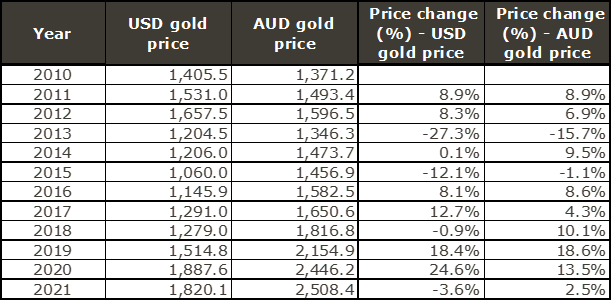

Gold prices have started the year in a narrow trading range, sitting at US$1,822 per troy ounce (oz) on 14 January 2021. This follows an underwhelming performance in 2021, with the precious metal falling by 3.6% in US$ terms, its first annual fall since 2018.

End of year gold prices and annual returns – 2010 to 2021

Source: The World Gold Council, The Perth Mint

Despite this pullback, gold has rallied by more than 70% since the low seen in 2015, making it one of the best performing assets during this period.

What went wrong for gold last year?

Several factors contributed to the gold pullback last year, including:

- A strong move higher in the US dollar index, which finished the year up 6%.

- The rollout of vaccines across most of the developed world which reduced fears about the economic damage COVID-19 would cause.

- A major upward revision in actual and forecast GDP growth, with OECD estimates for 2021 rising from 4.2% to 5.7% over the year.

- A strong rally in global equity markets, epitomised by a more than 25% increase in the S&P 500, with global equity strategies also seeing record inflows.

- A boom in digital assets with Bitcoin up 65%, while the value of all cryptocurrencies rose by 205%.

Global gold ETF investors also lightened their exposure, with total holdings falling by 8% from the peak seen in late 2020. Notably, Australia was an outlier in this regard, with investments in gold ETFs holding up far better than their global counterparts last year.

Did anything go right?

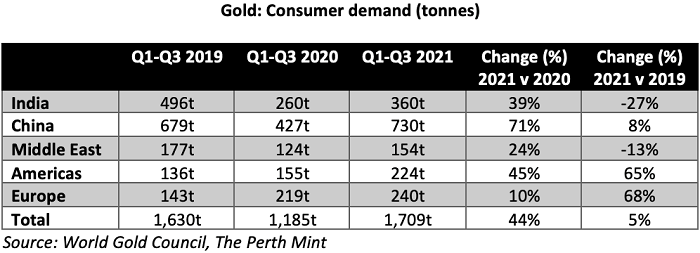

Encouraging signs for gold in 2021 included very strong consumer demand for bars, coins and jewellery.

This is highlighted in the table below, which shows demand in the first three quarters of 2021 was 44% higher than 2020. It was also 5% higher than 2019, before anyone had ever even heard of COVID-19.

Central bank demand was robust, with net purchases in H1 topping 330 tonnes, almost 40% above the five-year average. Most estimates suggest net purchases by central banks for 2021 will be in the 400-500 tonnes range, with developed markets like Singapore and Ireland joining the list of nations adding to their gold reserves.

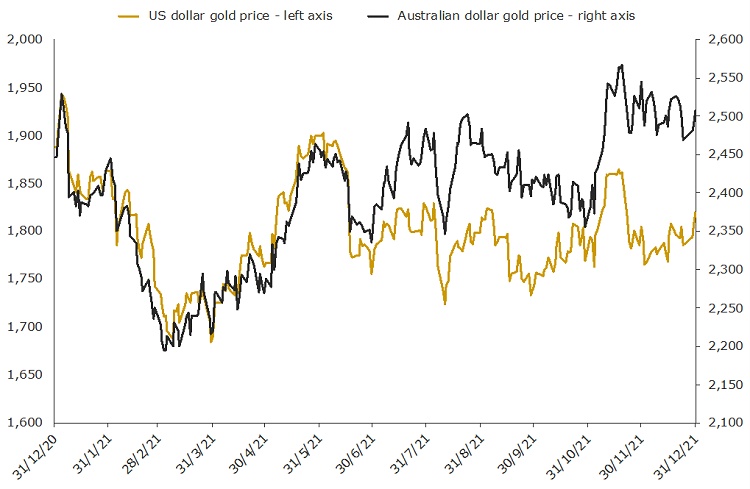

Finally, while gold recorded a calendar year loss in 2021, all the pain was seen in Q1 when gold dropped by 10% to the end of March, trading below USD 1,700/oz. From then on, gold trended higher, as the chart below illustrates.

Daily gold prices in 2021

Source: The World Gold Council, The Perth Mint

The outlook

Multiple factors are likely to influence gold during 2022.

Potential headwinds include the fact that US inflation rates may soon decelerate. The expectation that we will see at least three interest rate hikes in the United States this year (with more to come in 2023) could also weigh on the precious metal, as would any further upside in the US dollar.

That said, the fact gold rose during December last year suggests that the accelerated tapering of asset purchases and the more hawkish interest rate projections announced by the US Federal Reserve (Fed) at their most recent FOMC meeting, were largely priced in.

Gold also has a history of delivering positive returns once the Fed begins rate hiking cycles (for example, gold prices rose by 30% between December 2015 and July 2019, a period that saw the effective Federal Funds rise from 0.24% to 2.40%).

Given such history, the Fed tightening monetary policy this year may not be the death-knell for gold that some assume it will be.

Gold may also experience renewed safe haven demand in 2022 given the potential for higher volatility in equity markets. This may prove to be a particularly relevant driver for gold, given:

- the low nominal and negative real yield environment investors face when looking at sovereign debt markets.

- how expensive equity markets (particularly in the United States) are today, with the famous Buffett Indicator showing the market capitalisation of US stocks ended 2021 at 218% of US GDP.

Indeed, with markets beginning to show signs of fragility in the face of the withdrawal of policy support, it would not take much to boost gold. Any further complications caused by the spread of the Omicron variant, and geopolitical flare ups from the Ukraine to Kazakhstan, are also potential tailwinds.

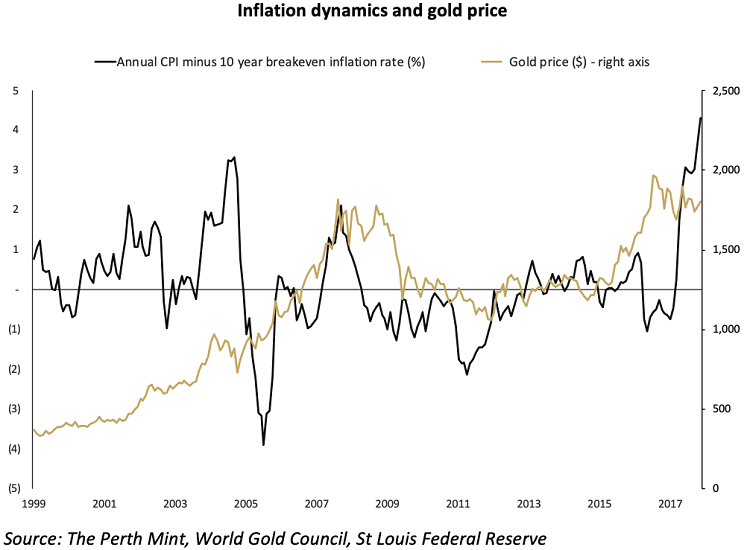

On the inflation front, while surging consumer prices didn’t lead gold to deliver a positive return in 2021, it’s too early to say the precious metal no longer works as an inflation hedge, as some have claimed.

While the Fed dropped the word ‘transitory’ late last year to describe inflation, the market has yet to meaningfully price in higher rates of inflation. The US five-year break-even inflation rates ended 2021 at just 2.87%, while 10-year break-even inflation rates were below 2.6%.

This meant the market ended 2021 with the largest gap between current CPI rates (6.8%) and 10-year break-even inflation rates on record, as the chart below highlights.

Given this set up, there’s plenty of room for the CPI to fall a long way from current levels, yet still end up overshooting current market expectations.

Finally, it’s worth noting that gold has now worked through a roughly 15-month period that at its worst saw prices correct by almost 20% from peak to trough.

Corrective cycles like this are part and parcel of gold bull markets, and indeed are often healthy developments as they allow the market to rid itself of excess froth and speculation.

Sentiment towards precious metals has also done a 180-degree turn, from near unanimous bullishness in Q3 2020 to a far more subdued outlook today.

This is illustrated through a range of high-profile headlines in recent articles discussing gold. They have ranged from describing the precious metal as 'unloved and uninteresting', to others claiming that gold has 'lost some of its investment allure'. A number of financial institutions have also released bearish gold price forecasts for 2022.

They may, of course, turn out to be correct, but these are typically the signs one sees at, or very close to, the end of a corrective cycle.

At the very least, it might be too early to give up on gold just yet.

Jordan Eliseo is Manager of Listed Products and Investment Research at The Perth Mint, a sponsor of Firstlinks. The information in this article is general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.