Q4 22, we then expect to see the pace of inflation moderate through 2023, with both headline and underlying inflation forecast back in the RBA’s 2%-3% target range by early 2024. Note these forecasts assume some form of intervention by the government on energy prices.

RBA monetary policy

All in all, with the housing market already turning down, consumer spending in the process of softening and inflation expected to peak in coming months, we expect the RBA is close to the end of its monetary policy tightening cycle. Especially when we consider the lags between interest rate hikes and higher mortgage repayments, as well as the large roll off of fixed rate home loans in 2023.

The RBA Governor has been signalling in recent weeks that the RBA is not on a pre-set course for monetary policy. It is clear from the rhetoric that the RBA thinks they have more work to do and that they could resume a faster pace of tightening if the data dictated this, but the RBA has also stated on several occasions that “the Board is prepared to keep rates unchanged for a period while it assesses the state of the economy and the inflation outlook.”

Our base case is that by the time we get to early February 2023 there will be enough accumulated evidence to support the view that the RBA does not need to tighten monetary policy any further, although there remains the risk of one last rate hike in early 2023.

Stephen Halmarick is Chief Economist and Head of Global Economic & Markets Research at Commonwealth Bank of Australia.