Weekend market update: The S&P/ASX200 Price Index was flat for the week, closing at 7,061 on Friday versus its record of 7,197. Increases in global virus cases and reports that President Biden will double capital gains tax for wealthy people weighed down the market, although the US also ended the week flat. Bond yields continued to fall. The big down for many new players and punters was the 25% fall in Bitcoin, which would especially hit the people who buy on margin. Beginning of the end or the start of the next wave? Who knows?

***

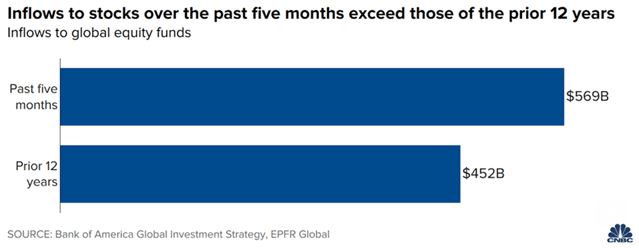

In a market where the valuation superlatives and 'meme investing' gains become more ridiculous by the day - a joke cryptocurrency like Dogecoin is now valued higher than Ford or Wesfarmers, Tesla trades on a P/E of 1,200, a digital nonfungible token (NFT) sells for USD69 million - it's welcome when a chart is the surprise of the week. While we have written about the rapid increase in new participants who consider the stock exchange like a video game, this chart from CNBC shows inflows into global stock funds in the five months since November 2020 were greater than in the previous 12 years.

Morningstar data shows US mutual fund and ETF flows for March 2021 were a record, exceeding the record set the previous month.

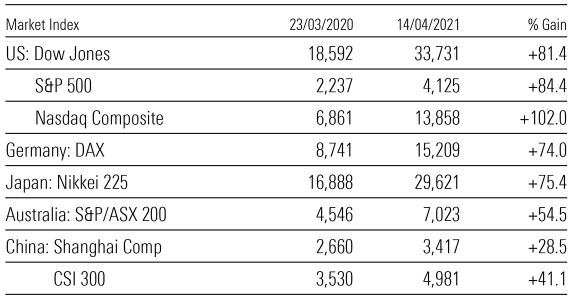

During the period when new investors received stimulus cheques while locked up at home in front of their computers, these are the spectacular returns delivered as social media reported how rich their mates had become:

Global stock market moves since low on 23 March 2020

With returns like this, Australia's 55% looks like an underachievement, and even conservative investors feel a FOMO when their term deposits are earning a miserable 1%.

If it's any consolation, however, this chart from NAOS Asset Management shows the three-month relative price performance for the first quarter 2021 for four Australian tech stocks which were darlings in 2020. Phew, thank goodness they have finally fallen, I hear many of you think.

Where to from here? We check the 'all-in equities' thesis recommended over many years here in Firstlinks by Peter Thornhill, who feels vindicated in the middle of a pandemic, versus the famous 'Warren Buffett indicator'. Buffett is the ultimate long-term stock market bull but even he believes returns depend on the entry price, and by most measures, the market is very expensive. At some point buyers will be scared away by rising inflation, a pull back in stimulus or a black swan. What does Buffett say about buying at market extremes?

Continuing this theme, Robert Almeida checks this last year like no other and forecasts the types of stocks likely to do best as markets return to what might be considered more normal.

The critical component driving markets is the stimulus packages from governments around the world, and Michael Collins analyses the consequences of President Joe Biden's massive spending, where a vast range of social programmes are putting money into the pockets of millions of Americans.

At the more conservative end of the investing spectrum, for those looking for more predictable and steady income, Andrew Lockhart reports on what to look for in a corporate bond fund and why they are worth a defensive allocation. In this sector, it's better to spread the investments rather than go into individual bonds.

Super update ... but industry needs to step up

The big news keeps coming in superannuation with The Australian Financial Review reporting that the Government has decided not to change the legislation increasing the mandatory super rate to 10% on 1 July 2021 on its way to 12%.

The Minister for Superannuation, Jane Hume, was using the Retirement Income Review to argue that 9.5% was sufficient if super was used more efficiently. Why the change? The reason seems to be that lower super would further disadvantage women who are already well behind men in retirement savings, and the political mood for a policy not attractive to women is zero after recent events. Paul Keating told the AFR:

“Such a decision would amount to a consensus between the parties on the superannuation aggregates, underwriting a generational opportunity for superior income adequacy in retirement. Such an outcome would allow people to plan for retirement knowing they are able to rely on a much larger accumulation, while allowing funds to create longer-term instruments. This would lead to more innovation and efficiency in the deployment of funds across the economy ... More than that, such a change would lead to a much fairer and more equal economic society.”

Professor Deborah Ralston responds to last week's article from Ross Clare as she defends the Retirement Income Review's position on spending money in retirement.

And amid all this argument within the industry and politics about how superannuation should work, two senior finance executives take aim at the failings in the industry. Amara Haqqani has stepped away after six years in retirement income product and policy, disappointed with the focus on products and not people. In any case, says Donald Hellyer, super funds have not earned the right to more of his money, and cooperative structures do not allow super funds to offer the risk-based products needed to protect from longevity risk.

The Comment of the Week comes from Mart in response to Ross Clare's article on superannuation balances at death:

"There will always be hacks or smart strategies (take your pick on which is the best description) to better protect your capital from certain 'imposts' (including the 17.5% 'death tax' in the situation you reference)! I think the real points are (a) careful about the law of unintended consequences and (b) there are often options to those impacted to restructure if they wish to (and are clued up enough to)."

This week's White Paper from Shane Oliver at AMP Capital gives three reasons why the long-term bull market in Australian home prices may be close to the end.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website