In a world where data is the new gold, the 2017 Reader Survey provided excellent feedback on who Cuffelinks readers are, their level of investment experience, what they like and don’t like, as well as their expectations of the newsletter and website. Thank you to the 2,135 people who participated in the survey, and the overwhelmingly positive support that Cuffelinks receives.

A summary of all results is linked here, and below are some highlights.

Reader demographics

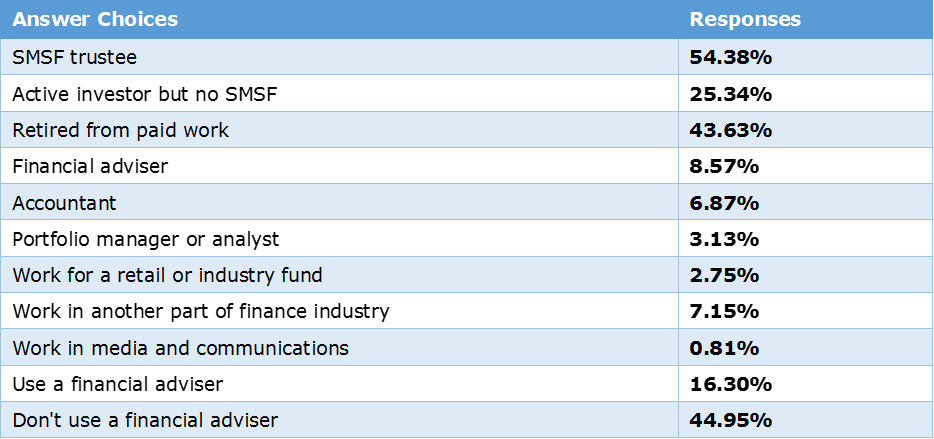

We first asked respondents to categorise themselves based on career or investor type, and whether they use an adviser. More than one option could be chosen. About 54% said they were SMSF trustees, 44% were retired and almost 45% said they do not use a financial adviser. In sum, about 30% are market professionals working in wealth management.

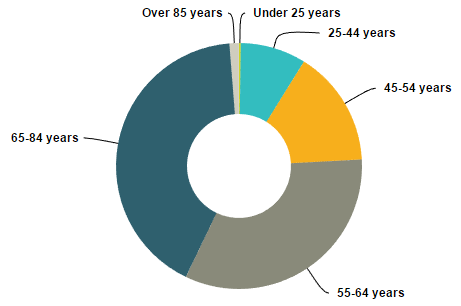

Question two gave us a breakdown by age bracket.

Question two gave us a breakdown by age bracket.

It wasn’t a surprise to learn that most readers are over 55, but it was unexpected that a high 42% were 65 to 84 years old.

There is a solid group of almost 10% under the age of 44, but no doubt the readership corresponds with when people want more sophistication in their investment knowledge.

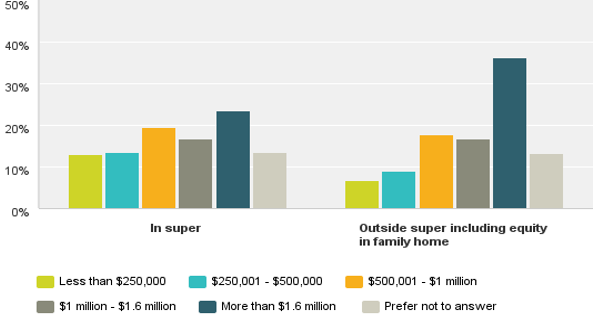

Distribution of existing investments

Questions three and five asked respondents about their current asset distribution (in and out of super) and their knowledge of different types of investment products. Showing the importance of the new superannuation caps, the highest category was balances over $1.6 million. Notably, this group held far more in assets outside super, but the majority of value is probably the family home.

Investments strongly favoured by SMSF trustees are direct holdings in Australian shares (24%), listed investment companies (16%), actively managed funds (12%), ETFs and A-REITS (both around 11%). These preferences didn’t change that much when investing outside super. We also had a solid group of readers who do not know enough about particular asset types, so we will continue to address this.

Knowledge gaps

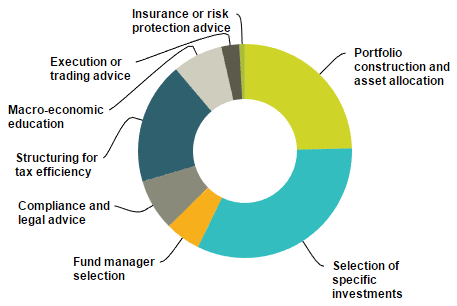

Question four allowed respondents to tell us the one investment area they needed most help with.

The top three knowledge gaps were the selection of specific investments (33%), portfolio construction and asset allocation (25%), and tax efficiency (18%).

Cuffelinks will continue to target these areas, along with many other aspects of investing. We’re pleased to see portfolio construction and asset allocation receive prominence, and structuring for tax efficiency was surprisingly high.

Relevance and readability of articles

Questions six and seven asked about the relevance and readability of Cuffelinks’ articles. We’re happy to see that the vast majority of readers find our articles credible and professional, easy to understand and independent. Only 2.5% said the content was not useful for their own portfolios.

Article length is about right, with tiny minorities saying the articles are either too short or too long. Time is also a factor, with 10% saying they don’t have the time to read the full article. This is where our downloadable version of the newsletter might be preferable. Saving it to your computer or device allows you to read it later, perhaps offline.

How is Cuffelinks different?

We received almost 1,300 comments for this open question, so rather than print every comment, this word cloud shows the most regularly occurring words and phrases. Thank you for the overwhelmingly positive comments (and the word ‘bias’ below was invariably in the context of ‘lack of bias’).

Future direction

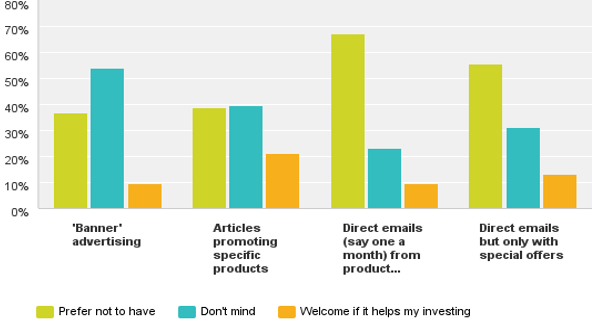

On new ways to finance the Cuffelinks business, we saw an aversion to direct marketing emails either for specific products (67%) or special offers (55%). About 54% of readers wouldn’t mind if Cuffelinks used banner advertising to generate revenue, and 10% more would welcome it where it helped in some way with their investing.

Opinion is mixed on whether Cuffelinks should run articles promoting specific products. While we have run articles in the past that promote, detail, or explain certain products, it’s usually done to inform readers of new products coming to market, emerging trends, or in the interests of financial education. However, over 60% of readers seemed comfortable with articles promoting specific products.

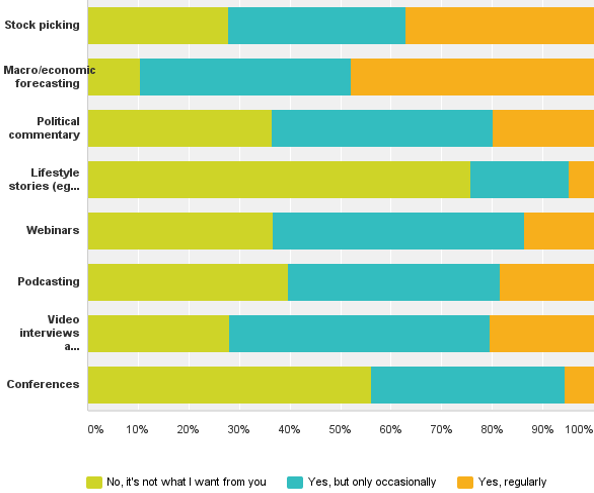

In question ten, we sought readers’ views on providing additional content and services.

The top two additions that would be welcomed are stock picking (37% on a regular basis, 35% occasionally) and macro/economic forecasting (48% on a regular basis, 42% occasionally). Traditionally, these are areas we have downplayed, because the future is so uncertain and much commentary is guesswork, and because of the proliferation of coverage elsewhere.

There was little appetite for lifestyle articles, but nearly half would like to see Cuffelinks run conferences. We hope to add resources to do more webinars, podcasting and videos.

Recommending Cuffelinks

Most encouraging, about 94% of respondents said they have already referred friends or colleagues to Cuffelinks or are highly likely or likely to, and only 6.5% said they are unlikely to. Without a big advertising budget, Cuffelinks relies on referrals support to grow our subscriber base.

Other feedback

We received over 1,370 comments for this question requesting general feedback, so rather than print every comment, here’s the word cloud. Again, thanks for the great feedback.

Leisa Bell is Assistant Editor at Cuffelinks.