The August 2020 results were the first real chance investors have had to properly look under the bonnet and dissect the performance of listed A-REITs (property trusts) since the onset of COVID-19. Not surprisingly, there were wide variances reported, given the impact that forced lockdowns have had on the various property sectors. However, the output was better than initially feared back in March 2020 when COVID-19 first hit.

Valuations across the A-REIT sector now look compelling especially relative to bond yields. The A-REIT sector is priced on an FY21 dividend yield of 4.8%, a 390 basis point spread over 10-year bonds, and well above its long-term average of 200 basis points.

We believe market dislocations create good buying opportunities for active managers. We continue to focus on select A-REITs with high quality portfolios (assets, lease covenants and longer lease tenures) and strong balance sheets (low gearing, diversified funding sources, longer duration debt) which trade on cheap multiples (low P/E and large discount to NTA).

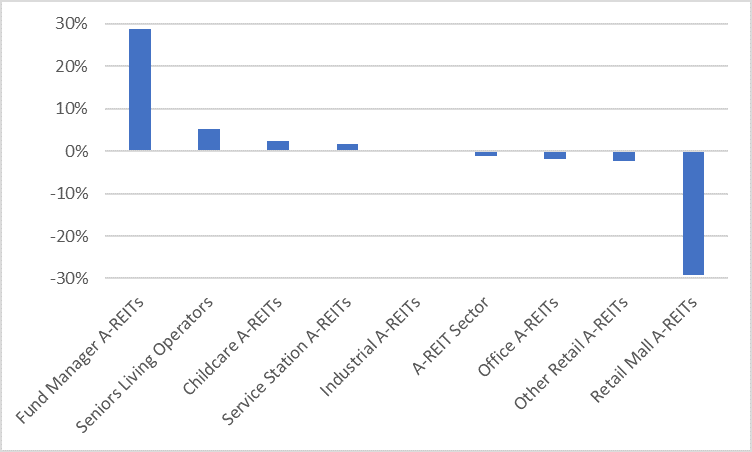

Fund manager A-REITs outperform retail mall A-REITs

On average, A-REITs delivered annual EPS (earnings per share) growth of approximately -1.1% for the year ending June 2020. Yet this headline hides the significant dispersion across the different sectors.

Strong performances were recorded by the fund manager A-REITs (including Goodman Group ASX:GMG and Charter Hall ASX:CHC) and seniors living operators (including Ingenia Communities ASX:INA), which delivered EPS growth of +28.8% and +5.2% respectively, while not surprisingly, retail mall A-REITs (including Scentre ASX:SCG and Vicinity ASX:VCX) were the weakest with average EPS growth of -29.3%.

Figure 1: A-REIT Sector Earnings Growth - FY20

But it’s all about the cashflow

While EPS numbers provide a useful measure of performance the focus this reporting season was on cashflow. Leading into this reporting season, we knew things would be different given the difficult trading operating environment.

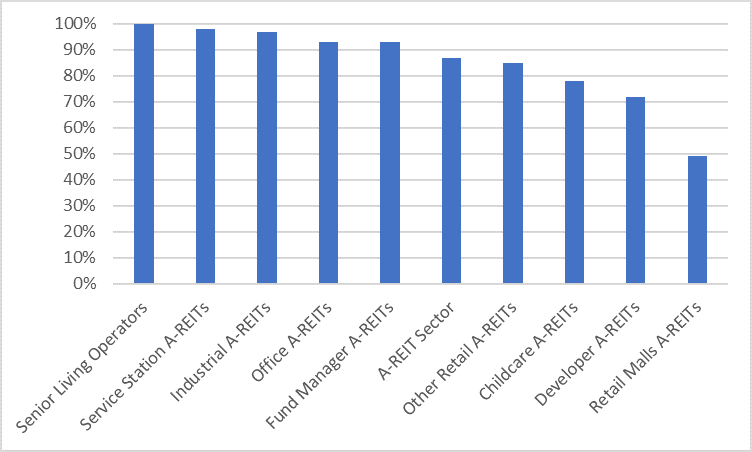

A-REITs have had to contend not only with enforced closures (e.g. pubs) but also the federal government’s Code of Conduct legislation for landlords and tenants which mandated that landlords would be required to waive or defer rent to small and medium enterprises tenants who had annual turnover less than $50 million and had a greater than 30% loss in revenue.

The extent of the impacts on individual A-REITs were influenced by a mixture of sector focus, tenant covenant, and management skills. Clearly those A-REITs whose portfolios were more leveraged to the consumer and small to median enterprises fared worse (Figure 2).

Figure 2: Proportion of Rent Collected – March 2020 to June 2020

A-REITs took different approaches to account for these shortfalls in rent which made assessing individual earnings performance less reliable than usual. Hence the assessment of cashflow became key.

Given the cash shortfalls across several REITs, dividends were cut by an average of -9.6% for the past financial year, although excluding retail mall A-REITs the result was only -4.8%.

A quick take on each sector

Turning to the A-REIT sub-sectors, both industrial and office delivered stable results, and despite all the noise about ‘working from home’, cash collected from rents remained high.

In contrast, the performance of retail A-REITs was weaker, particularly those with larger malls that are more exposed to discretionary focused retail. In particular, Scentre Group (ASX:SCG) and Vicinity Centres (ASX:VCX) reported very weak results with large falls in foot traffic, tenant sales, reported earnings, and asset values. Their performance reflects both the cyclical elements associated with a slowing economy and the acceleration of the structural changes from the growth in online shopping.

The momentum in online shopping was well under way before COVID-19 but as a number of industry players have noted, the COVID-19 lockdowns forced consumers to go online in greater number and frequency, accelerating the shift away from physical stores to digital shopping by at least five years.

Residential developers, Stockland (ASX:SGP) and Mirvac (ASX:MGR), delivered flat growth in settlement volumes on stable margins, but promisingly net deposits were up about 20% which indicates a stronger outlook. Both groups referred to the positive affect on sales activity from recent increases in government stimulus programs for housing.

Property fund managers continued their recent trend of strong growth in FUM and earnings, given the supportive backdrop of low interest rates and demand for yield-orientated investments. Standout performers in this category were Charter Hall (ASX:CHC) and Goodman Group (ASX:GMG).

Select alternative sectors, such as rural and service stations, were largely unaffected by the effects of COVID-19 and delivered solid results. In this context we highlight good results from Rural Funds (ASX:RFF), Waypoint REIT (ASX:WPR) and APN Convenience REIT (ASX:AQR).

Seniors living operators such as Ingenia Communities (ASX:INA) continue to benefit from Australia’s ageing population and low levels of supply of quality seniors living. These groups were generally able to drive strong EPS growth from their development of new stock and high occupancy from existing villages.

Balance sheets were under the microscope

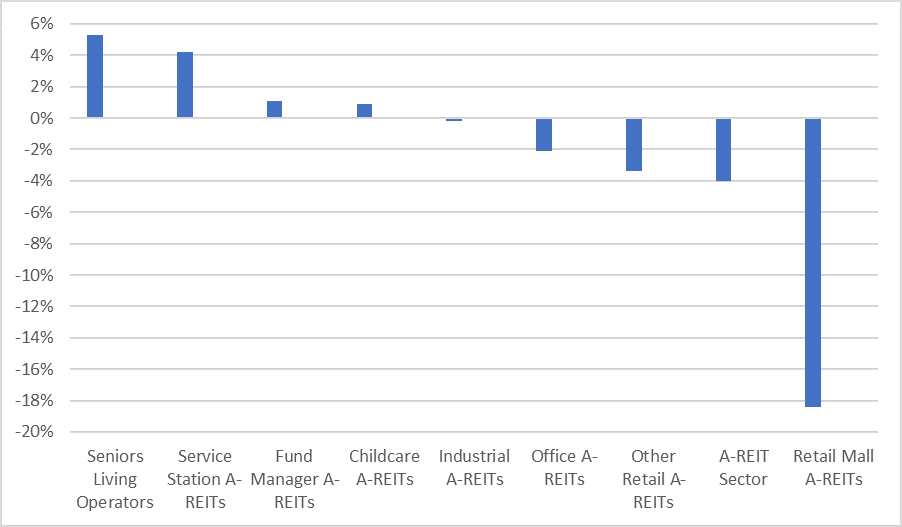

The emergence of COVID-19 has acted as a trigger for some asset softening across the commercial property sector. But as with EPS results, the damage was largely contained to large retail malls, with mall values falling on average by 11% with some further dilution to net tangible assets (NTA) coming from the cash shortfalls of rent collected.

Figure 3: NTA Growth – 6 Months to June 2020

Balance sheets overall came out in reasonable shape. Some A-REITs went to market and raised capital through April to June to strengthen their balance sheets. The sector appears to have learnt the lessons of the GFC, coming into the COVID-19 crisis with more diversified funding sources, lower gearing – at 30 June the average gearing level was circa 26% - and longer debt tenor (average tenor is circa 5 years).

No guidance but clear upside

Earnings guidance was hard to come by this reporting season, with only a handful of A-REITs willing to stick their neck out given Melbourne is still in lockdown and the timing of a vaccine remains unclear.

However, there are enough signs to be optimistic on the outlook. Operating performance for retail focused A-REITs have started to improve (excluding Melbourne assets), rent collections are up across most sectors in July and August and as noted earlier, most balance sheets are in good shape.

While the potential of further COVID-19 waves cannot be ignored, the most likely outcome is for COVID-19 domestic cases to subside or the emergence of vaccine which would be positive for both the economy and A-REITs. We believe given the significant variance across the underlying A-REIT sub sectors and individual A-REITs that this will continue to be a market for active managers to make selective investments.

Jonathan Kriska is Portfolio Manager, Listed Securities at Charter Hall Maxim Property Securities. Charter Hall is a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.