Every year around 60,000 humpback whales leave the frigid, food-rich waters of Antarctica and begin the world's longest mammal migration, a 5,000-kilometre, three-month journey to the warm waters of northern Western Australia and Queensland.

One cohort of Australians who make an effort to witness this event are retirees, blessed with abundant free time and desire to tour our great country. Just like the whales, this group and their collective wealth is about to undertake its own massive migration, one from accumulation to retirement - its early phase forged by the first baby boomers who began hitting retirement age in the early 2010s.

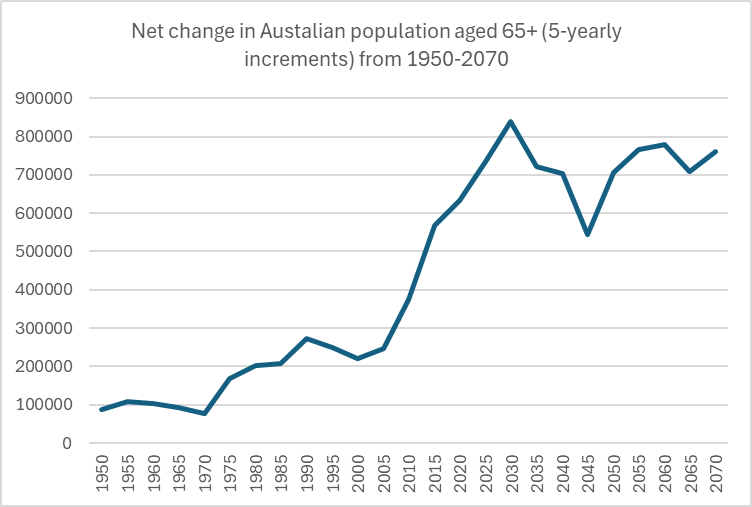

Source: Australian Bureau of Statistics, historical and projected data.

Over the coming decade, around three million Australians will shift from accumulating wealth to drawing down their savings in retirement, migrating ~A$1.2 trillion with them - yes that’s trillion with a ‘t’.

This transfer signifies a substantial amount of capital that could impact investment trends, healthcare and housing markets among others. Migrating from accumulating wealth to living off it also raises the importance of having sustainable withdrawal strategies, to ensure funds can both adequately fund and effectively last throughout the retirement journey.

The role of income

One of the key and often underappreciated strategies is for retirees to have an income stream as part of their savings. The 2024 Mercer CFA Institute Global Pension Index report, which ranks how well countries help their retirees manage their savings and provide a secure income, showed Australia had slipped to sixth position globally and dropped out of the number one spot in the Asia Pacific.

Why the drop? Our system in Australia is great at making people save and invest via compulsory superannuation but when it comes to strategies to help retirees generate a steady income stream that lasts, we’re less impressive.

While there are a variety of income strategies available including Bonds, Annuities, REITs and dividend paying stocks, retirees are not required to have any one type of income investment. There is also no real guidance on how investors should balance the ‘retirement trilemma’ which refers to the challenge of balancing of three interlocking and competing objectives, namely:

- Maximising retirement income

- Managing risks (inflation, interest rate, market volatility, economic cycle)

- Having access to capital when you need it.

In addition, all investments have their challenges when you consider inflation and higher interest rates, the potential for a weakening economy, liquidity, the economic cycle and increasing government debt which places further pressure on the ability of governments to maintain their current level of service (pensions etc).

In the absence of policy that prescribes how retirees invest their superannuation, strategies that can balance the generation of income but also are liquid and less volatile can be crucial.

The volatility factor

Most people understand market prices can go up and down, but it’s less apparent that once money is lost, it’s much harder to get it back. A loss of 10% requires a subsequent gain of 11% just to break even; likewise, a 20% fall will break even only after a 25% rebound and a 30% fall needs 43% rise and so on.

Withdrawing capital during periods when losses occur involves ‘selling low’, compounding the effect as the portfolio enters a market upswing with a lower balance, requiring even stronger returns to recover.

For retirees, this makes it critical to effectively reduce the sequence of return risk, by avoiding volatile returns (often hidden by focusing on the ‘average’ return) so as to help maintain a wider range of financial choices in retirement.

One option is to manage market volatility. While volatility can never be eliminated, it can be mitigated by investing in more defensive assets.

Equities, particularly value stocks, fit these criteria best because they are typically well-established companies with stable earnings. Reliable sources of portfolio income, such as dividends or interest-bearing investments, can also help mitigate market downturns by providing a steady cash flow. However, as we saw during the 2020 COVID downturn, many of the highest paying dividend stocks either cut or significantly reduced their dividends, just when people needed them most.

The option option

For the more financially literate, options can be used to reduce portfolio volatility while generating an additional source of income. The benefit for retirees in particular is that the process is structural, consistent and repeatable.

As the great migration happens over the next 10 years, as more than a trillion dollars are moved into retirement, having a reliable source of income will be increasingly more important for retirees.

Chad Padowitz is Co-Chief Investment Officer of Talaria Capital. Talaria’s listed funds are Global Equity (TLRA) and Global Equity Currency Hedged (TLRH). This article is general information and does not consider the circumstances of any investor.