Investors are increasingly being attracted by the relatively high yields and stability of returns offered by private credit.

Australia’s largest superannuation funds are leading the way by allocating billions of dollars into this asset class, and we expect robust growth over the next year. However, many retail investors and self-managed superannuation funds (SMSFs) are not yet allocating as much to private credit as larger institutions.

The growth of private credit is a global phenomenon and institutional investors in particular have recognised the benefits of relatively attractive yields with lower volatility than shares or publicly traded corporate bonds.

Assets under management for the global private debt market topped US$2.1 trillion (A$3.15 trillion) in 2023, and the asset class is projected to increase to US$2.3 trillion by 2027, according to research house Preqin.

Private credit investments, such as senior secured corporate loans, offer investors gross yields above 10%. This could represent an attractive opportunity for investors to benefit from regular income while their capital is protected by the loan's senior secured position at the top of the capital stack.

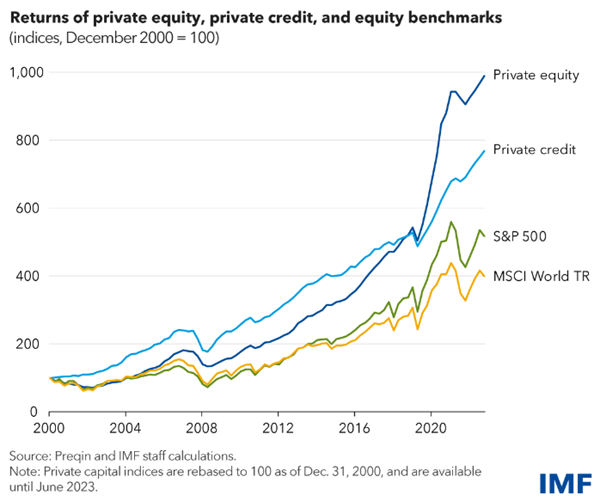

The International Monetary Fund (IMF) recently noted in this research paper the sharp growth of private credit asset allocations globally, with most demand coming from institutional investors such as superannuation funds. The chart below from the IMF displays the performance of private credit against other asset class benchmarks.

Figure 1: Outpacing other asset classes

Private credit has delivered high returns with what appears to be relatively low volatility.

In Australia, several larger industry superannuation funds such as Cbus and Aware Super are directly investing in private credit, while other funds are choosing to invest through specialist private credit fund managers to gain exposure to the asset class. AustralianSuper is one of the largest investors and has allocated over US$4.5 billion (A$7 billion) in private credit globally, with the stated ambition to triple its exposure in the coming years.

Cbus is reportedly planning to triple its global allocation to private credit over the next 18 months, while fellow industry fund Hostplus is also looking to add to its already record holdings of the asset class.

Separately, the biggest investment allocations UniSuper has made into any asset class over the past 18 months has been in the debt markets, not equity markets. While the fund is holding back on allocating any more to investment-grade bonds, believing them to be expensive, UniSuper’s chief investment officer John Pearce recently told The Wall Street Journal that he is still taking bets on private credit.

Whilst once solely the domain of institutional investors, retail investors are benefitting from increased access to the private credit asset class. However, retail investors and SMSFs still haven’t allocated much to private credit at all.

New data from the ATO reveals SMSFs have almost a $150 billion exposure to Australian property investments alone, with residential and non-residential property investments totalling a record $141.8 billion in the March 2024 quarter, up 6.2% from $133.5 billion in the December quarter. That represented 15% of total SMSF net assets, which sat at $932.9 billion on March 31, 2024.

SMSFs also invested a near record of $145.1 billion in cash and deposits, another 15% of their total assets, earning yields barely above inflation. Another $287.1 billion was invested in Australian and overseas shares, or around 31% of total SMSF assets.

In contrast, SMSFs have invested just $9.5 billion directly in debt securities and $6.5 billion in loans. Together these accounted for less than 2% of total SMSF assets.

Stable returns on offer

Given their high allocations to Australian property, shares and cash, SMSFs and retail investors overall could benefit from assessing greater allocations to private credit investments. Private credit investments could provide attractive all-cash returns of close to 10% for senior secured corporate debt, with much lower volatility in a more senior part of the capital structure.

The additional appeal to investors is that direct lending to companies typically provides investors with higher returns and greater influence over loan structure, terms and conditions compared to lending into large syndicated deals or publicly traded bonds.

With inflation remaining sticky, this could favour yields on private credit as interest rates on corporate loans are typically floating rate. This could allow investors to take advantage of interest rates in a higher for longer scenario. Gross cash yields of around 10% for private credit portfolios represent an attractive level of regular cash income for investors, particularly in comparison to the long-run average returns of other more volatile asset classes such as equities and commercial property.

Share market valuations are also relatively high versus historic long run averages and could correct over the next 12 months. In our opinion, private credit offers investors the potential for downside protection in this environment and diversification into an attractive, defensive asset class with features and characteristics that mitigate several investor concerns.

However, it is important to invest with an experienced fund manager to maximise the benefits offered by the asset class. A manager with a strong focus on deal selection will be key to success in 2024 and beyond as higher interest rates challenge some sectors of the economy.

Peter Szekely is Managing Partner of Tanarra Credit Partners, a fund manager partner of GSFM, a Firstlinks sponsor. The information included in this article is provided for informational purposes only.

For more articles and papers from GSFM and partners, click here.