Vanguard has just released its third annual How Australia Retires report which offers a deep dive into how Australians are planning for retirement and where they’re falling short. Here are extracts from that report.

The How Australia Retires 2025 report explores how Australians are preparing for and experiencing retirement.

Based on a nationally representative survey of over 1,800 Australians conducted in February 2025, the report examines financial and retirement literacy, expectations versus realities of retirement, the role of housing and overall retirement sentiment and confidence.

Retirement income expectations

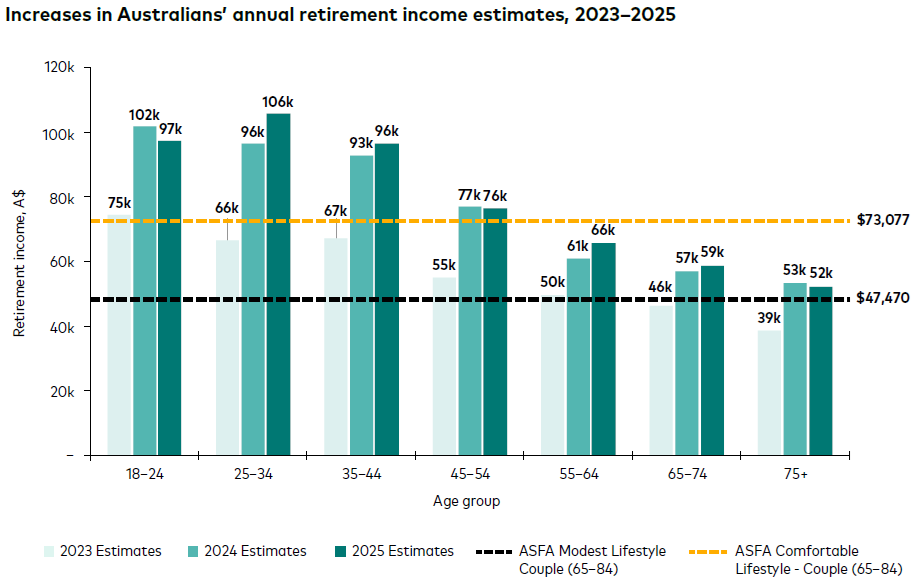

This year’s survey found a gap between the amount of income working-age Australians expect they will need in retirement and the amount current retirees spend in retirement. We also found that all age groups in the 2025 survey had significantly higher estimates for minimum income required than those in 2023, the first year we collected this data.

Retirement income expectations for working-age Australians differ vastly from the reality for current retirees: Australians under 45 estimate their minimum retirement income to be double what current retired couples are spending.

Younger Australians anticipate needing significantly more income in retirement than current retirees or what common retirement income benchmarks suggest. On average, Australians under the age of 45 estimated they would need a minimum household income of $100,000 per year in retirement. Australians aged 25–34 estimated they would need a minimum household income in retirement of $106,000, the highest of any age group. This figure represents a 10% increase from 2024, when the same group estimated $96,000, and a 59% cumulative increase from 2023, when this age group estimated needing $66,000.

The survey asked for estimates in real terms — that is, today’s dollar value — to account for the impact of future inflation. However, some may have misunderstood the question and included future inflation in their responses, potentially inflating their estimates.

To put these figures in perspective, retired Australians with a partner reported spending an average of $55,000 in the last 12 months — almost half of what Australians aged under 45 believe they will need. As the figure below shows, those aged 65–74 estimated needing $59,000, while those 75 and older estimated $52,000 annually.

The Association of Superannuation Funds of Australia (ASFA) provides benchmarks for retirement income. ASFA estimates that for a comfortable lifestyle in retirement — which includes top level private health cover, regular leisure activities, annual holidays and the occasional overseas trip — couples aged 65–84 need $73,077 per year.1 This estimate is based on data from the December 2024 quarter, which was the most recent available at the time of the survey.

This is significantly more than the $55,000 Vanguard sees current retired couples spending, however still significantly below the income levels Australians aged under 45 are anticipating they will need. Notably, the ASFA benchmarks assume retirees own their own home outright and are relatively healthy.

There are several reasons why working Australians’ expectations may not align with the spending realities of today’s retirees. One possibility is that younger Australians are simply overestimating the income they will need in retirement. This could reflect lower levels of retirement planning among these age groups, as well as the inherent uncertainty in making financial projections for a life stage that may be decades away. Another explanation is that younger Australians may be factoring in continued increases in the cost of living. A representative basket of goods and services that cost $100 at the start of 2020 would cost $121.08 today, reflecting an effective annual inflation rate of 3.74% over the last 5 years.2

Having experienced recent inflationary pressures, younger Australians might be extrapolating those trends into the future, leading them to anticipate higher expenses to support their desired lifestyles and cover essential needs. This, of course, would be a misunderstanding of Vanguard’s survey question as they asked the survey participants to estimate future spending needs in today’s dollar value.

Of course, it could also be that younger Australians genuinely require a higher minimum household income in retirement. This may reflect rising expectations for lifestyle and living standards, or concerns about ongoing housing costs — such as rent or mortgage payments — extending into retirement. In recent years, rising interest rates have significantly increased mortgage repayments and rental prices, which are among the largest expenses for many Australian households.

Planning for retirement

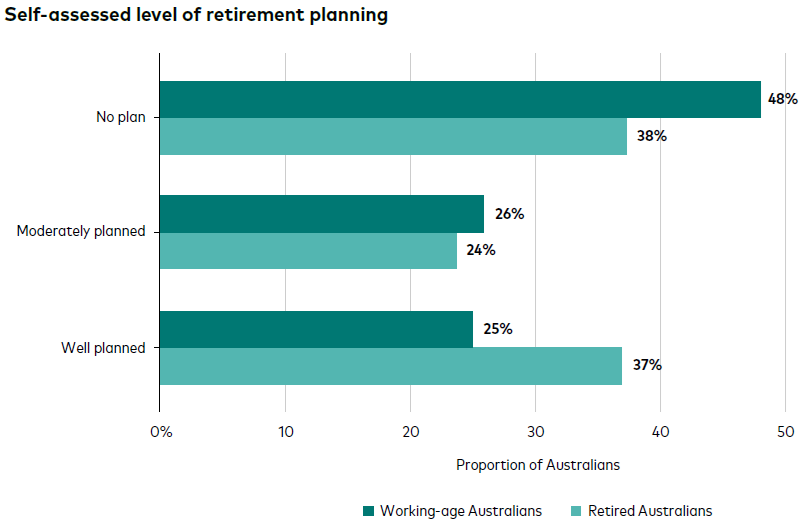

Retirement planning plays an important role in helping Australians retire with confidence, yet many Australians are unprepared.

Concerningly, nearly half of working-age Australians said they had no plan for how they would financially support their desired lifestyle in retirement. One in four working-age Australians said they had a general idea of what they would need with “some details planned out,” while another one in four said they were well-planned. This is relatively consistent across age groups, with only 29% of Australians aged 55 to 64 who are still in the workforce describing themselves as well planned for retirement.

When looking at the level of planning retirees had when they retired:

- 38% said they had no plan for how they would support their desired lifestyle.

- 24% said they had a general idea of what they needed for retirement; and

- 37% said they were well-planned.

Retirees who had a good idea or clear understanding of what actions they needed to take were three times more likely to feel highly confident in their ability to support their desired lifestyle in retirement. They were also 65% more likely to have a positive outlook on retirement.

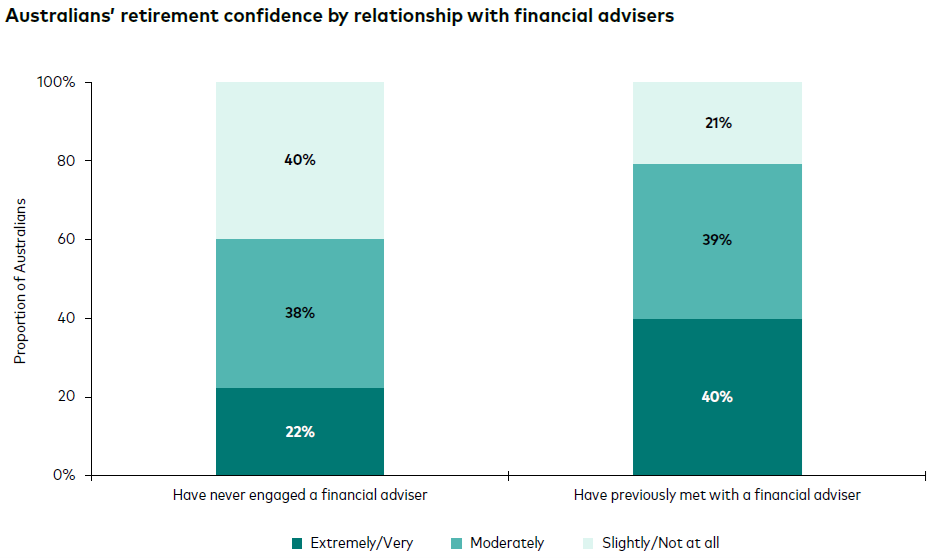

Financial advisers can play an important role in helping Australians prepare for retirement, which in turn can boost their confidence. While many Australians are unwilling or unable to engage a financial adviser, those who do were more confident and positive towards retirement.

For example, 40% of Australians who had previously met with a financial adviser said they were very confident or extremely confident about their ability to fund their desired lifestyle in retirement. That compares with 22% of Australians who had never engaged with a financial adviser.

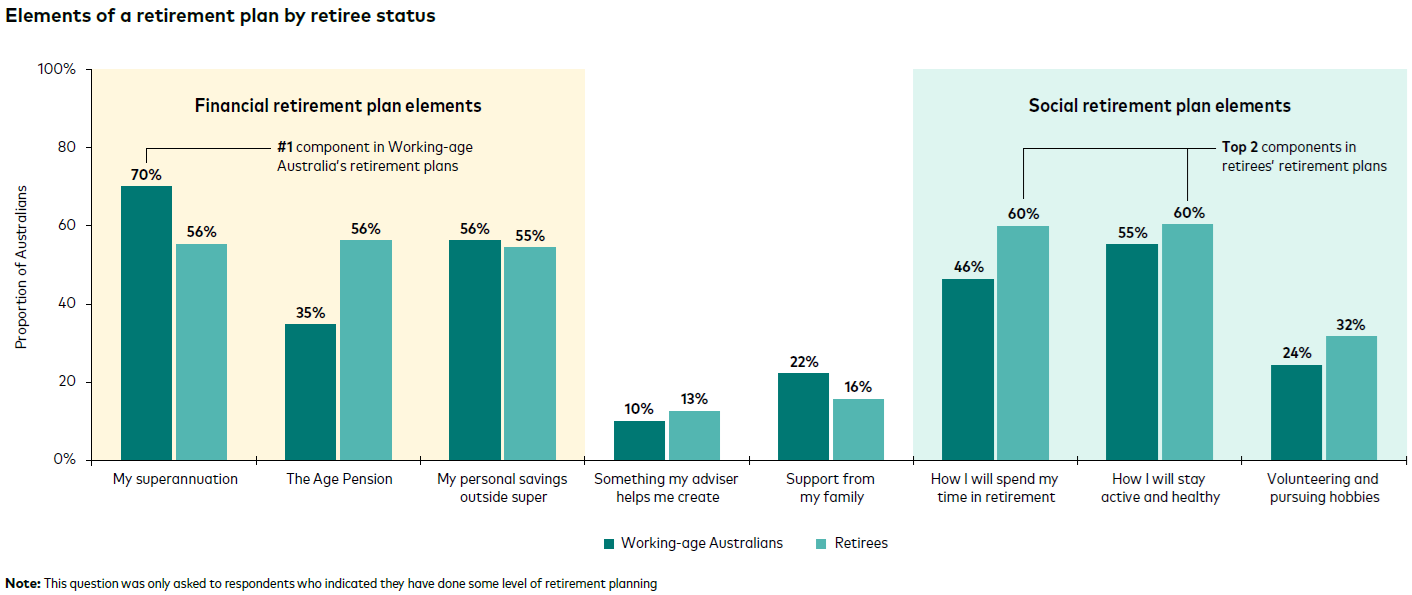

Vanguard found that both working age and retired Australians considered financial and lifestyle factors as being important parts of retirement plans, but they had different priorities.

When asked what their plans for retirement might include:

- Working-age Australians focus on the financial aspects, like superannuation (70%) and personal savings outside super (56%).

- Retirees focus on non-financial aspects, like how they will spend their time (60%) and how they will stay active and healthy (60%).

During our working lives, retirement is often viewed as a distant goal and there is a strong focus on financial preparation — for example, having enough superannuation. Because work plays such a central role in our daily routines and identity, the transition to retirement can feel abrupt and bring significant lifestyle changes.

The report’s findings suggest that good retirement planning goes beyond finances. Working-age Australians may benefit from looking ahead to their goals for lifestyle, health and social connection in retirement and factoring them into retirement planning.

Part-time work in retirement

Retirement doesn’t necessarily mean stopping work completely. For some Australians, retirement involves working reduced hours, participating in the “gig economy” or taking on a new role with flexible working conditions.

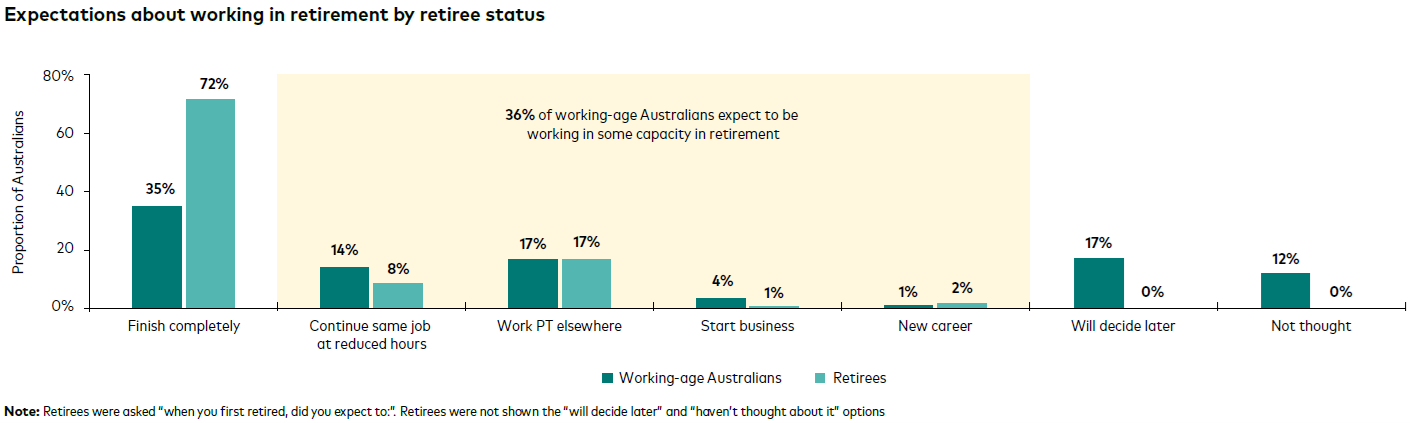

This year’s survey showed that more than two in three retirees expected to stop work completely when they retired. However, working-age Australians have significantly different expectations:

- only 35% of working-age Australians expect to stop working entirely when they retire.

- 36% of working-age Australians expect to be working in some capacity in retirement.

- 29% said they were either unsure or would decide later.

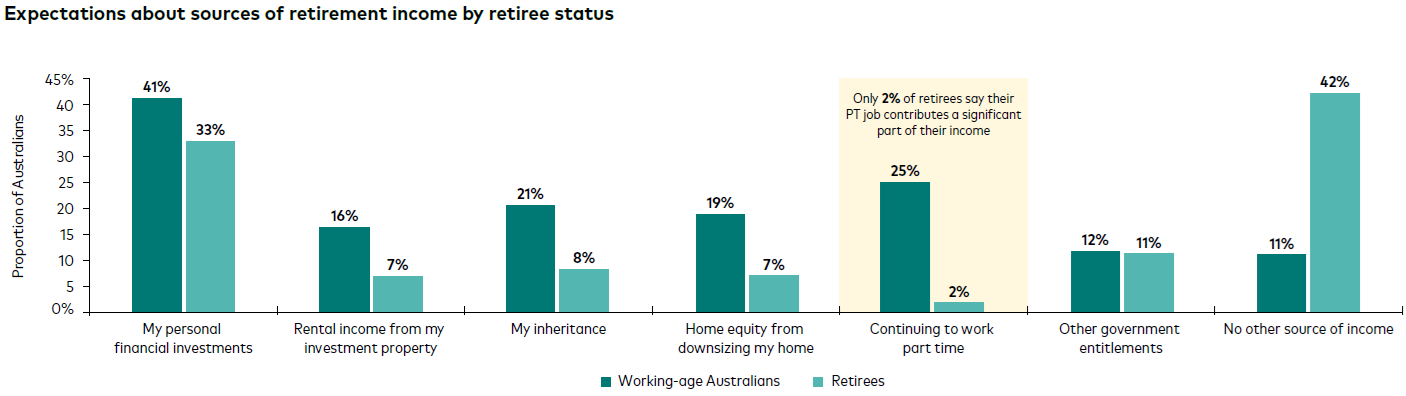

Working-age Australians also have different expectations about the role of income from part-time employment in retirement.

- One quarter of working-age Australians believe that part-time work will form a significant part of their retirement income.

- Meanwhile, only 2% of current retirees report that part-time work contributes a significant portion of their retirement income.

The significant gap between how younger Australians and current retirees view the role of work in retirement may reflect evolving work patterns, shifting attitudes toward retirement, or rising expectations for income later in life.

While working-age Australians may be overestimating their likelihood of working part-time in retirement, ABS data shows that the proportion of the workforce aged over 65 has grown from around 1% to 5% over the past three decades.3 This trend suggests that part-time work in retirement is becoming more common, even if it may not always contribute significantly to retirement income.

1 Association of Superannuation Funds of Australia (2025), ASFA Retirement Standard, December quarter 2024, ASFA Website.

2 Australian Bureau of Statistics (Mar-quarter 2025), Consumer Price Index, Australia, ABS Website. National all-groups CPI change from quarter ending Dec-2019 to Mar-2025.

3 Australian Bureau of Statistics (April 2025), Labour Force, Australia, Detailed, ABS Website.

You can read the full report here.

Vanguard Australia is a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any individual.

For more articles and papers from Vanguard Investments Australia, please click here.