The Weekend Edition includes a market update plus Morningstar adds links to popular articles from the week.

Weekend market update from AAP Netdesk: A broad-based rally helped the ASX close the first week of 2022 slightly ahead, although the prospect of earlier rate hikes remains a worry for investors. The market gained 1.3% on Friday in a semi-recovery from Thursday's heavy losses caused by the warnings in the US Federal Reserve meeting minutes.

Energy and financials were the top performing shares in the latest session.

Energy shares gained more than 2%. ANZ and the Commonwealth were best of the major banks. Each gained about 2.6%. Utilities and property were the next best. The benchmark S&P/ASX200 index closed up 95 points to 7,453 points. For the week, the market inched higher by 0.1%.

However, there was concerning news for Australia that national spending was at lockdown levels. On the ASX, private hospital operator Ramsay Health Care warned of a material impact from tighter restrictions on elective surgery in NSW and Victoria. The two states have not given a date for when the restrictions may ease, due to coronavirus patients overwhelming hospitals. Woolworths withdrew its bid for Australian Pharmaceutical Industries (API), leaving Wesfarmers as the only suitor.

On US markets: After the big US market fall on Wednesday, traders were hoping equities would bounce back by the end of the week, as quick price recoveries have become common since the start of the pandemic. 'Buy the dip' was rewarded in 2021, and in fact, has generally paid off for the last decade with a little more patience. But the market now seems more worried about the Fed's actions to control inflation as bond rates edge higher.

US stocks ended the week lower, with a poor payroll report adding far fewer jobs than the market expected. On Friday, the US S&P500 was down another 0.4% and the tech sell off continued with the NASDAQ losing 1%.

***

Welcome to our 10th year of publication. Each week, Firstlinks receives far more articles than we publish. Selections are based on relevance for our subject areas and audience, quality of the writing and expected popularity. In 2021, 48 articles received over 10,000 hits on our system. While a good quality article on an investment topic might receive 5,000 views, this year we had several articles over 30,000.

This week, we compile a table of the most popular articles of 2021. Worth checking through the list for any you missed. It confirms that Firstlinks is read for more than investment ideas.

Many thanks to the hundreds of experts who wrote for us in 2021 and we look forward to publishing the best again in 2022.

*A footnote to the article last week on eligibility for the Commonwealth Seniors Health Card. It has become more worthwhile as up to 10 rapid antigen tests will be free for holders of this card (as well healthcare cards, low-income cards, pension concession cards and DVA cards, in total, 6.6 million people).

A few charts to start the year

Last year was unusual for many new forms of 'investments' - NFTs, SPACs, meme stocks, crypto - that defy the way traditional valuation metrics work. But standard broad-market index investing paid off handsomely, with the S&P/ASX200 Gross Total Return Index rising 17.5% and the S&P 500 returning 28.7% (both including dividends). Remarkably, 2021 included 70 days of new daily all-time highs in the US, which was more than the 1970s and 2000s decades combined.

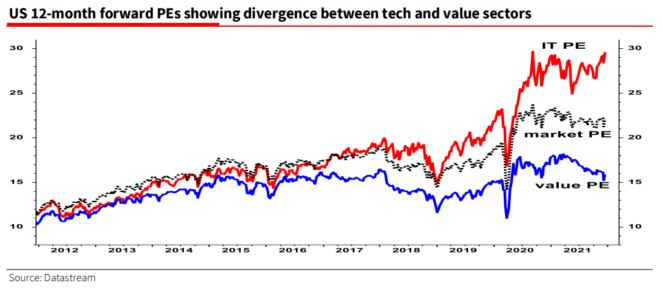

In recent years, the US tech sector and the FAANGs in particular, have driven strong gains. The chart below shows that while the Price/Earnings ratio for the tech and 'value' sectors followed a similar path for five years from 2011 to around 2016, tech boomed until the start of 2021 and its average P/E is now double that of value. In early 2021, it looked as if value was coming back but it was not sustained.

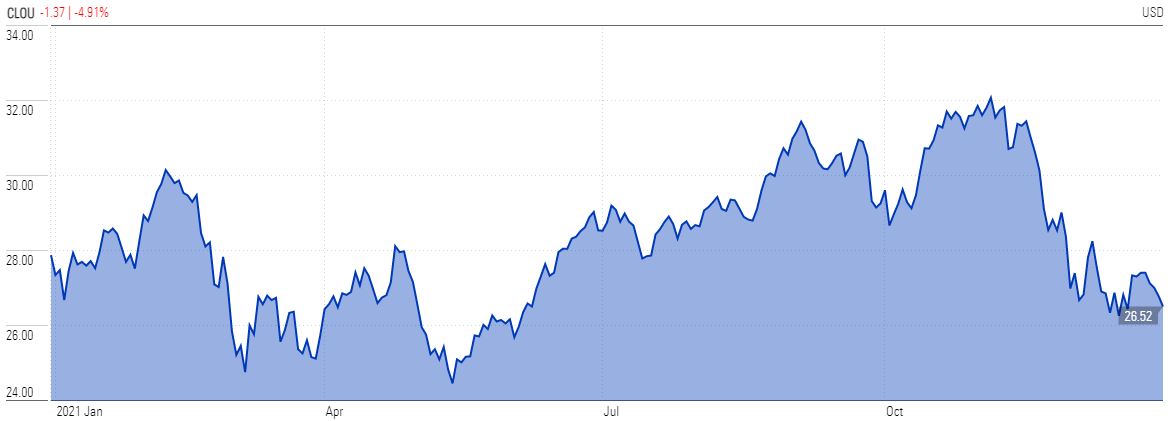

But to illustrate the difficulty following tech themes, consider the major Cloud Computing ETF listed on NASDAQ: CLOU. Surely, the uptake of cloud computing is an obvious investment during a tech boom. As shown below in a chart from Morningstar, CLOU was not only volatile but lost almost 5% in the last year. So don't kick yourself for missing these obvious 'trends'.

In other examples, Amazon was flat for the year and Cathie Wood's Innovation ARKK Fund was down 26%. Meanwhile, old world companies in coal and gas often did well, despite the ESG momentum to renewables.

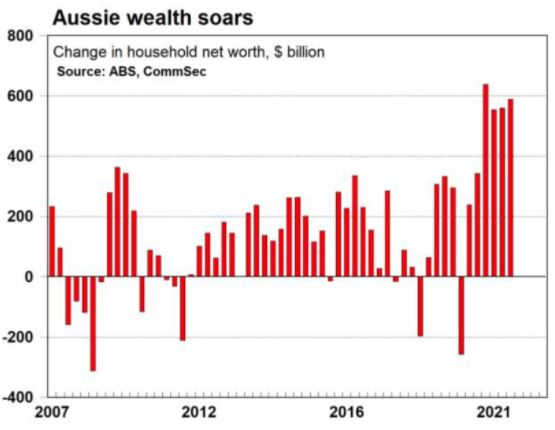

And so did many Australians, regardless of lockdowns, pandemics and inflation threats. Governments and central banks came to the rescue. Mainly due to rising house prices, but also surging stock markets and superannuation balances, the change in Australian household wealth was spectacular. The losses of early 2020 when COVID first struck now seem a long time ago. On dwelling prices, the CoreLogic data released this week shows Australian capital city averages rose another 0.6% in December taking the 2021 increase to 21%, the largest year since 1988, although with signs of a slowing.

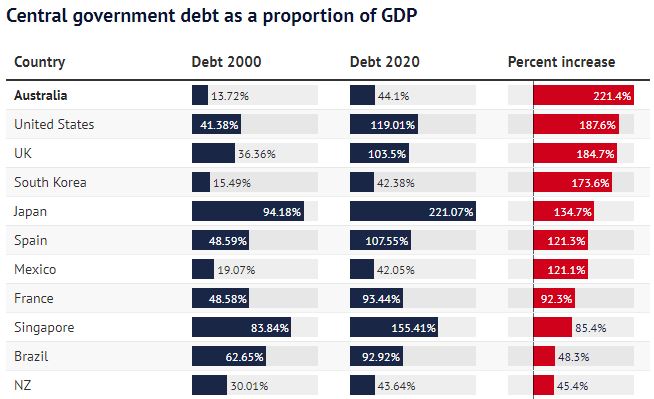

We are a few months away from a Federal election, so there will be little budget repair in the short term. Politicians will dangle carrots of tax cuts and public spending and push austerity sometime into the distant future. Australia's gross debt finished 2021 at about $850 billion and the recent MYEFO points to $1.2 trillion by FY25. There will be no budget surpluses for at least another decade, and COVID makes 'back in black' a distant memory.

According to The Sydney Morning Herald chart below, based on International Monetary Fund data, Australian Federal debt has increased more in percentage terms than any other major economy in the last 20 years. Although we have always taken comfort that our debt to GDP ratio is better than most countries, now at 44%, we have learned how to spend and not tax.

Source: SMH, 28/12/2021

Two other articles this week in our holiday edition for the new year. Portfolio managers from First Sentier select the major factors they are watching in 2022. Plus for those using the new year as a time to research their investments, we include a reminder of the ways to use Firstlinks for the best results, including our searchable archive of thousands of articles on almost any finance subject.

A weekend update from Morningstar. Lewis Jackson examines Sharesight’s annual most-active ASX investments and finds ETFs offering exposure to international markets, US technology and ‘all-in-one investments.’ It’s a change from 2020, when the top trades were banks, travel companies and buy-now-pay-later firms. Morningstar editors also take a quick look at the news you may have missed over the holidays.

Let's start 2022 with a cautionary and humorous video showing how some analysts pump a stock. This one boasts about his gains on a US company called Upstart Holdings, bought four days previously and already up 25%.

"What do they do?" asks the host.

"Excuse me," replies the analyst.

"What does Upstart do?"

"Well ... I'm sorry ..."

"What kind of company is it?"

(Pointing finger to ear) "I'm not ... You're breaking up."

"Oh, we've got an audio problem there. I'm sorry." And the interview ends.

Anyone who has seen the new Adam McKay movie, Don't Look Up, will treat much of this media commentary and spin with great skepticism.

Here's to prosperous investing in 2022, although I'd settle for half as good as 2021 as rising interest rates are likely to deliver a reality check.

Graham Hand, Managing Editor