Frustrated by the underperformance of many Australian blue-chips, SMSF trustees have increasingly turned to a more diversified group of mid and small cap companies that have shown strong gains over the past 12 months. As shown below, in 2017/2018, small caps significantly outperformed stocks in the ASX50.

The trend away from the ASX20

ASX20 shares now account for just 33% of the total value of shares traded by SMSFs, down from 40% a year ago. However, SMSFs are still more likely than other investors to trade ASX20 shares. ASX20 stocks account for only 29% of trades by value undertaken by non-SMSF investors.

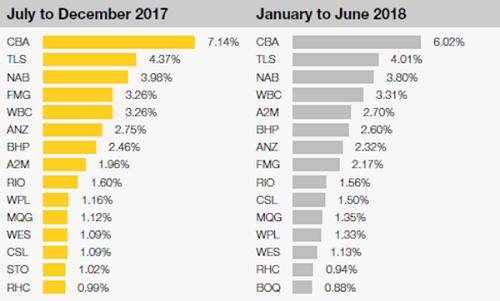

The top three most-traded stocks by value remain Commonwealth Bank (CBA), Telstra (TLS) and National Australia Bank (NAB), although they now account for a smaller proportion of trades overall. The key changes were CSL (CSL) into the top 10, while A2 Milk (A2M) moved up from eighth to fifth. On the flip side, Woodside (WPL) fell out of the top 10, and Fortescue Metals (FMG) fell from fourth to eighth.

Top 15 shares traded by SMSFs (by value, as a proportion of total trades)

Some of the biggest increases in traded values included Mirvac (MGR), with trading by value up 937%, Wisetech Global (WTC), up 161%, AMP, up 154%, and Afterpay Touch (APT), up 126%.

There was a clear overlap with seven of the top 10 performing stocks in the ASX200 over the 12 months to 30 June 2018 appearing in the top 50 stocks traded by SMSFs, as the winners attracted the buyers. Many of these are in the ASX MidCap 50, comprising the companies in positions 51–100 of the ASX200, and the technology sector.

Traditional blue-chips continue to have a strong attraction and we have seen SMSFs taking advantage of share price weakness to buy into companies like AMP, Ramsay Health Care and Telstra, in a blue-chip bargain hunt that reflects an underlying belief in the long-term prospects for these ASX stalwarts.

Offshore diversification

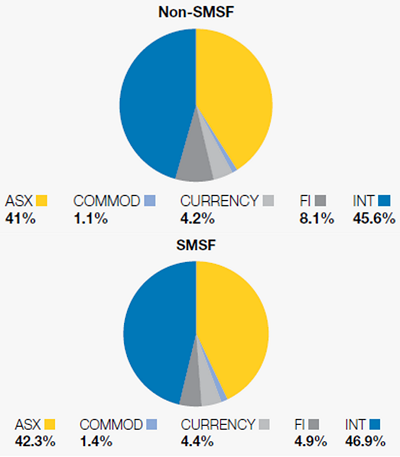

SMSFs increasingly use ETFs to diversify offshore. Over the last six months, we’ve seen this trend intensify, with internationally-focused funds now comprising nearly 47% of all ETF trades, up from 44%. As a result, Australian share ETFs now account for only 42% of ETF trades, down from 43%.

ETF trades by value and category

While the top four ETFs have remained unchanged over the last six months, an analysis of the top 12 ETFs traded by value shows SMSFs increasing their exposure to currency and property, as well as international equities. The strength of this shift suggests it is being driven by a desire for greater diversification, rather than simply the relative performance of different markets.

The Top 10 ETFs by trade value 1 January to 30 June 2018

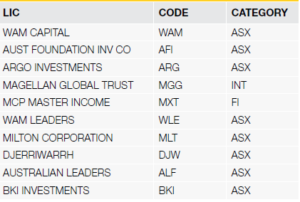

Like ETFs, SMSFs are increasingly using Listed Investment Companies (LICs) and Listed Investment Trusts (LITs) to gain exposure to new asset markets, particularly offshore. During the last six months, the value of international LIC and LIT trades by SMSFs has risen from 23% to 26% of total LIC and LIT trades.

The Top 10 LICs/LITs by trade value 1 January to 30 June 2018

While the top four most-traded funds by value have remained the same over the last six months, the MCP Master Income Trust has moved into fifth place, with trades increasing 60% by value. This trust is a fixed income LIC, and its newfound prominence is further evidence of a growing tendency by SMSFs to use listed investment vehicles for greater diversification.

Overall, recent trading data confirms that the new, internationally focused LICs and LITs have carved out a significant niche, despite the considerable head start enjoyed by long-established domestic LICs.

Direct investment into international shares

As international trading becomes easier, adding Apple or Facebook to an SMSF portfolio has become increasingly attractive.

Over the last six months, the value of direct international shares traded by SMSFs has grown by 30%, building on a 27% rise in the prior period, a growth rate significantly higher than that of non-SMSF investors. International share portfolios have become increasingly diversified, with the average number of international stocks held by SMSFs rising from 5.7 to 6.4, compared to just 3.4 among other investors.

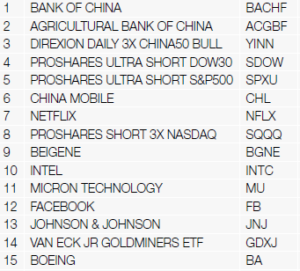

Looking at the top 15 stocks held by SMSFs (refer Top 15 table above) reveals a list of well-known names and strong share price performers, especially the FAANG stocks – Facebook, Amazon, Apple, Netflix and Google (or Alphabet). They also include trusted names such as Berkshire Hathaway and Microsoft, with a strong overall US focus.

However, Chinese-based stocks, particularly technology stocks Ali Baba and JD.com are also represented, and over the last six months, some of the largest increases in trading value have been Chinese-based bank stocks, as shown in the trading values table. This interest in international diversification among SMSF investors extends beyond individual companies to ETFs available only on overseas exchanges. As a result, the value of offshore ETF holdings has increased 49% over the last six months, albeit from a low base.

Increasing SMSF diversity and sophistication

Looking back at the last six months, SMSF investors are increasingly diverse and sophisticated in their investment choices. While their portfolios are still heavily weighted towards larger domestic stocks, SMSFs are looking beyond the ASX20, as well as taking advantage of market dips to buy into blue-chip shares at a bargain price.

Marcus Evans is the Head of SMSF Customers for Commonwealth Bank. This article is based on a report, the CommSec SMSF Trading Trends Report, an exploration of the online trading behaviour of SMSF investors, released every six months, prepared by Commonwealth Securities Limited (CommSec). This article is general information and it is not intended to replace professional advice.