The new Labor Government and Treasurer Jim Chalmers will hand down their first Budget on 25 October 2022, and the policy conflicts are obvious. Inflation is surging and interest rates are rising without commensurate increases in wages, but Treasury knows giving cost-of-living increases will compromise some of the Reserve Bank's attempts to slow spending. Chalmers said last week that no new cost relief should be expected although previous commitments would be honoured:

“The Budget is about six or seven weeks away, but we have made it very clear to people that our priority is to implement the cost-of-living relief that we have announced. That will be in areas like childcare, medicines, TAFE fees, the cost of electric vehicles and also we want to get wages moving in this economy again. The Budget will be about a few things. It will firstly be about how do we provide some cost-of-living relief in a responsible way that doesn’t add to the pressure on the Reserve Bank.”

For this Reader Survey into these dilemmas and more, we provide a brief summary of each policy. The issues are not addressed in full detail but we hope to learn the mood of our readers. The Survey questions follow these comments, and full results will be published next week.

1. Should the Stage 3 tax cuts be cancelled?

The Coalition Government with Scott Morrison as Treasurer announced tax cuts in 2018, with Stage 3 commencing in mid-2024. Over 10 years, the final stage is estimated to cost in excess of $240 billion. Stage 3 will cut the rate that applies to incomes over $45,000 from 32.5% to 30%, extending all the way to $200,000 and flattening the marginal tax rates.

Details of who benefits most from the Stage 3 tax cuts are outlined in costings provided by the Parliamentary Budget Office.

The two main arguments for cancelling Stage 3 are the changed budget outlook after the pandemic, and the cuts at the top end favour the wealthy. Economist Saul Eslake said:

“From the standpoint of economic management, the main argument for abandoning or deferring [them] is that the medium-term budget outlook is now very different from when those tax cuts were proposed and legislated. At that time, the budget was projected to be in surplus throughout the 2020s, and net debt reduced to zero by the end of the decade. Now, deficits are projected to continue as far as the eye can see, and net debt to continue growing in dollar terms into the early 2030s.”

On the other hand, Labor has always voted in favour of Stage 3, arguing it includes relief for some lower income earners, and while in Opposition, Labor did not want to carry the label of a high-taxing party. Anthony Albanese will break an election promise if the cuts are reversed. The changes do not take effect for a couple of years so a cancellation would not impact current budget predicaments.

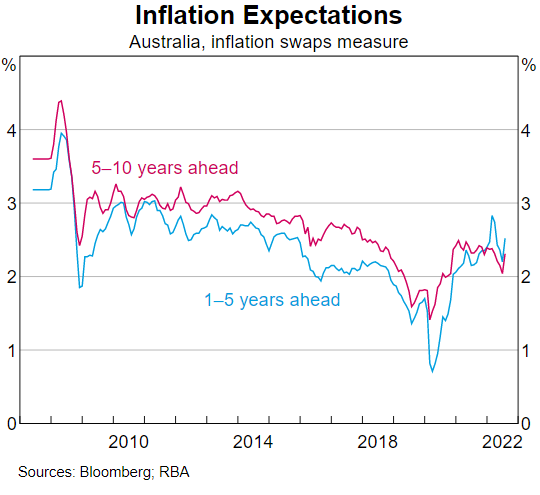

2. Are prices increasing due to embedded inflationary expectations?

We all experience evidence of rising prices in our daily lives. It is common to see cafes, restaurants and retailers increasing prices, and business remains brisk. We seem to have accepted it with expectations embedded, and this is a worry to the Reserve Bank. However, falling fuel prices and central bank determination to stamp out inflation may have an impact.

At his speech on monetary policy to the Anika Foundation on 8 September 2022, Governor Philip Lowe spent much of the time justifying the need to control expectations. We have become more tolerant of prices rising, as the Governor fears:

“There is something here, though, that is worth watching that is not easily captured in our standard models, and that is the general inflation psychology in the community. By this, I mean the general willingness of businesses to seek price increases and the willingness of the community to accept price increases.

Prior to the pandemic, it was very difficult for a businessperson to stand in the public square and say they were putting their prices up. And a common theme from our liaison was that, because most businesses had trouble putting their prices up, wage increases had to be kept modest. That was the mindset.

Today, businesspeople are able to stand in the public square and say they are putting their prices up, and they can point to a number of reasons why. The community doesn't like it, but there is a begrudging acceptance. And with prices rising, it is harder to resist bigger wage increases, especially in a tight labour market. So the psychology shifts.”

3. Should the childcare subsidies be brought forward to 1 January 2023?

At the recent Jobs and Skills Summit, many speakers claimed the single most-important initiative to ease labour shortages and improve productivity would be to improve access to childcare and bring more women into the workforce.

At the last election, Labor campaigned strongly to extend support for families earning up to $500,000 a year, with a start date of July 2023. Although the cost is estimated at $5 billion a year, it is also claimed that the boost to economic activity would produce even more in revenues. Treasurer Jim Chalmers said the earlier introduction cannot be sustained with tight budgets, but he also recognised the benefits:

“There is a massive multiplier effect investing in childcare. But the way that the budget rules are set up mean that we account for the cost, but not for the benefit ... Childcare is the most obvious example where you provide substantial cost of living relief but it’s also good for the economy.”

4. Should a mining super profits tax be introduced?

Oil and gas companies are making record profits, attracting investors such as Warren Buffett who has now ploughed US$37 billion into Chevron and Occidental Petroleum. Nobel Prize winning economist Joseph Stiglitz recently visited Australia and called a windfall profits tax a ‘no-brainer’. Prominent Australian economists have argued the resources belong to Australia and the country needs a solution to its massive debt burdens.

For many years, Norway has showed that taxing oil industry gains does not prevent investment, and with a population of around five million, Norway will collect $137 billion from a tax on the oil industry this year, 50% higher than previously estimated.

Professor Ross Garnaut advocated at the Jobs and Skills Summit that Australia should tax energy companies more:

“There are many opportunities for raising additional revenue in Australia while enhancing equity and improving or at least not damaging economic efficiency. A significant part of the increase in the profit share in recent years is in mining, where wages are high relative to other sectors. The appropriate public policy response is mineral rent taxation and not pressures for higher wages.”

The European Union has also announced plans to cap energy company profits, but Treasurer Chalmers was involved in the failed 'super profits' tax proposal under Treasurer Wayne Swan in 2010 and does not want to revisit the painful experience.

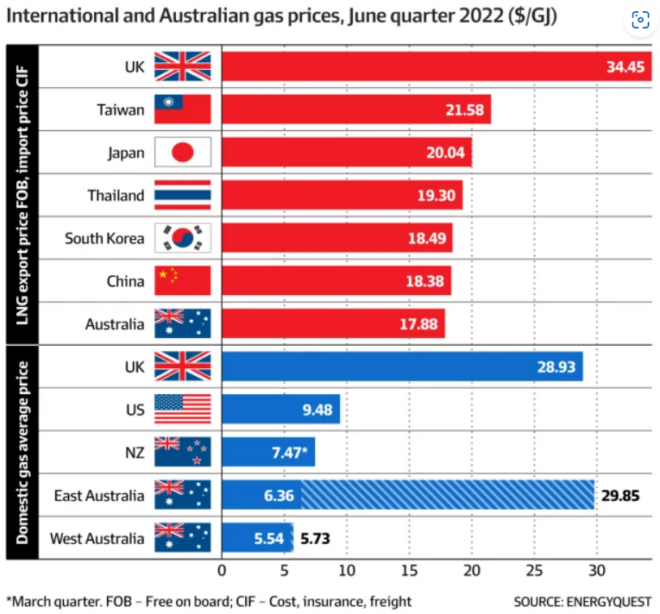

5. Should gas supplies be reserved for the East Coast domestic market?

Australia has massive gas reserves and is the world’s third-largest exporter of fossil fuels, and yet high prices are being passed on locally for petrol gas and electricity. Australia’s own power comes 70% from burning coal while we export most of the gas. Western Australia introduced a simple gas reservation policy, and its residents and businesses are enjoying far cheaper prices than eastern states, as shown below.

6. Should the budget include additional cost-of-living concessions?

At the same time that the Reserve Bank is increasing cash rates to make borrowing more expensive and curb consumer demand to control inflation, Treasurer Chalmers is considering cost-of-living concessions at the coming Federal Budget. It’s not only ‘one hand giveth, the other taketh away’, but if the Chalmers goodies stimulate activity, the Reserve Bank may be required to increase rates even more. The impact on homeowners, company borrowers and home prices would be severe for sections of the community.

7. What other major policy question should we ask?

Use the comments section to let us know about other critical issues, such as climate change, the potential move to a republic, provision of adequate aged care, or whatever.

We invite you to share your views by completing the survey embedded below or via this link.