One of the reasons investment property is popular is that many people do not realise the full extent of the costs. They often fall in love with a place without checking all the expenses, and estate agents quote gross returns and go unchallenged. While investors may be familiar with (often understated) strata and council fees, the state government charges such as stamp duty, land tax and car space levies can come as a shock.

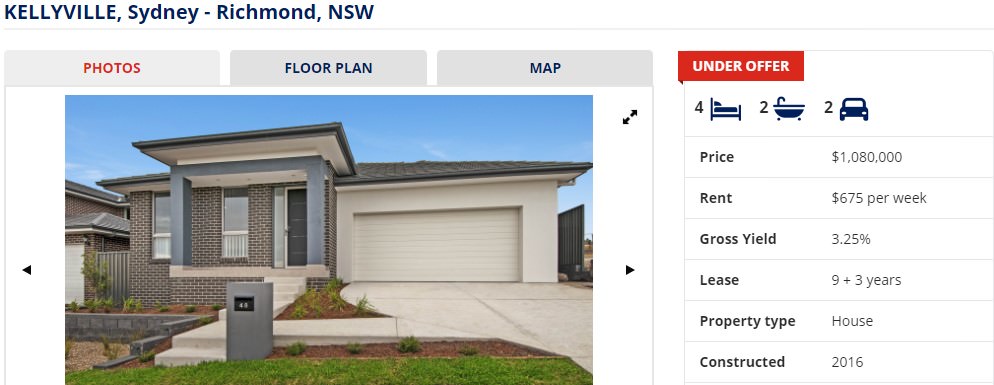

Even the Defence Housing Authority, a statutory authority and a major Government Business Enterprise (GBE), responsible for providing housing to defence members by selling property and leasing it back, quotes gross yields, as in the example below. Net yield before borrowing cost may be only 1%, as we’ll show later.

We have previously discussed the many costs in property (for example, here and here), and we will not repeat those points, except to note that NSW stamp duty on a $1,080,000 house would be a chunky $45,000.

This article focusses more on two other state charges which are often overlooked by investors.

Parking space levy

The property pages in our newspapers love a good car park story. It might be only 14 square meters of concrete, but it can cost over $200,000. They rarely mention the car space attracts council levies and strata fees, although there will never be a garbage collection. At least there are no water rates. A check of real estate pages reveals these gems:

$222,000 Undercover security carspace in Potts Point

“Very tightly held, this carspace is situated in 'The Chimes', a secure building accessed via McDonald Street, just off Macleay Street on the northern end of vibrant Potts Point. This space is of special interest to local businesses, local new development investors and owner occupiers wanting a car spot in Potts Point.”

$190,000 Rare separate title car space in security building

“Situated in 'St Killian' a secure building which is conveniently located between Victoria Street and Macleay Street. This is an ideal opportunity to add a car space to your apartment or business.”

These high prices are usually paid by people who want to park near their home. But in many parts (see map here) of the City of Sydney, North Sydney, Milsons Point (Category 1) and Bondi Junction, Chatswood, Parramatta and St Leonards (Category 2), investors face a parking space levy. It creates a two-tier market as owner occupiers are exempt from the levy if they live adjacent to the space. It’s the same in some other states.

Before you think a slab of concrete sounds like a solid investment, let’s look at a specific example away from the glitz of Potts Point.

In 2004, the development of an old wool store at 360 Harris Street, Pyrmont included 425 parking spaces, with prices starting at $56,000 per space. The marketing said it was “the best investment you’ll ever make”, “amazingly affordable” and “unbelievably scarce”. Two of our main newspapers helped with the marketing. A Sydney Morning Herald article (‘On the lookout’, Domain, 1 July 2004) reported hundreds of calls and that over 200 sold before public launch:

“At prices of $56,000 to $70,000 per space with long leases in place, this unique opportunity should be rushed by investors.”

The Australian Financial Review article (‘Good places to park money for useful returns’, 17 June 2004) generously quoted the agent saying:

“When something has a $56,000 starting price, it is not hard to imagine it doubling over time.”

At the time, for any investor who cared to check, the parking space levy was $840 a year. A crystal ball might have shown billions of dollars spent a decade later in the adjacent Darling Harbour and the coming boom in property prices. Secure Parking offered long-term leases. What could go wrong?

The investment yielding … nothing but a capital loss

The state government needed money, disguised as “to discourage car use in leviable districts while attracting customers to public transport”. From 1 July 2009, the levy doubled to $2,000, and it has since risen to $2,390.

In 2017, Secure Parking will pay gross rent for a car space at 360 Harris Street of about $4,000 a year (it was $3,600 in 2004). The investor pays $2,390 in parking space levy (reduced somewhat by the occupancy rate of the parking station), $680 in council rates and over $1,000 a year in strata fees. That leaves … not enough to pay the accountant to prepare the tax return.

And the value now of the car spaces that cost at least $56,000 in 2004? If you like the idea of buying a piece of Sydney real estate, right next to the new International Convention Centre and the CBD, it can be yours for only $35,000. Here’s the advertisement in Domain (at least three to choose from, and I have no vested interest in any of them). Just like 13 years ago, it’s amazingly affordable.

This development was clearly targeted at investors, and the increase in parking space levy was a material factor in destroying the value of these car spaces.

Land tax

Thousands of people own investment property, but how many realise that the next time they buy another, the land tax could remove almost half the estimated net return?

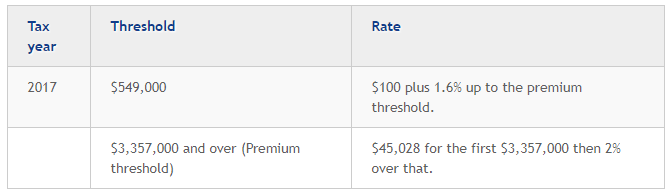

In New South Wales (and there are equivalents in other states), the land tax is currently charged at:

The tax is paid on the combined value of all the taxable land owned above the threshold. Let’s assume an investor already owns one property with a land value of $549,000, and buys the Kellyville house with a land value of $600,000. The annual land tax for the new property would be $9,000 a year.

Liability for land tax includes:

- Vacant land even if it is generating no income, and holiday homes

- Commercial and industrial property, including (wait for it …) car spaces

- Payable by the owner whether an individual, company, trust or trustee of a super fund.

The principal place of residence in excluded when the property is owned by a ‘natural person’. This exemption is not affected by the size or value of the land, which is why some cash poor pensioners can sit on a $10 million harbour mansion, draw a full pension and not pay land tax.

Let’s do some quick calculations on the Kellyville investment:

Cost of house: $1,130,000 including stamp duty $45,000 plus legals and inspections, say $5,000

Gross rent: $675 a week for 52 weeks (DHA guarantees no vacancy) $35,100

Annual costs (ignoring mortgage): Water $1,144, Council $1,285, DHA service fee $5,800, Repairs say $5,000 a year. Total costs $13,229 (the DHA fee includes some 'make good' action at the end of the lease).

Net return before land tax: $35,100-$13,229= $21,871 on $1,130,000 = 1.9%.

In this example, the land tax of $9,000 then takes over 40% of the net return. Final net: 1.1%.

The investor is probably borrowing and enjoying the tax benefits of making a loss, but that’s another story.

Go in with eyes wide open

Any time you buy property, open a spreadsheet and add all the initial expenses to the purchase price. When calculating income, assume one month a year of vacancy. Subtract every cost including agent fees, and allow for increases. In a new apartment, strata fees always rise as soon as the new strata committee sees the maintenance bills. Add the state levies.

Investment loans have become more expensive lately. Make sure you have other sources of income than rent because for most investment properties in Sydney and Melbourne, the net income will not cover the mortgage. You’d better hope the capital gain kicks in … and the government does not think up another tax.

Graham Hand is Managing Editor of Cuffelinks.