Unless there is a remarkable economic recovery or a rapid burst of inflation, we will have low interest rates for a very long time. It's doubtful we will see short-term rates above 5% for at least a generation, maybe a lifetime. It's a weird thing to say for someone who spent his first decade in money markets with double-digit rates and a bank bill rate of 17.5% in 1990.

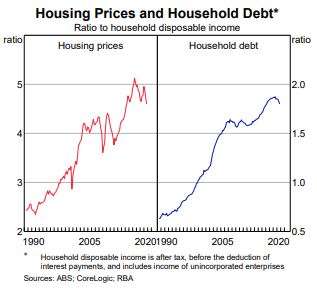

The Reserve Bank of Australia (RBA) has already promised the 3-year bond rate will remain at 0.1% until at least 2024, but there is limited scope to increase rates after that. Home buyers are not worrying as much about the prices they pay as the amount they can afford in repayments. What looks fine in the household budget at 1.75% is a severe strain at 3.75%. For our older readers who endured borrowing rates of 15% and more, anything below 5% would look like a dream, but the amounts borrowed these days supercharge the debts of 1990. (Source: RBA Chart Pack, March 2021).

Putting further doubt into any potential for rate rises was RBA Deputy Governor Debelle, who told a Senate Committee last week that there will be no rate increases until the unemployment rate falls "to a number in the low 4s or even in the high 3s". It is currently 5.8% but with an estimated 150,000 likely to lose their jobs with an end to JobKeeper last weekend. The RBA's rationale is that it wants more wages growth to achieve its inflation target of 2% to 3%.

As David Harrison, CEO of the Charter Hall Group, said last week:

"I cannot see a long-term rise in inflation. I talk to chief executives who occupy Charter Halls' $50 billion portfolio. No one I talk to predicts a wage breakout and technology will continue to be a wage deflator."

Notwithstanding, the trillions of dollars of economic stimulus injected by governments in the last year would normally signal too much money chasing too few goods, and therefore inflation, so it needs to be watched carefully.

High-profile experts on superannuation...

We had some great reactions to Bernard Salt's article last week, and we keep the big names coming.

One of the features at the COTA Policy Forum we previously reported on was the appearance of the three members of the Retirement Income Review together for the first time. Discussion clarified some of their thinking which is upending super policy. Dr Deborah Ralston said many retirees do not know how to manage their super:

“So what are people doing with their money? There are quite a number of people who get to retirement and, in the absence of any guidance or advice, they simply take the money out, pay a few bills and put it in a term deposit. Other people get to retirement and they think, ‘wow, I’ve got a little nest egg for emergencies’ so keep it in accumulation and they don’t even transfer it into an account-based pension. Others do transfer it, but almost invariably draw it down at the minimum rate because – and this is the thinking – we need to make it last.”

Dr Ralston is increasingly influential in the retirement income debate, so we are delighted that she is writing exclusively for Firstlinks in developing her thoughts on access to the equity in housing.

Similarly, Dr David Knox is highly respected in superannuation circles, and he presents a radical new idea to solve the intractable arguments about whether the Super Guarantee should increase from 9.5% to 12%. It balances current emergency needs with future living standards.

Still on super, Julie Steed provides an excellent summary of the threshold changes coming on 1 July 2021. I must admit I did not realise the changes, and therefore the opportunities, were so extensive.

And please forgive us if we use the shorthand to refer to Senator Jane Hume as the Minister for Superannuation when, in his scramble to address women's issues, Scott Morrison has now given her the title of Minister for Financial Services, Superannuation, the Digital Economy and Women’s Economic Security.

An Easter look at buns and funds

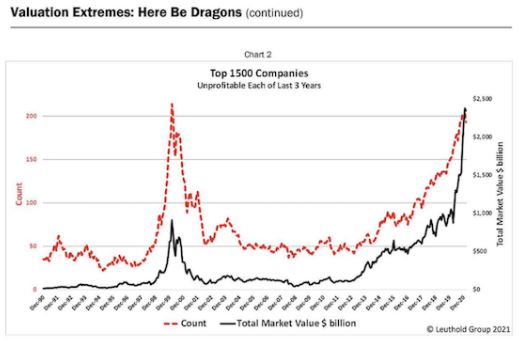

When companies don't make profits (sometimes called earnings), the stock market turns to other ratios because the Price to Earnings ratio (P/E) is infinite. The market needs something to justify the excess. Popular for growth stocks is Price-to-Sales. Think about that. There's no profit but the company is valued at at a price that is a high multiple of the revenue it receives, ignoring what it costs to make the revenue.

In the US, of the top 1,500 listed companies, over 200 do not make a profit, with a market capitalisation of over $2.5 trillion. That's by far the most for unprofitable companies ever. When we talk about market excesses, it's not really the FAANGs which are the issue. It's hundreds of other companies that will never justify their market value.

This week, we look at the dichotomy between the fund managers who look for companies with consistent earnings in predictable ways, and the growth managers who back the disrupters. Like selecting your hot cross buns, there is no single correct answer to which is best, as it depends on what suits your taste and appetite.

We highlight not only some respected fund managers with recent underperformance, but also Cathie Wood’s NYSE-listed Ark Innovation ETF, where the median Price-to-Sales ratio for her portfolio companies is 22 versus 2.5 for the overall stock market.

Then Edward Glyn delves into fund flow data to show that active funds are attracting far more support versus passive than is popularly believed, especially in Australia. We are either leading or lagging global trends.

Richard Dinham concludes his series on retirement with a look at five strategies which can be personalised based on risk appetite, capacity and needs.

If articles on sustainability have started to sound repetitive to you, as we must by now accept the implications of ESG on companies, then Robert Almeida and Robert Wilson bring a fresh perspective. It's not all a bed of roses in which all companies will happily flourish.

This week's White Paper from Western Asset Management (part of the Franklin Templeton group) focusses on the threat of inflation, which will not only have a significant impact on long bonds, but valuations in the stockmarket.

And finally, because most readers do not return to check the prior week's comments, we are introducing a new feature: Comment of the Week. Here we share feedback from one of our readers, Roy Taylor, on a life well lived, in response to Bernard Salt's article:

"I'm 77 and worked 3 hours before school and after school from the age of 10, left school at 15 and never ever worried about getting a job worked full time 60 plus hours a week until 70 and I still do relief work in my industry. Unfortunately there are too many whiners in our country, get off your arse and get out there and into it. I have owned a number of houses during my time, never got interest rates as cheap as now, in the 60s rates were at 6%, I paid 17% in the 80s for home, paid 23% for bank bills for business at that time and I got through ok, bit of hard work never killed anyone. Too many people worry about things that they have no control over, the weather, the planet will give you what it wants to give, not what you want it to do. Just get out there and give life a go, it's the only one you ever get, be happy mind your own business, get married have kids, get divorced get married again buy cars, boats, aeroplanes, drink eat laugh with your friends, just enjoy life, and all of the ups and downs because you will get plenty and you will be dead before you know it."

Graham Hand, Managing Editor

Latest updates

PDF version of the Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Latest LIC (LMI) Monthly Review from Independent Investment Research

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website