The Weekend Edition includes a market update plus Morningstar adds links to two of its most popular stock pick articles from the week. You can check all previous editions of the newsletter here.

Weekend market update

From AAP Netdesk: The Aussie market set a five-day losing streak on Friday after mixed reaction to company earnings and the extension of Sydney's coronavirus lockdown. Mining giant BHP lost 16% this week while Fortescue and Rio Tinto fared little better as iron ore prices continued their descent. Many investors were caught by plunging commodity prices and investors continued moving away from economically-sensitive shares to `defensive' ones. The companies behind these defensive shares provide necessities, such as healthcare and food, and perform more consistently. Consumer staples, which includes the supermarkets, proved one of the best categories and rose 1.2% on Friday while the benchmark S&P/ASX200 index closed marginally lower at 7,461.

From Shane Oliver, AMP Capital: Global share markets had a rough week reflecting a confluence of bad news – Afghanistan, China’s continuing regulatory crackdown, worries about the Delta wave in the US and the Fed’s meeting minutes confirming that reduced bond buying (or tapering) is getting nearer. Helped by a Friday rally as dip buyers kicked in near the 50-day moving average, US shares only fell -0.6% for the week, but Eurozone shares fell -1.7%, Japanese shares fell -3.5% and Chinese shares lost -3.6%. Reflecting the weak global lead Australian shares also fell -2.2% not helped by a further rise in cases and more lockdown extensions locally along with the continuing slide in iron ore prices, with resources and financials leading the fall. Consistent with the risk off tone, bond yields fell.

Share markets are at risk of a further short-term correction as the boost from earnings reporting seasons is discounted. However, looking through the short-term noise, the combination of a likely continuation of the economic recovery beyond a near term interruption, vaccines ultimately allowing a more sustained reopening and still low interest rates with tight monetary policy being a long way off augurs well for shares over the next 12 months.

***

There are over a million words in my articles in the Firstlinks archive, and a few million more by other contributors. Investing comes with unlimited nuances and is as varied as the number of investors, but what if I were required to give one investment lesson in one sentence? How about:

"Allocate as much as possible to a diversified portfolio of growth assets, mainly shares, based on your risk tolerance and a long-term time horizon of at least 10 years and preferably up to 30 years."

Of course, this is deliberately open to personalisation. At some point in a 30-year period, the stockmarket will fall 40% to 50%. If an investor panics because they cannot tolerate losing half their portfolio, then they do not have the risk appetite for a large equity allocation, and they need to wind it back, to 80/20 or maybe 60/40. If capital preservation is paramount for a good night's sleep, then maybe 20% is all that can be tolerated.

There is also obvious merit in saving for and buying your own home, the most important step to financial security in retirement and the way most Australians have built their wealth. This is an example of investing to achieve a specific goal.

Why up to 30 years? It's longer than necessary for the market to recover from a major fall, based on historical precedents in Australia (although not in Japan). It's to encourage long-term thinking. The life expectancy of a 60-year-old Australian is currently about 26 years and many of today's 40-year-olds will work until they are 70. Investing should focus on strategies not speculation.

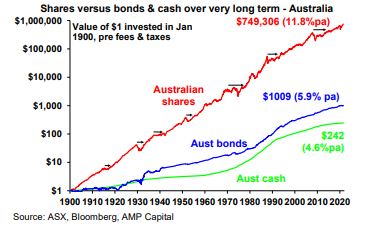

Why are shares the best for a long-term plan? Look at 120 years of data below. Long-term risk tolerance is required as this chart disguises the short-term pain, and that's the crucial question. Can you hang in for the long term? If not, then you don't have the required risk tolerance.

What does 'diversified' mean? Avoid the idiosyncratic risk of large holdings of a few companies which could perform badly. The best long-term choice is a broadly-based index fund (global and domestic) to reduce costs plus some active management if a particular fund is considered worthy. Add some small and mid caps and include assets such as infrastructure and property to diversify further.

Most of the rest goes into a diversified bond fund with say 5% left over for some fun. Set up the portfolio and stop checking the market every day or week. Here's a trio of classic Buffetts:

- “Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.”

- “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years."

- "If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

What about the vexed subject of market timing? Investing is not as simple as one sentence. The current equity market looks expensive and returns for the next few years are likely to be lower than the past because the entry price is high. That's where patience comes in. This is a 30-year view. Build a growth portfolio over time by gradually putting money into the stockmarket and then hang in for the long haul. There are always good reasons why a crash is imminent but few people can pick market turns consistently.

It is tempting at the moment to see money being made on hot stocks and hot assets and jump in heavily. Look elsewhere. As William Green wrote in his book, 'Richer, Wiser, Happier':

“My costliest mistakes have come whenever I grew impatient or envious of other people’s returns and strayed off course by gambling on private companies or individual stocks that held the promise of a racier route to riches. The paradox here is that the slower road almost always proves to be faster in the end. The investors I admire most tend to be heroically inactive, not because they’re lazy but because they recognize the benefits of patience.”

Romano Sala Tenna supports this theme with three excellent charts for the patient investor. It is extraordinary how well the Australian market has performed for the investor who can accept that one year in five will be a loser. If you can live with the risk and the time, you should do well.

This week's White Paper from Vanguard is further evidence, with its annual index chart in a paper called 'The Power of Perspective'. Quoting their founder, Jack Bogle:

“Stay the course. No matter what happens, stick to your program. I’ve said “stay the course” a thousand times, and meant it every time. It is the most important single piece of investment wisdom I can give to you.”

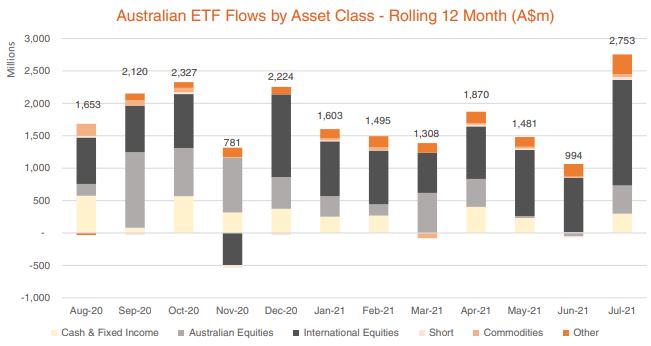

Many Australian investors have done well in equities in the last year, and the chart below from BetaShares shows how global equities have dominated ETF flows.

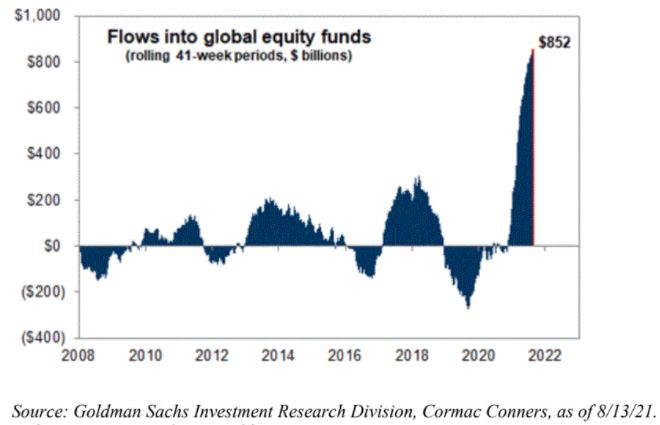

It's the same globally. The Goldman Sachs chart below shows more inflows in the last 41 week period (+US$852 billion) than for the previous 14 years combined. It will slow if the market goes through a down period but it supported the record highs of last week.

Gemma Dale explains what is happening behind the numbers, with the welcome signs that new Australian investors are not speculating as much as the 'Robinhood and Reddits' in the US, but there has been a change in 2021 versus 2020.

Our interview with Emma Fisher of Airlie (part of the Magellan Group) is a lesson in sticking to what you are good at, which might not be long-term trend picking but finding good companies at attractive prices.

Phil Ruthven takes a broader look at long-term trends in growth, inflation, markets and sectors and implores policymakers to overcome their short-term focus. Stephen Miller looks ahead to when the US Federal Reserve may be forced to increase US interest rates and asks how the Reserve Bank may react. Global monetary policy will gradually move towards tightening by weighing up virus risks against rising inflation.

Worried that your fund cannot sustain its stellar recent results? Andrew Mitchell provides his tips on how to separate skill from luck in the performance of a fund manager.

Then in a change of pace, two important articles on superannuation and SMSFs.

Noel Whittaker explains the choices that might face many of our readers, when one person in a couple dies and both have large super balances. What is the best way to manage the limits under the Transfer Balance Cap?

And Meg Heffron says we are already six weeks into a new financial year and there are important checks SMSF trustees must make around pensions and payments, as the ATO is increasingly clamping down on compliance.

Remember also that the ATO defines circumstances where the investment strategy of an SMSF should be reviewed, including a major market change, when fund membership changes or when a pension starts. The fund must have the cash flow to meet pension payments in each financial year.

Our new episode of the 'Wealth of Experience' podcast with Peter Warnes includes a look at buybacks, company profits, our survey results, 'no action' financial advice and we both have a grump. Plus the full unedited interview with Emma Fisher.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

A busy week of company results was overshadowed by a giant merger and the weakening economic outlook. Lewis Jackson writes that the Woodside-BHP deal has merits for shareholders. And Angus Hewitt believes there is plenty of runway left for Qantas despite strong share price recovery since the depths of the pandemic.

The Comment of the Week comes from Ken who wants different words in the discussion about 'retirement income'. I agree.

"This one is a hot topic! I wonder if we should refer to this as cashflows or 'spendings', rather than income, which is often interchanged with 'earnings'. "Where does your retirement cashflow come from?" might be a better framing of the question."

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website