In Part 1 last week, we looked at the characteristics of unlisted property funds (syndicates) that investors should look for. In Part 2 this week, we look at how the returns are generated.

Many investors must look at an unlisted real estate fund’s yield at say 7.3%, on a property acquired with income yield of say 7%, and wonder where the money comes from. The answer is leverage and cost of debt. Whilst a syndicate’s yield is a function of the net income that the underlying property generates, the ultimate yield to investors depends on the gearing level and borrowing costs.

Higher gearing enhances the yield if the cost of debt is below the yield of the asset, as in the current market. We advocate gearing not to exceed 50% and start with at least a 10% buffer to the bank’s loan to value (LTV) covenant, usually 60%. This buffer is in case asset values fall.

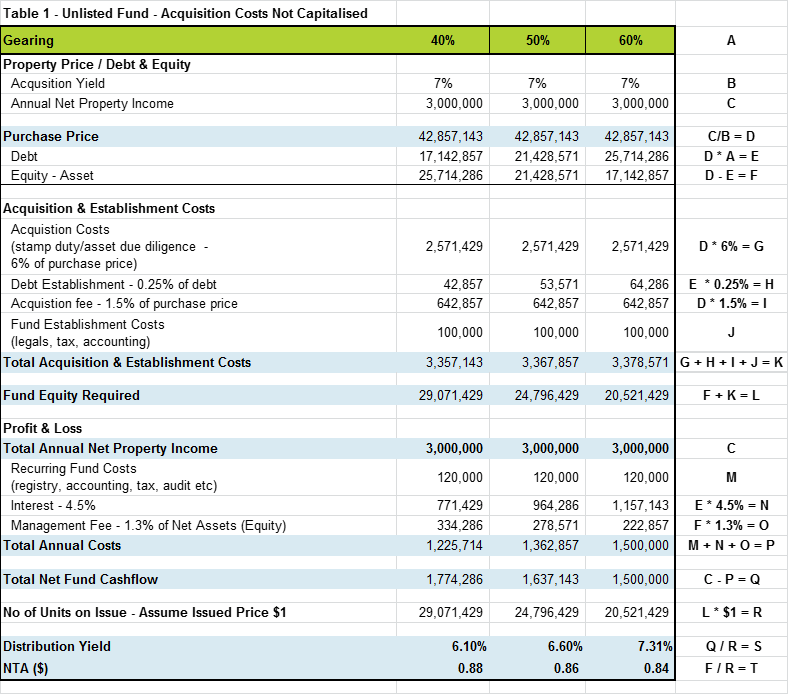

Table 1 shows an example of an asset generating a net income of $3 million per year and purchased on a yield of 7.0%. Let’s assume that it is fully tenanted and relatively new so the capital expenditure requirements are minimal. There are three scenarios – the asset has leverage of 40%, 50% or 60% and the acquisition costs are not capitalised.

The distribution yield varies between 6.1% and 7.31% depending on gearing.

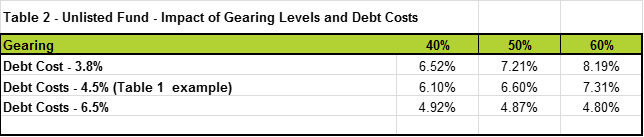

The cost of debt also has an impact. Table 2 shows the impact under two other scenarios related to the cost of debt. Firstly, the manager secures debt at 3.75% (assume a 90 day BBSY base rate of 2.3% and a bank margin of 1.5%), which is highly possible in today’s low interest rate environment and secondly, interest rates move back closer to long-term levels and debt is secured at 6.5% (a base rate of 5.0% and a margin of 1.5%).

Gearing enhances returns

There is a wide variation in a fund’s yield based on the gearing levels and cost of debt.

Leveraging up in a market when asset prices are rising (yields are falling) and debt costs are low, as the table above shows, can generate supersized returns. However, the risk in those funds is significantly heightened when the cost of debt goes up or the real estate cycle turns and prices fall as it inevitably will at some point. Investors need to understand that prudent use of leverage, with appropriate capital management strategies (covenant levels, type of debt, principal and interest or interest only, duration of debt (short or long term) and hedging) can be an effective financial instrument. Abused, the ramifications can be significant.

As real estate yields have fallen, it is pleasing most managers of recent unlisted fund offers are avoiding the temptation of leveraging up to boost a fund’s yield. Managers and investors must remain diligent as real estate yields head to cyclical lows, and avoid the temptation. As Warren Buffet said “when you combine leverage and ignorance, you get some pretty interesting results”.

Exit strategies, liquidity and term extensions

We are often asked what happens at the end of the syndicate's term? What happens if an investor needs liquidity? Why does the syndicate require such high thresholds to rollover for a longer term? These are all legitimate questions which managers need to clearly articulate to investors.

Unlisted real estate fund is a long-term investment. If investors are concerned about short-term liquidity needs they should consider investing in listed real estate. There are times when a person’s circumstances change due to death or divorce and they wish to liquidate the investment.

In a syndicate, the only way this can be dealt with is via an off-market trade in which another investor is willing to buy their units in the fund. There is no secondary market for trading of units although there are some funds that have been established to acquire units from investors, and from time to time, the manager may be approached by other investors who may wish to invest in the fund. The manager may put the two investors in touch with each other to negotiate an appropriate price but the manager is legally not able to create a secondary market in trading the units of its fund.

The GFC highlighted the inadequacy of many unlisted funds whereby they did not focus on the exit strategy which created a misalignment between investors and managers. A number of funds were extended for a further term prior to the GFC and then took a hit as the market collapsed. In effect, some managers ‘rolled the dice’ and kept their funds running beyond the initial term. This allowed the managers to collect fees for longer when asset pricing started to reach excessive levels and the funds had already delivered strong returns to investors.

Most of the leading managers now use structures that require unitholders to vote to amend the fund term and performance fee structures. They incentivise the manager to recommend to unitholders to wind-up the fund early if they believe the returns from the asset have been maximised or the cycle is nearing the peak. Managers have also inserted early wind-up provisions into the terms of the fund typically based on a Special Resolution ie at least 75% of votes cast by unitholders on the resolution to be in favour of the resolution for it to be passed.

The Special Resolution provision should also apply if the manager believes it is in the best interest of investors to extend the term of the fund. This may arise as the property has an upcoming lease which if renewed or extended can add value to the fund if the sale is delayed until this is actioned, or it could be that the market is soft and liquidating the asset at the time may not optimise the return to investors.

The key with exit strategies is for the investor to recognise that investing in an unlisted fund is long term and the manager’s role is to optimise the value of the asset and the return to unitholders which may mean, in certain circumstances, winding-up early or extending the life of the fund. The decision should be relatively straightforward for both the manager and investor if there is an alignment of interests (see Part 1 last week) and there is an appropriate voting mechanism that gives investors a say in what happens.

Adrian Harrington is Head of Funds Management at Folkestone (ASX:FLK). This article is general information and does not address the specific investment needs of any individual.