Last week’s release of the Intergenerational Report showed there will be an increase in the number of people retiring over the next few decades, and they will live longer in retirement than ever before. These changing demographics will create challenges for any government that is in power over coming years.

Reading through the pages of the Report, it is clear that policymakers recognise the important role superannuation plays in the Australian economy. Not only does it provide benefits to individuals by delivering extra income in retirement, it also benefits the community, by decreasing reliance on the age pension and therefore alleviating pressure on government finances.

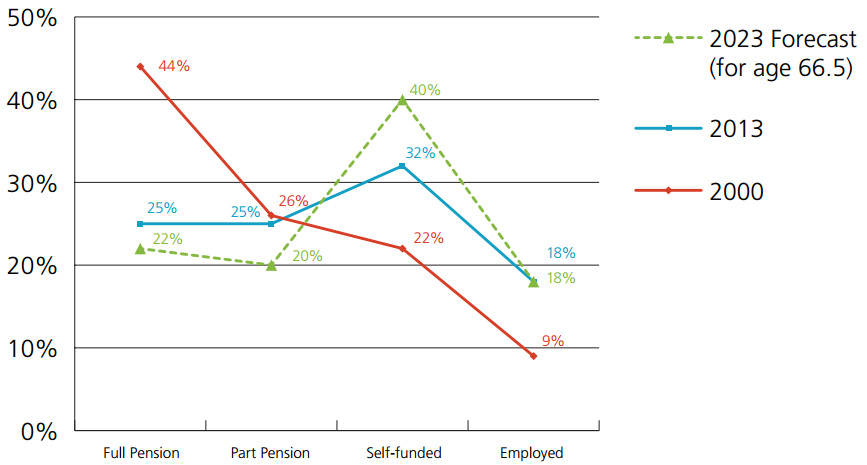

Rise in number of fully self-funded retirees

ASFA estimates that at present, around 32% of retirees aged 65 or over have accumulated enough superannuation and private savings to be fully self-funded. As the system matures, the benefits will broaden and increase, with the number of fully self-funded retirees rising to 40% by 2023.

Retirees at age 65

Source: Department of Social Services and ASFA Research Centre

Superannuation is working on a number of levels to alleviate demographic-related fiscal pressures. People who have private savings are more likely to fully or partially self-fund healthcare, aged care or other age-related expenses.

Super tax concessions will change

While this is a good news story for superannuation, there are other parts of the system that are not working as well as they could. You only need to glance at the newspapers over the past few weeks to see that the equity of superannuation tax concessions is continuing to be challenged. This is a debate that ASFA welcomes, but it’s essential that it be based on facts and not media hysteria.

The $32 billion dollar figure that is often quoted as the ‘annual cost to revenue’ of superannuation tax concessions is arguably inflated for two key reasons. It does not take into account the savings the government makes on pensions and other age-related government expenditure as a result of people having super. It also does not take into account what alternative vehicles people will seek particularly those with high net worth, if super becomes less tax-effective. The search for a better deal, for example into geared property or shares, means they end up trading one concession for another.

However there’s no doubt that as the system matures and account balances get bigger the cohorts that benefit from tax concessions in super will change.

Last year ASFA conducted an analysis of the flow of superannuation tax concessions by taxable income bracket. Parts of the analysis are somewhat different to what you often hear in the media. It found that around 90% of employer contributions to super go to individuals paying less than the top marginal tax rate, with 57% going to those paying a tax rate of 30% or less. This means the bulk of tax concessions applied to contributions flow to those paying either the 30 or 38% marginal tax rate. This is a large part of the Australian workforce and shows that the lower concessional contribution caps are doing their job.

However, the analysis also found that when it comes to tax concessions on earnings, the benefits are skewed towards middle-high income earners, who generally have a higher superannuation account balance, some in the millions. Given the demographic fiscal pressures, it’s appropriate to question whether it’s fair for future generations of taxpayers to fund generous tax concessions on earnings for older Australians who have accumulated these very high account balances.

As stated in the Financial System Inquiry (FSI) final report, the overarching goal of the superannuation system should be to allow people to accumulate private savings that deliver an income in retirement to substitute or supplement the age pension. It is therefore fair to say that tax concessions should start to fall away once a person has accumulated enough superannuation savings to generate an income that enables them to have a comfortable retirement.

How much is enough superannuation?

So how much is enough, and how much is too much? At a bare minimum, the superannuation balance required to live at the ASFA Retirement Standard ‘comfortable’ level should continue to attract the same tax concessions that are currently in place. Taking into account the fact that many people will continue to live in private rental accommodation during their retirement, and the financial risks associated with increased longevity and future medical and aged care expenses, ASFA estimates a balance of $2.5 million is sufficient to support a lifestyle in retirement which is comfortable for the great bulk of the Australian population. This could potentially be the ‘ceiling’ where the tax rules change.

Most people will never be able to accumulate an account balance anywhere near $2.5 million, so aiming tax changes above this amount will limit community reaction. It is also fair to say that most individuals who have super above this amount should have limited objections to paying a small amount of additional tax, particularly when they have received considerable tax concessions in the past on the contributions and investment earnings that enabled them to build such a large pot of savings.

These are discussions that will be had during the Tax White Paper process, and the FSI consultations. What’s important is that we all reach a consensus on what changes need to be made to our system to ensure it remains equitable and sustainable when the baby boomer tsunami reaches our shores.

Pauline Vamos is Chief Executive Officer of The Association of Superannuation Funds of Australia (ASFA).