Hedge funds are renowned for using cutting-edge technology to conduct research. Satellites are used to watch car parks outside Walmart stores to estimate retail sales. Some track corporate aircraft to understand where the jets are going in anticipation of acquisitions and deals. If you’re interested, you can track the FAA aircraft registration database where you can find registered aircraft and search flights under flightaware.com.

Like everything else, using this sort of technology is not at all perfect. Kellogg shares rose then fell sharply after hedge funds bid up the stock due to Kellogg corporate aircraft visiting Omaha, Nebraska (Buffet headquarters), Chicago (Kraft/Heinz 3G) and Southern California (where Berkshire director Charlie Munger resides), but no offer was made. It’s public information available for anyone who bothers to search for it.

You don’t need a satellite

Satellites and plane tracking are helpful for traders looking for takeovers. For everyone else, I recommend the internet. Popular sites that we use every day as consumers are very helpful for investors. Some of my favourite research sites are Amazon and Google.

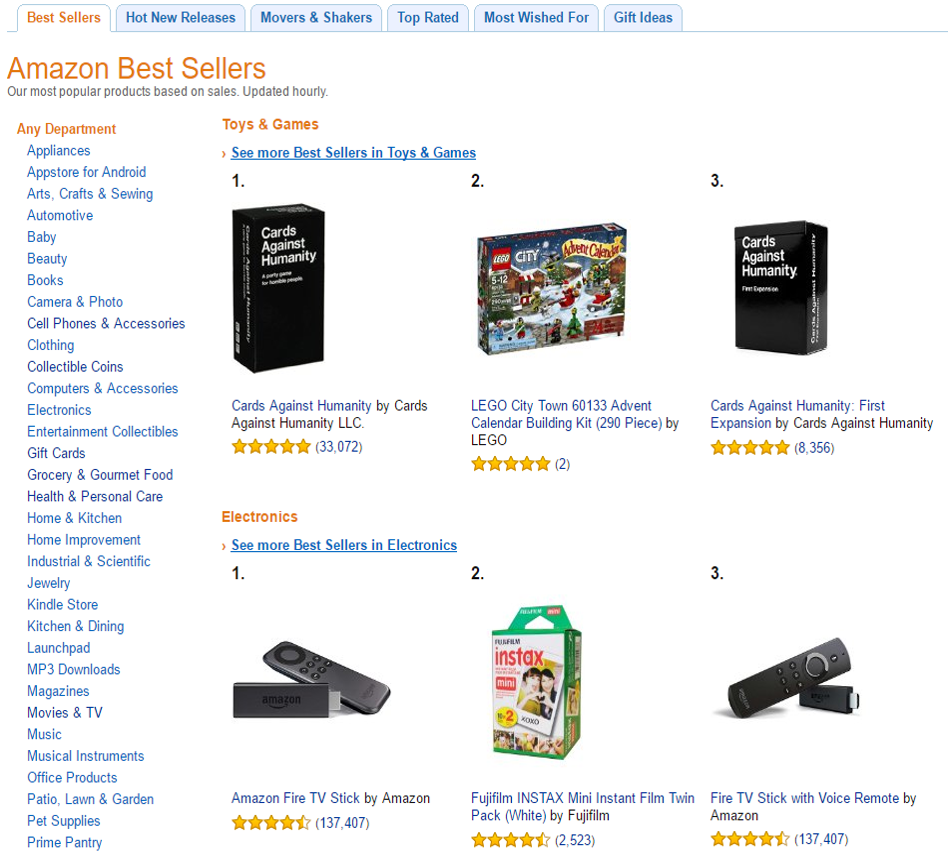

Amazon best sellers

Amazon is the largest e-commerce company in America. Under the best sellers tab you can see the most popular items under each category. It shows what consumers are buying. The number of customer reviews and ratings are important to see how consumers react to new product releases well before any financial data is released. Two of the top five toys are Lego. Some of the most popular electronic products are the Amazon Fire and Kindle. No surprise there, but the most popular gift card on Amazon is Amazon. If you are ever caught on Amazon at work you can now say you are doing market research.

Google Trends

Google has a similar database in Google Trends, which is great for seeing how searches trend over time. If someone is googling a product they are likely to be interested in it and it may lead to increased sales. An example is Netflix, the top searched for item in Australia for 2015. Amazingly, it also topped Google searches for ‘What Is?’, edging out ‘What is love?’ and ‘What is the meaning of life?’ Globally, Australia was the 18th most popular region for Netflix searches. For those interested, Pokemon Go searches peaked in mid-July, though searches are now down 85%.

The internet is allowing information to flow more freely, giving us access to information that previously did not exist. Thankfully we don’t need satellites, just an internet connection.

Jason Sedawie is a Portfolio Manager at Decisive Asset Management, a global growth-focused fund. Disclosure: Decisive owns Amazon and Google shares. This article is for general purposes only and does not consider the specific needs of any individual.