Governments and banks have reacted to concerns over the east coast housing boom by instigating cooling measures. Tighter loan criteria, additional stamp duties, and the election debate over negative gearing are all designed to slow prices. However, as the charts below show, there’s no need to do anything: the east coast market is about to be swamped with apartments.

The UBS economics team believes there should be a moderation rather than a downturn, as the tailwinds from record low interest rates offset the headwinds of tighter banking criteria and higher taxes. What is most concerning though, is the impending supply of apartment stock.

Record unit approvals

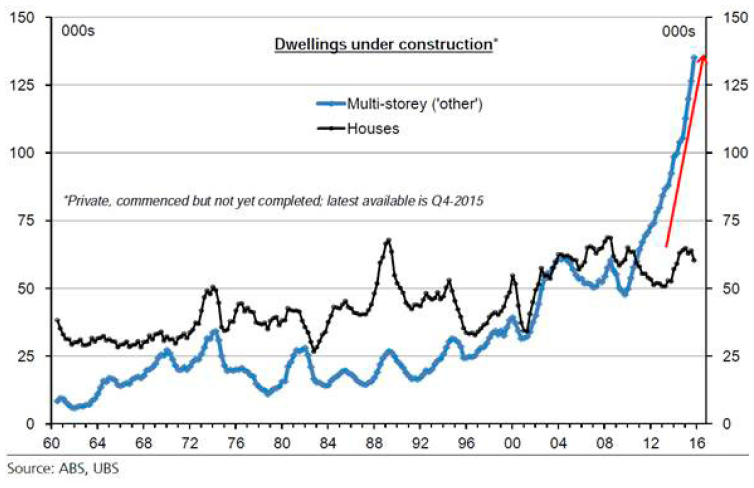

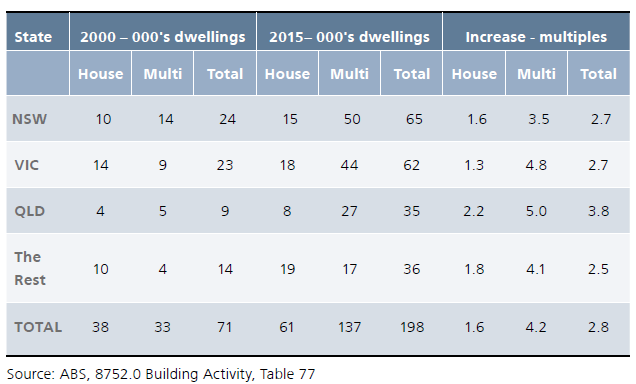

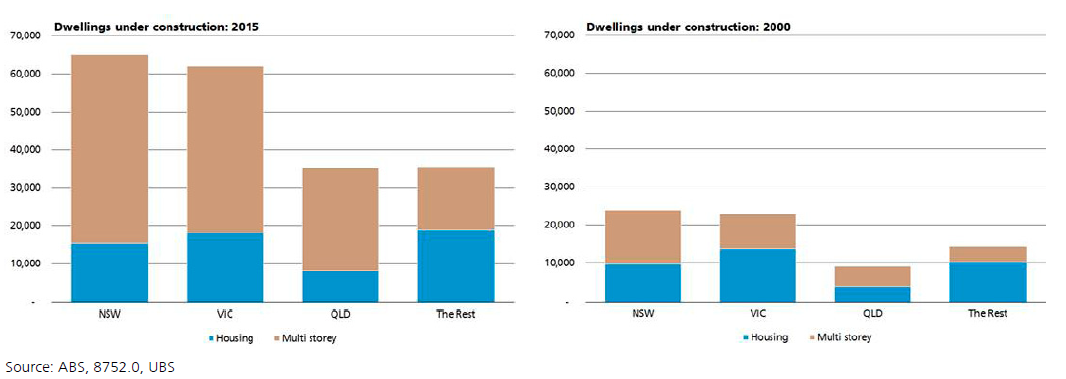

Last year I wrote about the record number of unit approvals along the east coast, with particular concerns about the expected levels of supply in Melbourne and Brisbane. Roll forward to June 2016 and most of those approvals have turned into commencements, with around 137,000 medium density dwellings now under construction. This is about four times more than was under construction in 2000, with 88% of the national total in NSW, Victoria and Queensland. The spike in multi-storey apartments can clearly be seen below, while housing is within historical ranges.

Chart 1: Dwellings under construction in Australia

In absolute number terms, it's startling. Construction of apartments in Queensland is running at five times its levels from the year 2000, while NSW and Victoria each represent over 30% of all supply.

At the project level, supply in Queensland and Victoria is largely centred around CBDs, while NSW supply is dispersed across metropolitan areas, spreading the risk. With this supply largely hitting the market in the next year, will those who paid a 10% deposit be able to finance the settlement of the remaining 90%? As a rule of thumb, we estimate that about 70% of purchasers are local buyers (owner occupiers and investors), while about 30% are connected to foreign buyers.

Table 1: Dwellings under construction by type and state as at Dec 2000 and Dec 2015

Settlement risk

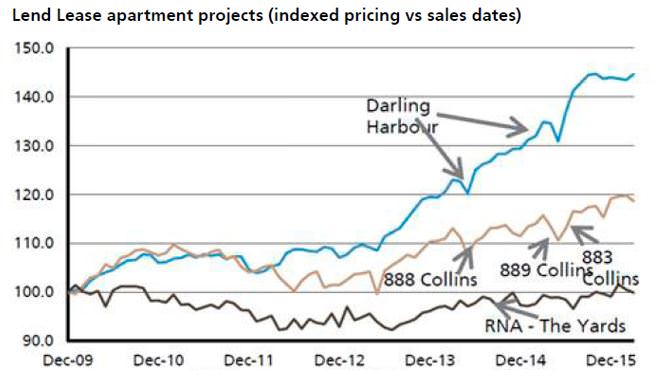

The key question is whether it’s in the purchaser’s best interest to settle and that will largely depend on price movements between the dates of the deposit payment (probably 10%) and settlement.

Using Lend Lease as a guide, it appears that anyone who bought an apartment in Sydney is ‘in the money’ and would forego strong capital gains if they walked away from the purchase. Developments such as Melbourne’s Collins Street and Brisbane’s The Yards are less conducive to gains, as shown in the chart below. While a profitable re-sale in Sydney seems highly probable, it seems less so in Melbourne and more difficult in Brisbane. Interestingly, Lend Lease’s highest default rate during the GFC was 3%, versus less than 1% at present. I must point out that the listed market developers like Lend Lease and Mirvac produce higher-quality units that would be more desirable in a re-sale market than some peers.

Financing switching from banks to mezzanine lenders

The great thing about a turning point in the cycle is that those with strong balance sheets and solid cashflows can take advantage of other groups’ weaknesses. I recently spoke to three mezzanine loan providers who said they’d never been busier. When the banks close the doors, other providers step forward and are happy to help, but it will cost more. All three have existing loans to residential developers with solid credentials who were refused construction finance from the big four banks. Two of these were working on plans to raise capital to ‘mop up’ developers who struggle. Those with strong balance sheets and cash resources such as Mirvac, Lend Lease and Stockland will increase their market share in the next two years.

The oversupply should lead to falling apartment rentals as investors compete to secure income. This will take the apartment yield (net of costs) to less than 2% or 50x price to earnings. Investors would do well to sit back and wait.

For those who wonder what happens to the traditional house and land site, weakness in apartments should have an impact. When inner city apartment rents decline, those renting on the fringes can upgrade location. Pleasingly, housing supply is not excessive and continues to be hamstrung by council approval processes. Note that the two markets (houses and apartments) are distinct with a large family on a suburban block with kids at the local school unlikely to switch to a CBD unit.

Of course, property investment is not only residential. A relatively high-yielding, liquid investment such as a REIT, with capital growth potential and expert management, should not be discounted. With our expectation of low rates and a healthy yield buffer above cash and bonds, we remain confident that investments in commercial property, in particular REITs, will continue to deliver solid returns.

Pat Barrett is Property Analyst at UBS Asset Management. Nothing in this document is to be taken as specific financial product advice and it does not take into account any individual investor’s investment objectives, tax and financial situation or particular needs.