In no other country in the world would a policy proposal on a subject like franking credits become a major election issue. Uniquely in Australia, three factors drive this focus:

- The compulsory system which requires most people to put 9.5% of their 'salary' into superannuation.

- The SMSF structure which allows individuals as fund trustees to manage their own investments in a tax-free pension environment.

- The attraction of high dividend yields and franking credits means Australians invest in shares for income, whereas foreign investors rely more on bonds for income.

As a result, to attract shareholder support, large Australian companies have high payout ratios, whereas US companies retain profits to fund growth. Warren Buffett’s Berkshire Hathaway, for example, has never paid a dividend. Around 90% of companies in the ASX/S&P200 index pay dividends at an average rate of about 4% before franking, versus only 40% of companies in the S&P500 with an average rate of about 2% with no franking.

Which is why Labor’s proposal to deny franking credit refunds is a major issue for so many retirees who have set up their portfolios and retirement lifestyles in expectation of a franking refund.

The impact of a possible franking change

This article offers alternative strategies if Labor wins the 18 May 2019 election and achieves the support of the Senate in passing relevant legislation. Labor proposes an effective date of 1 July 2019, only six weeks after the election and even if the relevant legislation is not implemented until, say, June 2020, it could be backdated.

This article will not repeat the previous explanation on ‘How franking credits work’.

Some people will be materially affected. An investor with $1 million in Australian shares in a pension phase SMSF earning fully franked dividends of 4.2% receives $42,000 in cash and $18,000 in franking credits, giving a total income of $60,000. The loss of franking reduces income by 30%, a massive change in lifestyle in retirement.

Here are seven strategies to consider for people facing a loss of franking credits.

1. Invest in asset classes that do not rely on franking

Nobody knows exactly what proportion of SMSF assets is allocated to Australian equities with franked dividends. Many investors hold shares directly as well as in unlisted managed funds and trusts and listed vehicles such as Exchange Traded Funds (ETFs) and Listed Investment Companies (LICs).

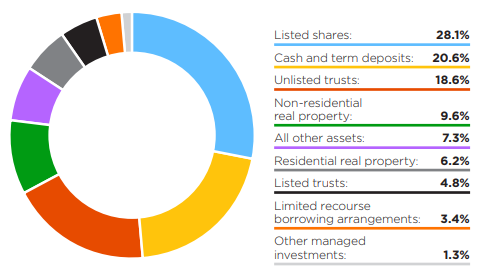

The SMSF Benchmarking Report from Class Limited (based on an analysis of 160,000 SMSFs) shows the following allocations between asset classes (as at 30 June 2018):

Adding the direct listed shares and domestic allocations from trusts takes the Australian share allocation to about 35% to 40%. The Class Report also advises that 52% of SMSFs are in accumulation mode (and therefore paying tax), 17% are in pension (paying no tax) and 31% are mixed, so most SMSFs are paying tax and can probably use their franking credits.

To access income from dividends and franking, pension SMSFs have become too reliant on shares such as Telstra, the major banks, Wesfarmers and Woolworths at the expense of better total returns, including capital growth. Facing the loss of franking, they are likely to allocate more to other assets where income is not franked including property trusts (A-REITs), bonds and global equities. In a survey of Cuffelinks' readers, over 50% said they will change their investments or super structure if Labor's policy is adopted.

In the Australian equities bucket, it is possible to choose more ‘growth’ companies where a higher proportion of the returns should come from capital rather than income. A good example among the banks is Macquarie, where the dividend is only 45% franked.

2. Add members (such as children) to an SMSF

Under Labor’s proposal, an SMSF where all members are in pension mode will lose its franking credits. There is no tax payable to use the credit. However, members who are still in the accumulation phase of superannuation could be added as members of the SMSF. In accumulation, concessional contributions (currently limited to $25,000) are taxed at 15% (or 30% for those with ‘adjusted income’ above $250,000 a year) and earnings are also taxed at 15%.

An SMSF is a single tax entity and the franking credits generated by all members can be used to pay tax. The franking credits can be used to pay the tax of the younger accumulators.

Some financial advisers are not keen on this solution because anyone who adds their children to their SMSF is mixing the superannuation of different generations. An older person may invest more conservatively than a younger person, making asset selection in the interest of all members difficult. Older people may need more liquidity to pay pensions.

3. Qualify for a part pension to receive the ‘pensioner guarantee’

This strategy applies for investments by individuals outside superannuation, as accumulation and pension super accounts are taxed differently.

Outside of superannuation, people should consider the merit of qualifying for an aged pension to retain franking credits if they are just above the pension qualification threshold.

Recipients of a government welfare pension (including full or part age pension, disability support pension, carer payment, Newstart) will continue to receive refunds under a 'pensioner guarantee'. The exception is an SMSF where a welfare recipient was not a member of the SMSF on 28 March 2018.

To be eligible for a part age pension, a homeowner couple can have combined assets (excluding the value of their own home) worth $853,000 before the pension cuts out. There are higher limits for non-homeowners and lower limits for singles (see the Asset test limits).

For a couple with, say, $900,000 in assets, it is worth doing the calculations on the merit of spending $100,000 on a home renovation (or taking a more radical and perhaps wasteful approach, a trip of a lifetime, spending up big) to qualify for a part pension, which may also come with other benefits such as a Pensioner Concession card and the recently-announced Labor policy on dental costs.

The potential result of this strategy is that a couple with $800,000 may have more income (including the part pension and franking refund) than a couple with $900,000.

Note that it is not possible to simply give the $100,000 away as such action will fall foul of the gifting rules. The maximum that can be gifted is $10,000 in any financial year and no more than $30,000 in five financial years. In addition, any gifts in the previous five years may count in the assets test. There is also an incomes test to check for pension eligibility.

We should encourage people not to rely on the age pension, and a self-funded retiree is making a strong budget contribution. Michael Rice of the actuarial firm Rice Warner has estimated that the present value of the maximum age pension for a couple who retires at 65 exceeds $800,000 in today's dollars.

4. Leave money in accumulation rather than pension

All individuals have different financial circumstances. With the assistance of a financial adviser, it’s worth checking whether the loss of franking affects the best way to hold superannuation.

For example, many wealthy people start pension SMSFs to access the tax-free status, not because they need income. Yet under the rules of a pension, the SMSF must pay a minimum amount each year to the member, which rises from 4% according to age. For someone aged 55 to 59, the taxable proportion of the pension SMSF will be taxed at their personal marginal rate less a 15% tax offset. Therefore, the superannuant is paying tax on income that they might not need, and under Labor, may lose access to franking.

It might be better to retain superannuation in accumulation, where there is no requirement to draw a pension.

Furthermore, a large SMSF holding more than the $1.6 million pension cap (or $3.2 million per couple) will already have assets in accumulation phase, where earnings are taxed at 15%, creating a way to use the franking credits.

Let's say someone aged 57 has $1.6 million in a pension SMSF, which they opened to access the zero tax on a pension (and assumed they would receive franking credits). However, they are required to draw 4% or $64,000 as an annual pension which is taxed at their personal marginal tax rate less 15%. So they previously did a calculation which included:

+ save tax on SMSF assets in pension mode versus accumulation

+ receive franking credit refund (which will now be lost)

- tax on pension (which is actually converting capital into taxable income which is not good)

Under Labor's proposal, they lose the franking credit refund. The economics may change, and going from pension back to accumulation may be good because it means:

- pay tax on SMSF assets in accumulation versus pension

+ retain franking credit refunds

+ + no tax to pay on a pension.

So some people should check the numbers as they will change without a franking credit refund.

5. Transfer super to an industry or retail public fund

Where a public fund has more younger members in accumulation phase than older members in pension phase, it will probably have enough tax payable to fully utilise the franking refund. A member in a public fund may receive a different treatment of their franking credits than in an SMSF. If retention of franking credits is the major issue, these funds are worth considering.

However, there are other structural advantages in SMSFs, such as the ability to:

- Invest in almost any asset. The industry and retail funds have limited menus and do not allow direct investment in unlisted assets such as property and corporate bonds.

- Access the government guarantee on deposits, as this is available ‘per entity per ADI’. A large fund is only one entity and only has one claim for $250,000 which is irrelevant given its scale.

- Borrow using Limited Recourse Borrowing Arrangements (although this is now diminished).

- Include more than one member and spread the cost.

The main reason trustees start SMSFs is for greater control over their investments, and this may not be available in a public fund. However, the ‘direct investment options’ offer far more flexibility.

Note also that not all public funds will refund franking in full, as covered in this article.

There is also some debate about the ability of the trustee of a large super fund to allocate a franking credit refund to a member in pension phase when the accumulation member who incurs the tax might claim some benefit entitlement.

6. Use concessional contributions to create taxable income

Concessional contributions incur a contributions tax which is included in the fund’s taxable income, creating taxable income which can use the fund’s franking credits.

Concessional contributions cannot be made by everyone. Generally, trustees aged between 65 and 74 need to pass the work test in the year of contribution, and those aged over 75 cannot make extra concessional contributions (although Super Guarantee and industrial award contributions can continue).

7. Transfer money from super to an individual's name

Accumulation funds are all taxed at 15% from the first dollar of income, whereas individuals have a tax-free threshold of $18,200 (or greater with the Senior Australians and Pensioners Tax Offset (SAPTO) and other tax offsets. The next personal tax scale is 19% plus 2% Medicare Levy. When an individual starts paying tax, the franking credits can be used. It might be worthwhile using this taxed component to push taxable income down to the tax-free threshold by holding investments in a personal capacity rather than in superannuation.

Like all these strategies, care and advice is needed to ensure the individual does not become subject to higher rates of tax in the personal range, as the accumulation fund would be taxed at 15%.

Conclusion

Labor’s policy proposal has many hurdles to jump, but if adopted, people should check whether the current way they invest, including the types of assets and investment vehicle, is the most efficient for their unique circumstances.

Graham Hand is Managing Editor of Cuffelinks. This article is general information and does not consider the circumstances of any investor. It is based on an understanding of Labor’s proposal which is not yet legislated, and this may never happen or occur in significantly different form. Investors are advised to seek professional advice before taking action, and at least wait to see if Labor is elected and able to work with the Senate to pass Labor policies.