Investors concerned about the outlook for their balanced (60% shares/40% bonds) portfolios may need to consider alternate strategies to deliver their future investment objectives.

Specifically, the reasons for including a large allocation to bonds looks particularly challenged. Aside from meagre future return expectations, the ability of bonds to meaningfully appreciate during a crisis appears impaired for the foreseeable future. When preparing for the next crisis, investors will likely need to look further than bonds for negatively-correlated exposures.

Two such exposures that should appreciate during future crises include:

- Tail hedging – option positions that appreciate in bear markets, and

- Unhedged foreign currency exposures - a more simplistic defensive approach, but one that has delivered a negative correlation during a crisis.

When integrated together within a global equity portfolio, these embedded features have consistently delivered a positive total portfolio return in Australian dollars during periods of peak to trough drawdown. We have coined the phrase ‘super-defensive equities’ to describe an equity strategy that includes both these negatively-correlated exposures.

Meagre expected returns

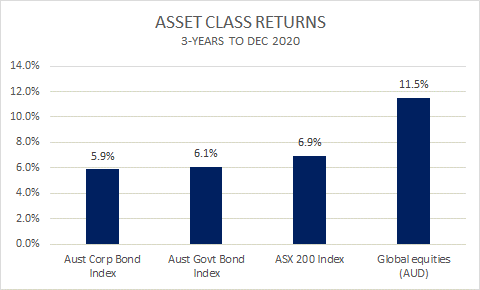

Fixed income is coming off the absolute best of times, with the massive decline in interest rates over the past few years helping to generate near equity returns for both government and corporate bonds. Over the past three years, Australian government bonds have returned 6.1% and corporate bonds 5.9%, which compare favourably with Australian equities over the same period despite presenting a dramatically lower risk profile.

Figure 1: 3-year asset class returns

Source: Wheelhouse

As a secondary effect, this secular rally in bonds has caused much of the future expected returns from this asset class to be ‘pulled forward’, which in turn has left Australian bond indices trading well above par. Future expected returns are likely to suffer accordingly and are represented by meagre yields to maturity.

Figure 2: Australian bond indices

| |

Price

|

Coupon

|

Yield to maturity

|

Weighted average maturity

|

|

S&P/ ASX Corporate Bond Index

|

107.68

|

3.32%

|

1.20%

|

4.7 years

|

|

S&P/ ASX Government Bond Index

|

110.86

|

2.65%

|

0.73%

|

8.2 years

|

Source: S&P

It is difficult to envisage returns for balanced portfolios that come close to what was delivered over the past decade. This view is consistent with the current five-year forecasts from BlackRock of negative 0.6% returns for Australian government bonds and positive 0.5% for Australia corporate bonds.

Impaired defensiveness

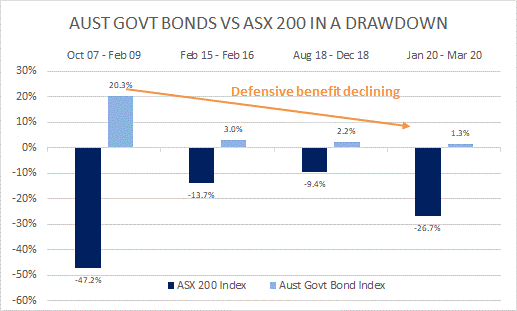

Alongside the secular decline in interest rates witnessed since the GFC, there has also been a markedly lower positive contribution to returns from bonds during periods of market crisis. There is little room for bonds to appreciate meaningfully during equity market corrections.

The chart below records the movement in Australian government bonds versus equities, from the beginning of a large drawdown to the trough (calendar month basis).

Figure 3: Returns from Australian bonds vs equities in drawdowns

Source: Wheelhouse

While bonds have remained robustly defensive during these drawdowns and did not decline in value, their recent inability to meaningfully appreciate makes them less attractive to smooth returns within a balanced portfolio. Furthermore, the last 20 years of negative bond/equity correlations is something of an outlier. Over the very long-term, bonds exhibit a more positive relationship, meaning they often fell alongside equities in a crisis. Combined with the poor expected future returns, the current allocation to bonds more closely resembles an allocation to cash.

This poses the question of how do balanced portfolios expect to deliver on their investment objectives when they have an effective 40% allocation to cash?

Positive contributions from tail hedging

Properly designed and managed, active tail hedging strategies can provide a positive contribution to portfolio returns during a crisis. The protection is mechanical in nature (markets go down, hedges go up) and not reliant on historic correlations or interest rate cycles.

A basic approach to tail hedging involves the purchase of equity put options, which act as a kind of insurance on the equity portfolio. Similar to insurance, a premium is paid, however when markets decline the put options are designed to increase in value, sometimes exponentially, which serve to offset equity losses. Efficient tail hedging requires specialist skill, including managing the expiry of the contracts and payoff design (at what point they should be bought and start adding value).

Another important point is that the systematic purchase of put options is expected to create some drag on returns. Depending upon the level of protection required, the long-term cost of a tail hedge can vary broadly.

The defensive tail-based strategy used within the Wheelhouse Global Equity Income Fund is expected to have an annualised cost of 1.5%. While this cost is not inconsequential, tail hedging may allow a portfolio to remain fully invested in equities, with the significantly higher expected returns (versus bonds) funding an efficient hedge. Relative to a large fixed income exposure, this may deliver higher returns with a more reliable defensive profile.

Positive contributions from a falling Australian dollar

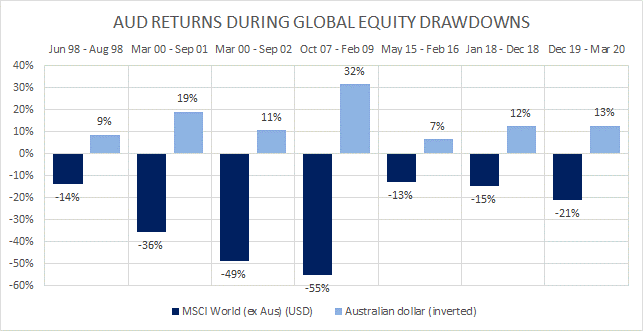

Historically the Australian dollar has fallen during global market crises, as investors seeking protection buy ‘safe-haven’ currencies such as the US dollar.

The chart below plots a 20-year history of market corrections (>10% declines) in the global equity benchmark (MSCI World ex Australia) on a US dollar basis, from the onset of the drawdown to trough (monthly basis). Due to the 2.5-year extended drawdown following the tech bubble deflation, we have included a separate point (March 2000 – September 2001) to reflects the initial 18-month phase. Plotted next to these declines is the positive contribution from the decline in the Australian dollar (vs USD) during these periods.

Figure 4: Australian dollar returns during >10% drawdowns in global benchmark (USD)

Source: Wheelhouse

Negative correlation matters most during times of crisis. The Australian dollar has reliably added meaningful positive return to an Australian-based investor in global equities.

While historical correlations do not offer ‘mechanical’ protections, we see no reason why this relationship should not continue, so long as the US dollar retains its safe-haven status relative to the Australian dollar. Furthermore, with interest rate differentials effectively zero, there is virtually no carry cost at present for having the defensive benefit of an unhedged global equity exposure.

Conclusion

A portfolio with 40% effectively in cash will likely have very different future returns and drawdown than balanced portfolios of the past. This represents the worst of both worlds for a balanced portfolio investor.

We have not considered active management, or other types of fixed income securities in this analysis, which may alter this relationship. However, we expect benchmark returns for all fixed income securities to be far lower in the future.

‘Super-defensive equity’ strategies as defined here are one solution that may deliver a higher rate of return, alongside a smoother return profile, during the next crisis.

Alastair MacLeod is Managing Director of Wheelhouse Partners. This article is for general information only and does not consider the circumstances of any individual.