Mounting uncertainty surrounding the outlook for the global economy and investment markets is highlighting the benefits of holding defensive assets, such as infrastructure, in a portfolio. Unlisted airports have especially attractive features.

While typically thought of as an investment for large superannuation funds, more private investors are adding unlisted infrastructure to their portfolios. Infrastructure assets provide essential services such as gas, water, electricity transmission and distribution networks, as well as transport infrastructure including airports, rail and toll roads. These assets are considered to be defensive as they provide reliable income given the prices they charge are often regulated by governments and their cash flows are predictable.

The airport attraction

Airports provide numerous sources of revenue from a diversity of stakeholders such as airlines, passengers, visitors, retail tenants and government agencies.

In fact, airports should be considered as two separate businesses – airside and landside. The airside operations include the management of the runways of the airport. Revenue is generated by either a charge levied per passenger or a charge levied on the weight of the plane or a combination of both. This side of the operations behaves much like a regulated utility. The landside operations involve the non-air aspects of the airport such as retail shops, car parking and property development and maintenance.

Airports have been a strong driver of returns for unlisted infrastructure portfolios. The sector in Australia has delivered long-term growth, with only one year of negative passenger growth over the last 25 years. This compares to four years of negative growth for Australian equities over the same period. The airport sector performed relatively well through the GFC, with airlines managing the down cycle through a range of initiatives including discounted ticket prices and reduced services for example.

In FY 2017, Melbourne Airport generated a return of 25%, Perth Airport returned 13.2%, Brisbane Airport returned 14% and Adelaide generated 23.2% for investors.

The value of unlisted infrastructure in a portfolio

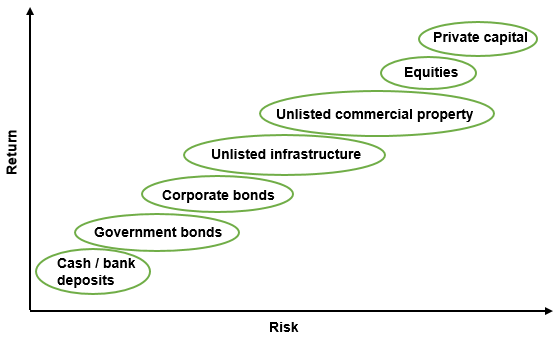

Unlisted infrastructure in a portfolio sits between government bonds and equities in terms of risk return, making it strong portfolio diversifier, as shown in the chart below. Infrastructure’s potential for stable, reliable income and capital growth is derived from long-term, stable and predictable cash flows, typically underpinned by long-term contracts or a regulated asset base. High visibility of income and revenues are often linked to inflation.

Unlisted infrastructure investments accounts for between 7- 12% of major institutional investor portfolios, with the Future Fund having allocated around 7% to infrastructure and Australian Super 12%, as at the end of 2017.

Risk return profile of unlisted infrastructure

Source: IPIF August 2018

The key is to determine which assets and projects will provide the greatest, and most consistent, returns.

Our investment strategy focuses on providing exposure to a diversified portfolio of mature, stable and cash-generating infrastructure assets. This includes exposure to transport assets including Perth, Adelaide, Melbourne and Brisbane Airports and Interlink Roads, and a number of energy and utilities assets including TransGrid, the UK’s South East Water and PowerCo and First Gas in New Zealand.

In infrastucture funds generally, it's worth checking on the type of assets held and the particular merits of airports.

Nicole Connolly is executive director at Infrastructure Partners Investment Fund Management Pty Ltd (IPIFM). This article is for general information only and does not consider the circumstances of any investor.