The latest Intergenerational Report (IGR) contains some scary statistics. Within 40 years the life expectancy of the average male will be 95.5 years, and for a female 96.6 years. The population will be almost 40 million and include more than 40,000 people aged over 100.

There is nothing really new in this. For more than 35 years, there have been warnings galore about the problems that will come when the baby boomers start to leave the workforce. These people, born between 1946 and 1964, are now aged between 69 and 51 - the oldest of them are either retired or thinking about it.

Their exit from the workforce will cause labour shortages, and put pressure on wages as employers compete for a dwindling number of workers. Furthermore, their increasing need for health services will cause immense challenges for an already stretched health sector.

Adversarial politics creates inaction

Governments of all persuasions have long been aware of this ticking time bomb, but thanks to the adversarial nature of politics, there has been a lot of talk but not much action. In 1997 the Howard Government tried to fix the crisis in the nursing home industry by introducing accommodation bonds. Labor ran such a successful scare campaign the scheme was dropped.

For example, in budget after budget there have been attempts to address the rising cost of the Pharmaceutical Benefits Scheme which in 2007/2008 delivered 170 million prescriptions at a cost of $6.6 billion. In 2006 the Howard Government laid out a four year reform package that was designed to save $3 billion over ten years, and in the 2008/2009 Budget the Rudd Government introduced new therapeutic groups aimed at driving down the cost of drugs. Still the costs escalate, and in 2013/2014 exceeded $9 billion.

The first IGR was included in the 2002/2003 budget, and a second report was released in 2007 and a third in 2010. Every time a new IGR is released we hear statements from the government of the day that we face massive problems in the future unless we make big changes to our tax and welfare system in the short to medium term. Unfortunately there is more talk than action.

The time to act is now

The good news from the latest IGR is that average annual income is expected to rise from $66,400 to $117,300, which will boost the property and share markets. The bad news is that there will be just 2.7 people aged between 15 and 64 — potential taxpayers — for every person aged 65 and over.

It is a wake-up call for every Australian. If you are under 40, you have time for compound interest to work its magic, which should enable you to build a decent portfolio if you start now and choose the right mix of growth assets. You will need this portfolio because you may well live to 100, at which time the age pension is certain to be severely restricted.

If you are between 40 and 65 you cannot afford to rely solely on employer-paid superannuation. The age at which you can access the age pension is being raised, and there are calls to also raise the superannuation age to 67 to match. The best strategy for you is to salary sacrifice to the maximum, and hone your skills so that you can work as long as possible. This will increase the power of compounding and make your money last longer, as it will delay the time you need to start making withdrawals.

Are you already over 65? Don’t panic. Any changes to the age pension will come in gradually, and are certain to be grandfathered. However, you need to be getting good financial advice to ensure your money works as hard as realistically possible. The alternative is to face the challenge of living longer than your money.

Where will the taxes come from?

The following case study illustrates the difficulty facing any government trying to get the budget back on track. Think about a single income couple with two children aged 8 and 10, where the primary breadwinner earns $75,000 a year. The income tax on this would be around $16,000, but the family's contribution to the national coffers would be just $9,000 after family payments of $7,000 a year are taken into account. If we assume the cost of the full age pension for a couple is $36,000 a year when healthcare concessions are factored in, it takes four such single income families (or eight adults of working age) to support one pensioner couple.

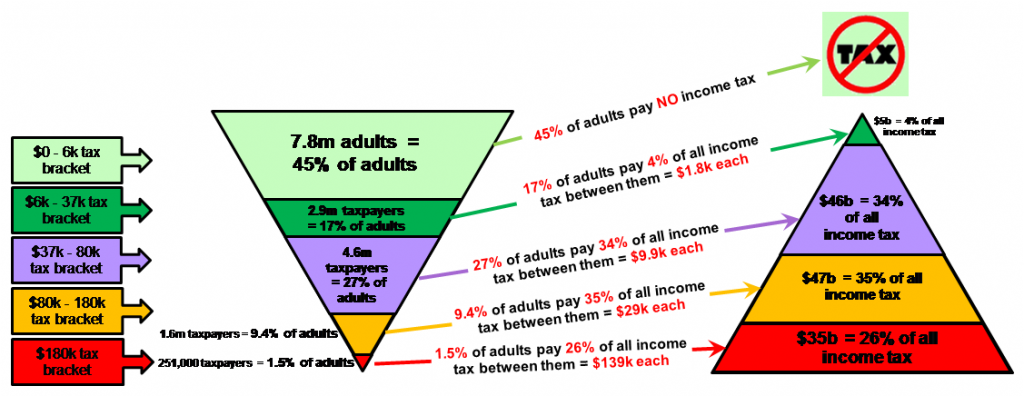

This imbalance will become worse as the ratio of dependants to workers grows over time. Our taxation system presents grave challenges too. Currently, 61% of personal income tax is received from a mere 11% of adults, leaving the bulk contributing very little. In addition, 87% of those aged 65 and over pay no personal income tax whatsoever.

Source: Philo Capital

Source: Philo Capital

A full review of our tax and welfare system is overdue, but the adversarial nature of politics does not make for optimism. Right now, the federal government reminds me of a dysfunctional family. Dad and Mum (the two major parties) spend all their time abusing each other and promising the world to their constituents (us, the children) while well-meaning but inexperienced relations (the minor parties) add to the turmoil by telling the kids that their parents don't know what they are talking about.

Unless you have more faith than I do that politicians of all parties will be able to solve these problems over the next 40 years, you should be making every effort to work as long as possible to accumulate as much as you possibly can for your retirement. Australia is moving inexorably to a society of haves and have nots. Despite a lot of rhetoric from our politicians, it will be the haves who will be first in line for medical care as the queues for health services grow.

Noel Whittaker is the author of Making Money Made Simple and numerous other books on personal finance. His advice is general in nature and readers should seek their own professional advice before making any financial decisions. See www.noelwhittaker.com.au