The patient preparation of a home-cooked meal with carefully selected ingredients is a rewarding endeavor. Knowing what’s in the meal should make it healthier and well-balanced. Pre-packaged takeaway is convenient but usually less satisfying beyond the immediate need to relieve hunger.

Trends in investing are similar. Indices are essentially investment shopping lists prepared by someone else that save passive investors time and effort in deciding what to buy, or they give benchmark-aware fund managers a starting point to decide what to put in their trolleys.

Changes in investing habits

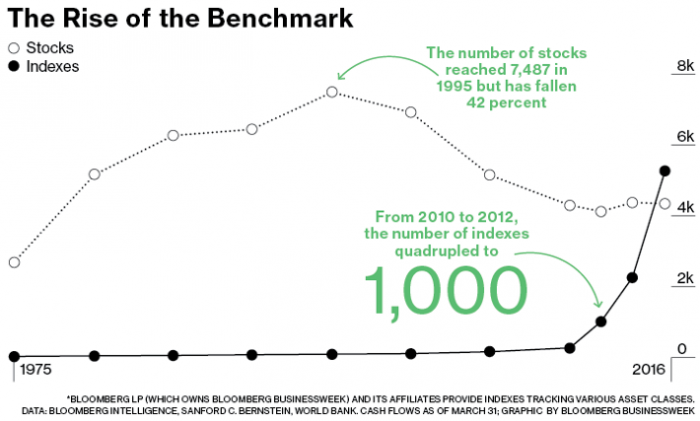

Yet in 2017, the number of stock market indices exceeded the number of stocks in the US, expanding the proverbial supermarket of investment ‘takeaway’ offerings.

Source: https://www.bloomberg.com/news/articles/2017-05-12/there-are-now-more-indexes-than-stocks

What does it say about our investment eating habits when the number of shopping lists exceeds the number ingredients? In our rush to embrace convenience, are we losing sight of selecting quality underlying ingredients and carefully preparing healthy, well balanced portfolios?

Many products in the new financial supermarket are built on the assumptions and ‘theories’ of markets, including that humans make rational economic decisions and that price should always reflect the intrinsic value of the investment. Yet humans, and therefore markets, are not perfectly rational, particularly in the short term.

The 2017 Nobel Prize for Economic Sciences, awarded to Richard Thaler, recognised this as much, acknowledging his research which demonstrated,

“…that, unlike members of homo economicus, members of the species homo sapiens make predictable mistakes because of their use of heuristics, fallacies, and because of the way they are influenced by their social interactions.”

Holding period returns

Value investing, like cooking, should be an exercise in careful selection, patience and conscious avoidance of biases. To this end, compelling research released last year from active management academics Martijn Kremers and Ankur Pareek looked at the relationship between holding period (duration), degree of ‘activeness’ and returns for thousands of US retail and institutional funds over nearly three decades. This sample set included US equity retail mutual funds from the largest database of returns, the Centre for Research in Security Prices (CRSP), and a sample of all aggregated institutional investor US equity portfolios as inferred from their quarterly 13F statements. It covered a 24-year period from 1990 to 2013 for retail and 1984 to 2012 for institutions.

Among high ‘active share’ mutual funds, those with patient investment strategies (average holding periods of more than two years) were able to generate average alpha of 2.05% per year in the study.

At the other end of the spectrum, irrespective of how dissimilar their portfolios were relative to their benchmarks, highly-traded mutual funds with short stock holding periods underperform, with average annual net alpha of negative 1.44%.

The lesson is that active investors must have conviction and be patient. What is good takes time to prepare and is best savoured, not quickly devoured. And the key to the success of high conviction, patient value investors is, funnily enough, … valuations.

Valuations at time of entry remain key

According to Bank of America Merrill Lynch analysis from 1971 to today, valuations at the time of purchase have explained 80-90% of returns from the S&P 500 over a 10-year horizon. The research, ironically, comes from a major investment bank which is part of an industry that prospers by encouraging short-term trading.

True value investors should focus on valuation as it maximises the chance of outperforming the market on a long-term basis. This can be hard to justify to investment oversight committees where peer comparison and human bias demand immediate action and results. It is understandable why so much of the retail and institutional funds management industry trends towards career-risk driven mediocrity and hugs the benchmark. Good investing, like good cooking, doesn’t benefit from having too many chefs in the kitchen. Too many investors trade too frequently, do not properly anchor assessments in fundamental, long-term reasoning, or fire their fund managers too quickly.

Cooking at home is more challenging as we become time poor, yet it is increasingly satisfying for the same reason. We believe patience and high conviction as sources of excess return and they are likely to persist due to the unchanging nature of human psychology.

Sam Morris is an Investment Specialist at Fidante Partners and Adrian Warner is CEO/CIO of Avenir Capital. Fidante is a sponsor of Cuffelinks. This article is for general information only and does not consider the circumstances of any individual.