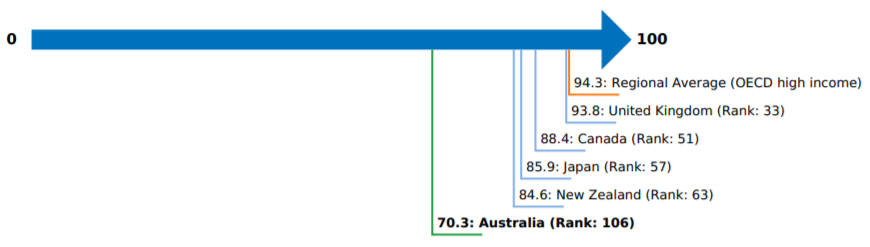

According to the World Bank’s 2020 Trading Across Borders report, Australia now ranks 106th in trade system productivity, having fallen precipitously from 27th position in 2010. This sounds dramatic, and it is, but why is this global ranking important for Australians?

Falling trade competitiveness

The World Bank has a Doing Business Score that, in the case of trade, measures the competitiveness of the regulatory performance of countries based on border compliance, documentary compliance and domestic transport costs. Organisations, such as the Australian Chamber of Commerce and Industry, believe the cause of Australia’s decline in competitiveness is quite simply that globally countries have digitalised their trade systems whereas Australia has not, and so our compliance costs are uncompetitive.

Trading across Borders in Australia and comparator economies – Ranking and Score

Source: The World Bank

Some readers may remember Australia’s trade battles were traditionally fought on the waterfront, coming to a climax in the 1998 Maritime Union of Australia versus Patrick Corporation stoush. This time the issue isn’t waterfront productivity but rather digital productivity.

Best practices in trade productivity today are supported by what is referred to as a Single Window approach, which is a system that allows traders to file standard information and documents through a single-entry point to fulfill all import, export and transit-related regulatory requirements. Importantly, these processes are digital.

Countries have developed web-based systems allowing traders to submit documents and pay duties online. These systems deliver long-term benefits through saving time and money while streamlining procedures. Further benefits from web-based systems are that they can help governments combat fraud and money-laundering, track statistical information on foreign trade transactions, and share information with key support players in trade such as banks, insurers and logistics companies. The benefits of a Single Window system therefore go beyond trade, to national security. The challenge for all countries wishing to secure these Single Window benefits is the ability to migrate their regulatory framework from paper to digital.

Further example of Australian red tape

The ANZ Bank estimates that a company which processes around 1,000 export documents a year would save close to $250,000 by moving to a digital trade solution. And like many government red tape related issues small- to medium-sized businesses are likely to gain the most from the establishment of a successful Australian Single Window trade system.

This is the state of play today, but the goal posts are moving, and quickly. While in Hong Kong in 2018 a large Australian Bank introduced me to the Hong Kong Monetary Authority (HKMA), the equivalent of our Reserve Bank. The HKMA was leading what they called their eTrade Connect initiative, largely funded by local banks, meant to move Hong Kong’s trade system from digital to a Blockchain enabled system. Singapore is doing the same, and a few months after returning from Hong Kong I met with a Japanese group with the same mission.

Banks globally are particularly interested in Blockchain-enabled trade finance systems as Blockchain technology provides far more security and transactions occur almost instantly. Trade credit providers are exposed to fraudulent trade transactions, and during the GFC trade finance professionals virtually lived at their offices as companies struggled to understand the financial credibility of the counterparties they were trading with. Blockchain-based trade finance significantly reduces those risks. And importantly the Blockchain technology being deployed is not particularly difficult to incorporate into trading systems, the hard part is getting the participants onside.

The World Bank is supporting Blockchain-enabled trade systems as they believe it will rip out further costs in global trade systems. And the World Bank also believes Blockchain-enabled trade systems will support micro exporters operating in developing countries gain access to inexpensive trade systems, including trade finance, which is often the difference between successful growth and merely surviving.

Left behind on trade competitiveness

Upon my return from Hong Kong (when Australia was ranked 95th) I spoke with government agencies such as Treasury, DFAT and ASIC, as well as private sector organisations with a stake in Australia’s trade competitiveness, as to who was responsible for improving our trade regulatory productivity. I was advised that The Department of Home Affairs was charged with delivering Australia’s Single Window; however, Home Affairs had no information on their website (and still do not) in respect to the Single Window initiative, and calls I made to Home Affairs on this issue were not returned.

As a country, we have known about our weaknesses in trade processes for many years, as the Australian government has been involved in stop-start initiatives to deliver a digital trade system since at least 2009 without success. Now the leaders of the trade pack are taking the leap to the next technology platform, Blockchain, to enhance their trade competitiveness.

As a trading nation, Australia cannot afford a ranking of 106, and the costs associated with it, in an area so important to our economic well-being. And a government looking for any opportunity to kick start a COVID-weary economy would do well to finally bring our trade systems into the 21st century.

Kevin Cryan is a technology and services investments specialist and Managing Director of Scarborough Partners. He was previously Senior Investment Specialist for Services and Technology at Austrade after spending 16 years at the CSIRO.