The Weekend Edition includes a market update plus Morningstar adds links to popular stock articles from the week.

Weekend market update

From AAP Netdesk: Stocks on the Australian market had their second-steepest fall of the year as investors brace for news next week of the path to higher global interest rates. The market closed lower by 2.3% on Friday and some of the biggest categories such as materials and healthcare were among the chief losers. The ASX lost almost 3% for the week, its worst performance in 15 months.

On Friday, materials shares lost 3.5% and energy shares plunged 3%. There were losses of more than 2% in consumer discretionaries, healthcare, technology, telecommunications and utilities. The benchmark S&P/ASX200 index closed down 166 points to 7,176 points.

In company news, Qantas will reduce domestic capacity by about 10% after Western Australia postponed reopening indefinitely. Serbia revoked Rio Tinto's lithium exploration licences, bowing to protesters who opposed the project on environmental grounds. Rio's Jadar lithium project is worth about $US2.4 billion. Shares in the miner were down 4.1% to $108.72. BHP investors in Australia and the UK voted for all shares to trade on the ASX. BHP was down 4.8% to $45.70. Analytics software vendor Nuix had more misery after revealing another first-half loss is likely. Investors sent shares lower by 22.8% to $1.59. The big banks were all down. ANZ fared worst and dropped 1.6% to $28.11.

From Shane Oliver, AMP Capital: Global share markets came under more pressure over the past week on the back of concerns about rising inflation, monetary tightening, the economic disruption from Omicron and tensions with Russia over Ukraine. For the week US shares fell 5.7%, Eurozone shares fell 1.6%, Japanese shares fell 2.1% but Chinese shares gained 1.1%. Long-term bond yields rose initially but their increase was curtailed by safe haven demand as share markets fell and US, German and Japanese yields ended slightly lower for the week. Oil, metal, gold and iron ore prices rose but the $A fell as the $US rose.

From their highs US shares have now fallen by 8.3% which is their biggest pull back since 2020, with the tech heavy and interest rate sensitive NASDAQ down 14.2% and global shares are down 5.3%. Australian shares are also down by around 6%, as RBA rate hike expectations were brought forward.

We have brought forward our forecast timing for the first RBA rate hike from November to August. Jobs data for December was far stronger than expected with unemployment at 4.2%, well below the RBA’s forecast for December of 4.75%. January and February jobs data will be disrupted by Omicron. We now expect a 0.15% hike in August taking the cash rate to 0.25% followed by another hike to 0.5% in September with the RBA then pausing until early 2023. Market expectations for 4 or 5 RBA hikes this year are too hawkish though.

***

One of the benefits of investing in Exchange Traded Funds (ETFs), besides the low fees for the index options, is the ease of entry and exit. Anyone with a broker account needs no fresh paperwork. Contrast this with the pain of many unlisted funds which still require a time-consuming 20-page application process with certified documents, copies of trust deeds, tax and residency checks, identification procedures ... and the name of your dog and favourite colour. Fill in Section A, B, G through K (if applicable). Who can be bothered in a digital age?

However, while 'friction' in business is normally a negative, there are disadvantages in making selling investments so easy when people overtrade. BlackRock CEO Larry Fink tells a story about meeting the manager of one of the world’s largest sovereign wealth funds. The fund’s objectives, Fink was told, were 'generational'. “So how do you measure performance?” Fink asked. “Quarterly,” said the manager.

In her book, “Good Habits, Bad Habits: The Science of Making Positive Changes That Stick”, Wendy Wood, a Professor of Psychology and Business at the University of Southern California, writes:

“Your behaviour is much more controlled by what’s easy in your environment than most of us think ... One of the really nice things about adding friction to a behavior is that it encourages you to do something else.”

To block bad habits, she says we need to add friction or restraints that turn easy, automatic behaviours into actions that require effort. Some of her tips are to set our phones to light grey to reduce the excitement of checking share prices and overtrading, or removing apps completely. She suggests watching business programmes with the sound off.

Howard Marks says in his latest memo to his clients:

"When you find an investment with the potential to compound over a long period, one of the hardest things is to be patient and maintain your position as long as doing so is warranted based on the prospective return and risk. Investors can easily be moved to sell by news, emotion, the fact that they’ve made a lot of money to date, or the excitement of a new, seemingly more promising idea. When you look at the chart for something that’s gone up and to the right for 20 years, think about all the times a holder would have had to convince himself not to sell."

One way to reduce overtrading is to think about the time and effort involved in investing. It's not only the buy and sell process, but the monitoring, accounting, tax returns and performance measurement. Are you convinced enough about an investment to bother or is it more of a punt? This year, particularly when I'm scaling back exposure to the market, an investment must deserve my attention to warrant the effort. It's counter-intuitive to want more friction but do you spend too much time checking prices and trading for marginal gains?

Although I'm a fan of ETFs for the choice, cost and easy access, there are potential risks in using them that should be considered. As more Australians invest overseas for diversity, check the link to the Morningstar analyst selections below for their top global picks.

It has been well reported that smaller tech companies without proven revenues are experiencing a sell-off, with 40% of NASDAQ companies off 50% from their yearly highs. At times like this, it is better to focus on resilient balance sheets and companies with pricing power and strong cash flows. While Roger Montgomery is generally optimistic about markets in 2022, he identifies the types of companies that will do better if there is a selloff.

Similarly, Rob Lovelace sees strength in company earnings in 2022. While he expects some level of correction after 11 years of the bull, it's better to weather the storm by staying invested rather than guessing when to buy and sell.

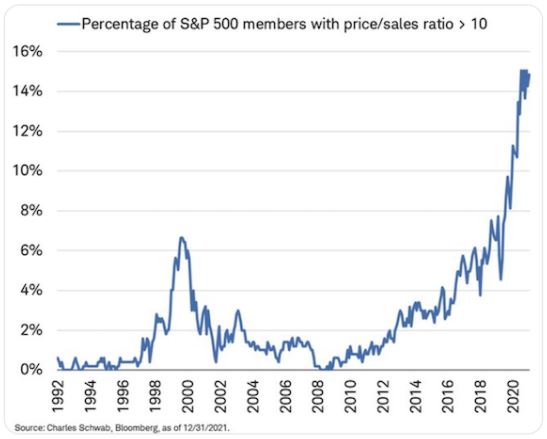

One of the remnants of a rampant bull market and IPOs of companies based on a dream is the move away from judging value based on Price to Earnings (P/E) ratios. It's not possible to calculate a P/E if there's no E, and so promoters of new companies find other metrics, such as Price to Sales (P/S). No longer is an investor deciding whether a P/E of 20 - paying for 20 years of current earnings - is expensive, but a record percentage of companies are trading at a P/S of over 10. No profit so investors are paying for sales.

Still overseas, a friend who writes for the BRINK newsletter sent me a global snapshot of what two dozen of their experts think were the surprises of 2021 and the challenges of 2022, and it's good to read a global perspective at a time of major change.

It's not surprising in such a strong market that 2021 was a record year for IPOs and capital raisings in Australia. James Posnett shows the highlights of 240 new listings, including nine companies with a market cap over $1 billion at listing. While the original owners no doubt did well, not all the new investors have. For example, the largest IPO of the year, fund manager GQG Partners, listed at $2 and is currently $1.82.

Is it time for gold to shine again after a disappointing 2021? Jordan Eliseo looks at gold's potential as inflation and interest rates rise.

And Michael Collins asks the question on many minds: what is the limit to how much governments can borrow? There must be some boundaries or we would not need taxes - governments could simply borrow to meet all expenditures, and promise their populations (and voters!) everything they desire.

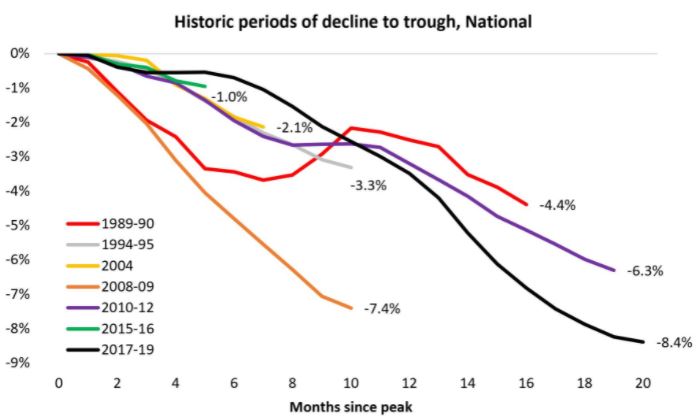

This chart released by CoreLogic during the week brings some perspective to the tearaway national residential price growth seen in 2021. It's tempting to forget that prices do fall. Faced with tight lending conditions imposed by the Financial Services Royal Commission, prices struggled for much of 2017 to 2019. So while 2021 was stellar, there was some making up of lost ground from prior years.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

This week, Morningstar analysts published their annual list of the best companies for investors to own. These are a group of rock-solid global companies that analysts believe are truly positioned to stand the test of time. And Lewis Jackson surveys Australian equity analysts about their outlook for dividends in 2022.

This week's White Paper from Fidelity International looks at the vital subject of demographics. It defines megatrends shaping global growth, and the trends are long term and predictable for investing outcomes.

And it was good to see the Australian Shareholders Association issue a note this week on its top three webinars of 2021.

Look out below for details of the 2022 Morningstar Investment Conference. Filled with star guests, I will be interviewing Hamish Douglass. Due to the virus, the event will be held online, and registration is only $25.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Morningstar Investment Conference for Individual Investors, all-digital event on 3 Feb 2022. Join us from wherever you are for research, insights, and analysis that can help you position your portfolio for the future. Register here.