It's been a turbulent period for Australia's 1.1 million SMSF trustees. Just as they put the franking credit debate behind them, the coronavirus hit, causing the market to plunge almost 40% and slashing dividend payouts. Meanwhile, saving and term deposit rates are at record lows and income from investment properties has dropped amid pleas for leniency from distressed tenants.

Despite US indices erasing the losses, trustees have reported high level of concern and negative return expectations over the next 12 months.

The downturn also pushed some trustees to make significant changes to their portfolio. About 8% of SMSFs made substantial adjustments (50% or more of the fund) to their asset allocation in 2020, doubling the number who did the same last year (4%) and the highest level on record.

The 2020 Vanguard/Investment Trends SMSF Investor Report surveyed trustee's response to the pandemic market sell-off and asked how they're positioning for the future.

Here are this year’s five biggest trends:

1. SMSF sector growth is slowing

The number of SMSFs continues to rise, reaching almost 600,000 in 2019, but the annual establishment rate has declined to a decade low. Last year, only 20,028 new SMSFs were set up, halving from a peak establishment rate of 42,033 in 2012.

Investment Trends Chief Executive Michael Blomfield attributed some of last years' slowing to the raging franking credits debate which permeated through the sector in the lead-up to the 2018 federal election. For several years, SMSFs have also expressed frustration at the increased complexity and expense of running a fund.

Blomfield expects establishment numbers to grow in the coming years and is keenly awaiting the response of trustees to the market sell-off. He says:

"What we saw following the GFC was a surge in establishment of SMSFs as people lost confidence in the value equation of paying for investment management. It remains to be seen this time whether that view is arrived that."

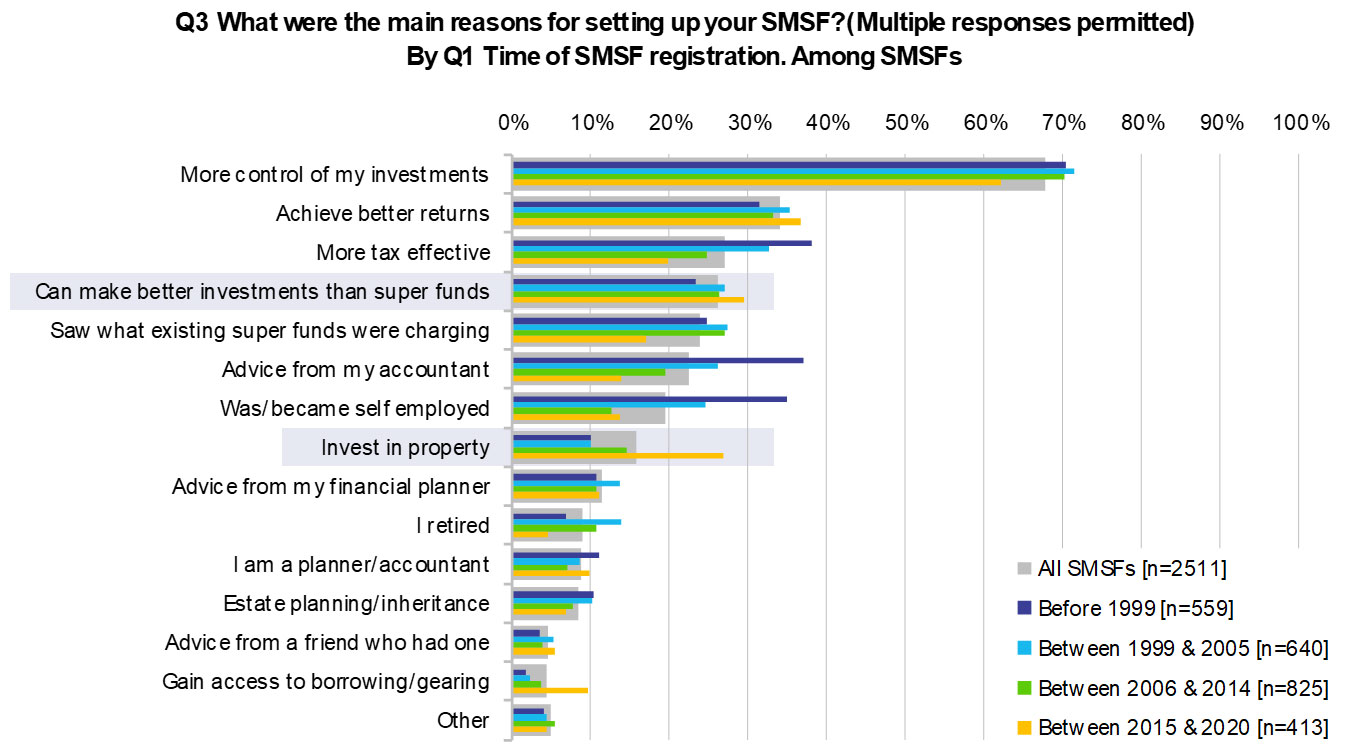

2. Desire for control drives establishment

There are two main factors driving establishment of an SMSF: first, the desire of trustees to gain control of their investments; and two, to achieve better returns. It seems that trustees believe they can do a better job than the nation’s leading fund managers.

Notably, the response 'invest in property' has come to the forefront with trustees who established a fund over the past five years despite increased controls around SMSF borrowing.

There has also been a drop-off in the number of people establishing a fund on the advice on their accountant. In the early 2000s, almost 40% of respondents listed 'advice from my accountant' as the main reason for setting up an SMSF. Today, that number is less than 15%.

Over the decade, the number of trustees who use an adviser – including accountants for tax advice, full-service stockbrokers, private bankers and mortgage brokers – has soared. At the same time, the number of SMSFs using a financial planner has dipped.

Source: 2020 Vanguard/Investment Trends SMSF Report

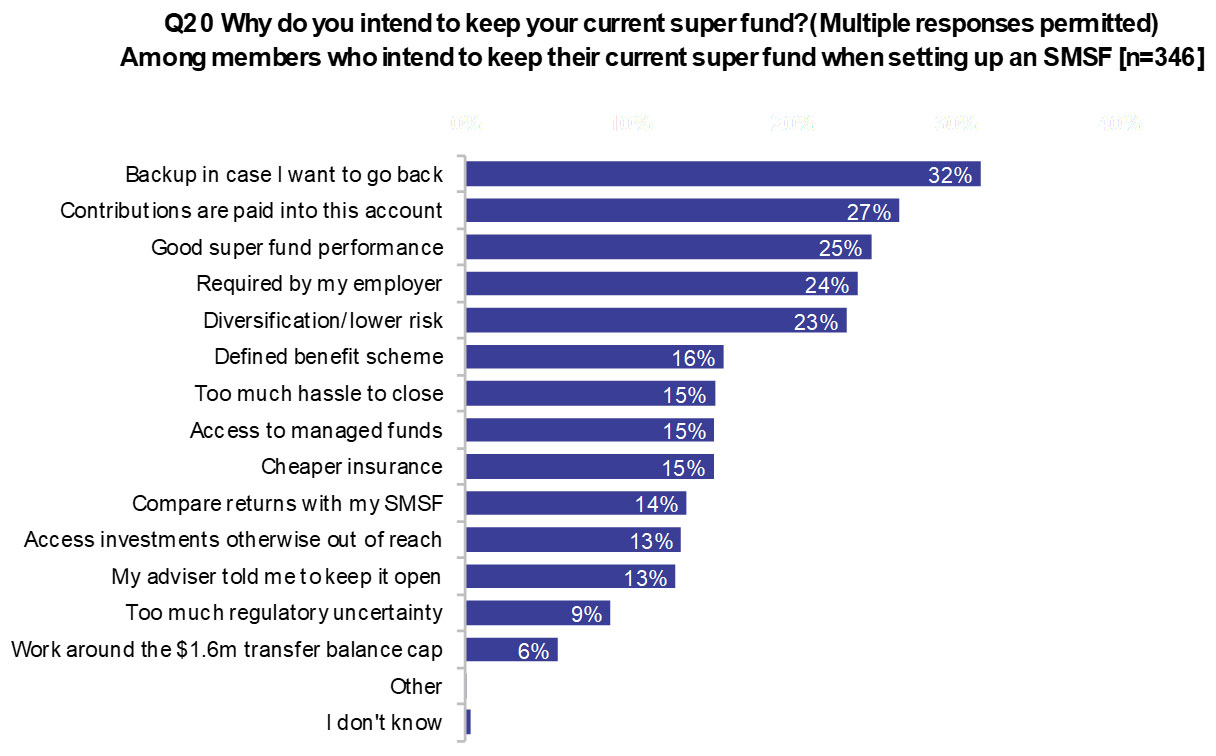

3. SMSFs have a back-up plan

It seems SMSFs want to have their cake and eat it too. In recent years, new trustees expressed an intention to hold on to their employer super fund – be it an industry, retail or corporate fund – when they establish an SMSF. And this trend is firming. Almost half of those who establish an SMSF said they intend to retain their APRA-regulated fund, up from 29% just four years ago.

There are several reasons for this. Firstly, trustees view their previous super fund as a 'personal insurance policy' in case of problems running their own fund. Secondly, as employer contributions are paid into the current super fund, trustees want to maintain this flow. Lastly, trustees want to continue accessing group insurance offered by regulated funds as these policies are often cheaper than those offered by external providers.

Blomfield views this trend as a positive for the industry and as a sign of a maturing market.

"We're seeing a more mature SMSF trustee market, using their self-managed fund for the reasons they value it but retaining professional advice and money management to lower their risk overall".

Source: 2020 Vanguard/Investment Trends SMSF Report

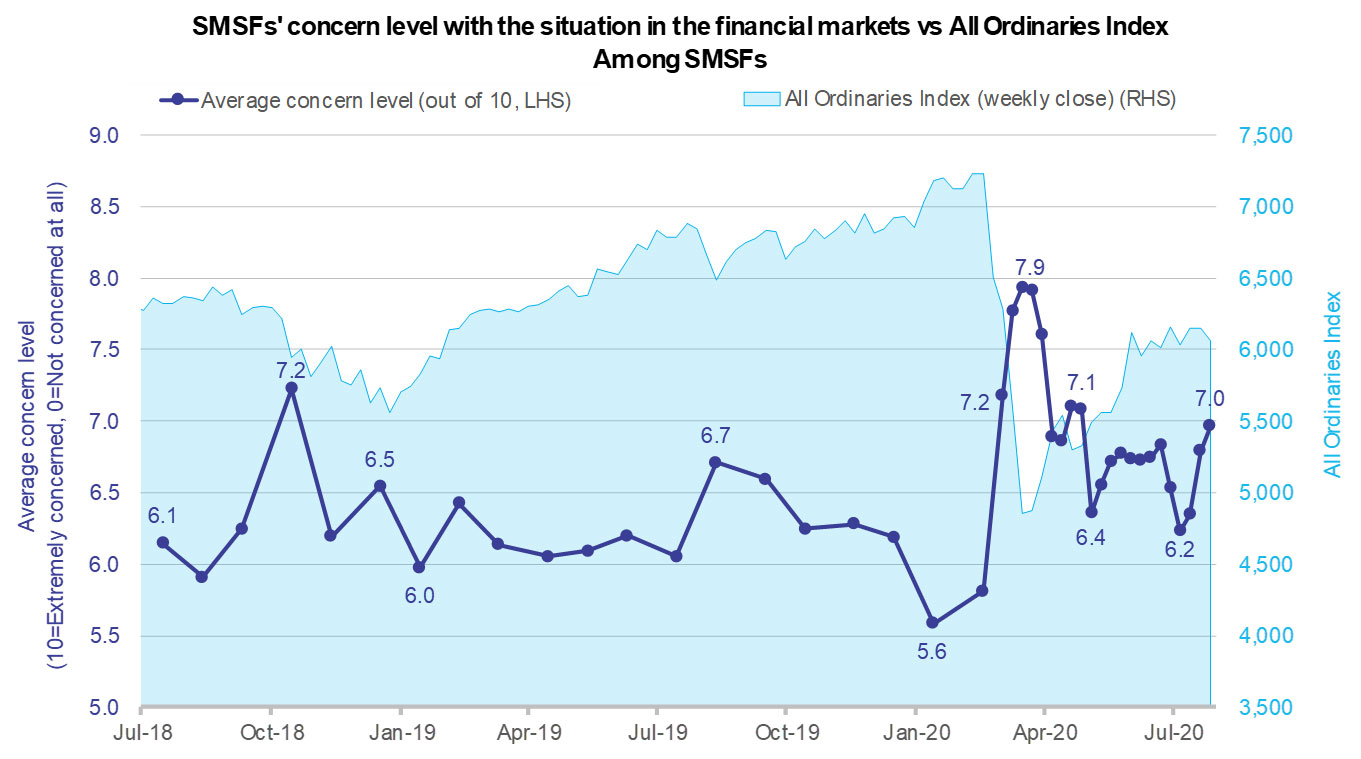

4. SMSFs worried during the height of covid crash

Concern levels reached new heights during the pandemic, following the ASX200’s 37% plunge from a peak of 7,255 in mid-February to lows of 4,564 by 23 March.

Investment Trends measures concern levels on a scale of 0 to 10, on which Blomfield says:

"Zero defined as lying on the beach drinking a margarita and 10 defined as standing at the edge of a very tall building taking one last breath."

During March and April, SMSF concern levels peaked at 7.9, up from 5.6 in January 2020. Concern levels are also volatile, as the numbers was down to 6.4 around April then back up again.

Return expectations (ex-dividends) have also been volatile since the pandemic, rocketing from lows of -2% in early April to highs on 7.4% in May. Today they are about -1.1%.

Trustees similarly reduced their dividend yield expectations, from highs of 4.8% in mid-February to around 3.1% today – or down 35%.

Source: 2020 Vanguard/Investment Trends SMSF Report

Despite high levels of concern, the response among trustees was not uniform. While almost half of SMSFs (44%) said they made a substantial change to their portfolio in the last 12 months (a substantial change is defined as an asset allocation change of greater than 10% of the fund) some trustees became more defensive (55%) while others saw the downturn as a buying opportunity (29%).

Blomfield was quick to note only a minority of trustees sold into cash following the downturn.

"Only 27% of trustees made changes to as much as 20% of their fund. The view that everyone sold out at the bottom and started to buy back in at the top is not supported by our research".

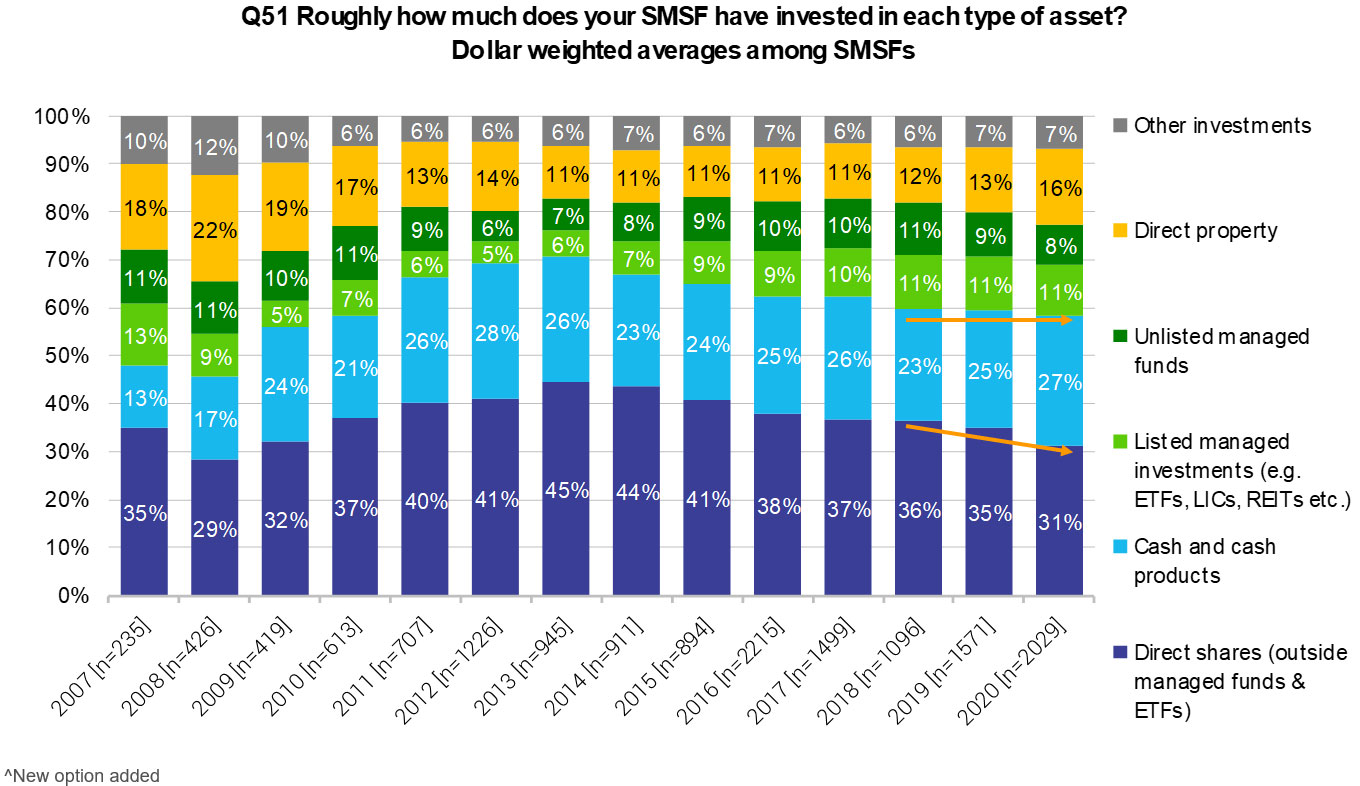

5. SMSFs moving from direct shares to property but not fixed income

For several years, SMSFs’ allocation to direct shares has been in decline. This trend has accelerated following the pandemic.

In 2013, trustees allocated 45% of the portfolio to shares. Today, allocation is down to 31%. Property and cash assets now comprise a larger portfolio of balances.

Source: 2020 Vanguard/Investment Trends SMSF Report

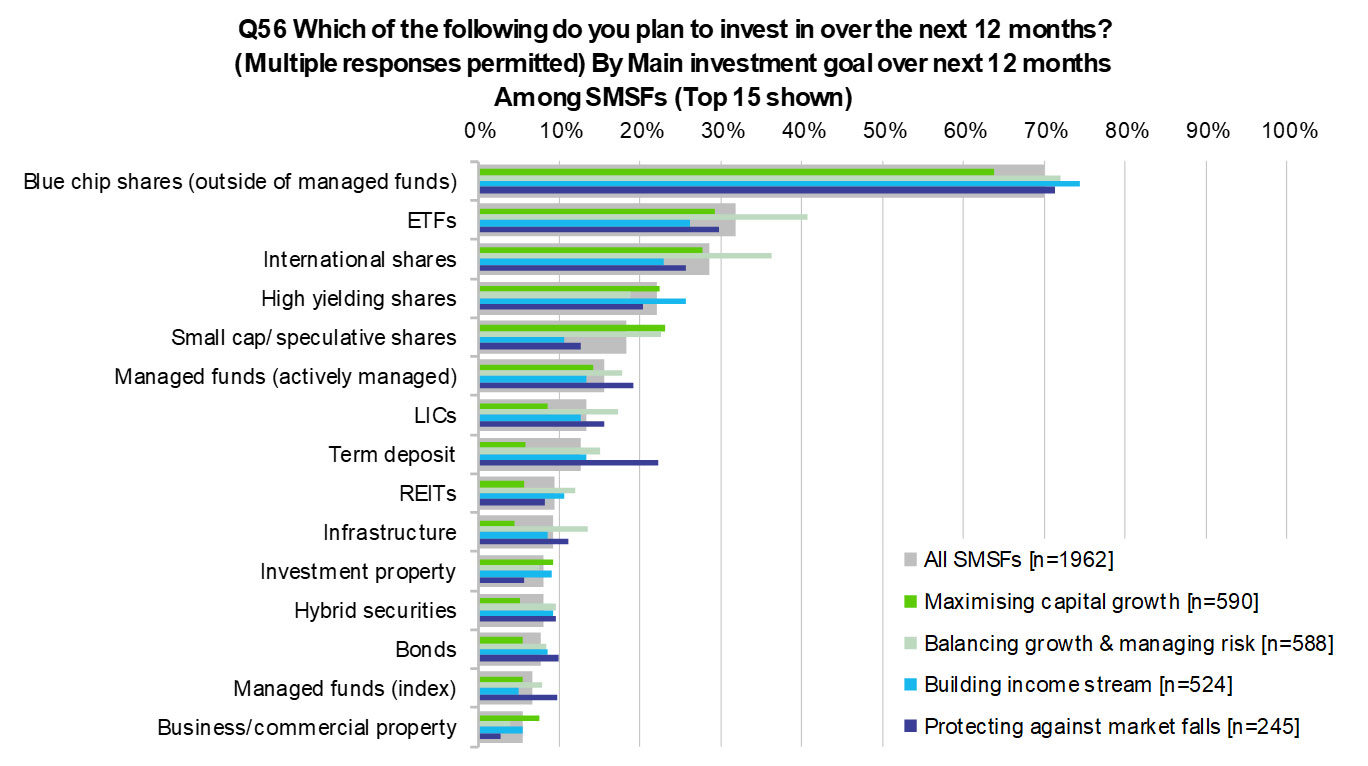

In the year ahead, more trustees than ever say their focus in on maximising capital growth, rotating into equities and increasing super contributions.

Despite expressing a desire for sustainable income streams, SMSFs have a lukewarm response to fixed income. Just 5% of trustees said they intend to increase their exposure to fixed income or bonds in the next three months, compared to 37% of trustees who are eyeing Australian shares. Instead, they are turning to the equities market and the hybrid market to access income. Blomfield says:

"Bonds are almost nowhere. In the absence of good fixed income exposure, people are still intending, even going forward, notwithstanding the volatility of the markets, to look for equity-based yield."

Those who do invest in the asset class, primarily to balance growth and manage risk, do so via bond ETFs (9%) or direct bonds (9%). From barely a dozen fixed-interest ETFs five years ago, there are now nearly 30 Australian and global funds, with more in the pipeline.

The biggest issues bonds face with trustees is the perception of low returns. Trustees are failing to appreciate the message that bonds exist as a truly defensive asset class in a diversified portfolio.

Source: 2020 Vanguard/Investment Trends SMSF Report

The 2020 Vanguard/Investment Trends SMSF Investor report surveyed over 3,000 SMSF trustees between February to May 2020.

Emma Rapaport is an Editor at Morningstar, owner of Firstlinks. This article is general information and does not consider the circumstances of any investor.

A Morningstar Premium free trial is available on the link below, including access to the portfolio management service, Sharesight.

Emma Rapaport is an Editor for Morningstar.com.au

Try Morningstar Premium for free