The Weekend Edition includes a market update plus Morningstar adds links to two recent stock pick highlights from the week.

Weekend market update

From AAP Netdesk: Shares had their biggest loss in more than two weeks on the ASX on Friday as investors despaired at US inflation figures that may prompt aggressive rate rises. The market dropped about 1% on the day and all but one share category was lower after US annual inflation rose to a 40-year high of 7.5%. Technology was the most affected category and lost 3%. Property, healthcare and utilities each lost 2%. Materials was the only category to buck the trend and gained less than 0.5%. The benchmark S&P/ASX200 index closed down 71 points to 7,217 points. However, for the week, the market rose 1.4%.

On Friday, the major miners helped limit the ASX losses. Fortescue and Rio Tinto each rose 2% while BHP had a 1% gain. In banking, the Commonwealth fared worst of the majors after this week's strong first-half earnings report. Shares dropped 2% to $98.55. The other banks in the big four each rose by less than 1%. Companies reporting earnings next week include JB Hi-Fi, BHP, Fortescue, CSL, Santos and Wesfarmers.

The ASX200 is about 400 points below its record high in August 2021 of 7,633. The yield on the US 10-year bond topped 2% for the first time since August 2019.

From Bloomberg: US stocks extended their losses on Friday due to tensions over Ukraine. The S&P500 lost 1.9% while the tech correction continued with the NASDAQ index down 2.8%.

***

In recent years, investors have relied on the 'Fed put', the belief that if the stockmarket falls, the US Federal Reserve will ease monetary policy and rescue the market. It worked in 2018 when the market fell amid a rate tightening cycle, and the Fed reversed its policies. And of course it happened as COVID struck in March 2020, and central banks around the world rode in on white horses.

Why do we in Australia focus so much on the US? Because it dominates global equity markets, comprising about 56% of total global equity market values, versus the next biggest, Japan at 7%, China at 5% and the UK at 4%. Australia squeezes into the Top 10 at about 2% of global market cap. The US is not only the largest foreign investor in Australia, but the place where Australians invest most overseas.

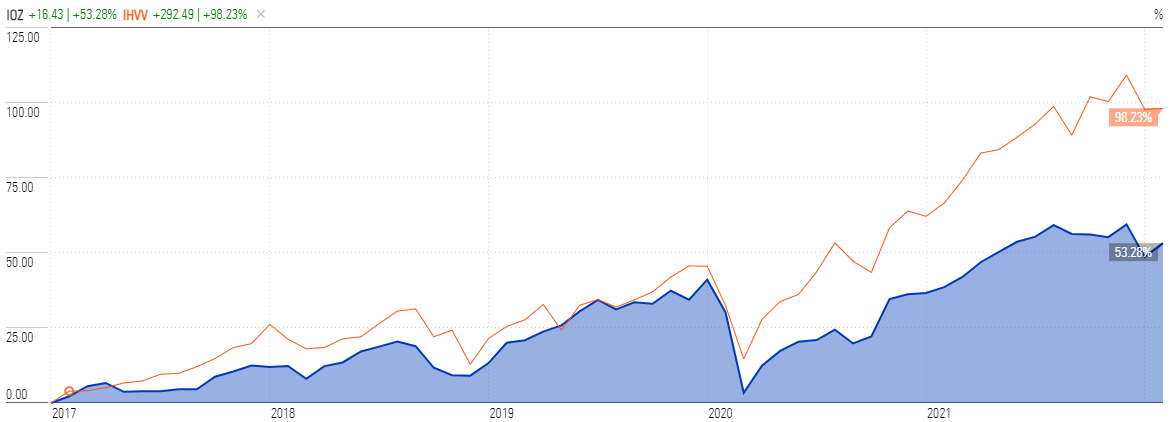

The broad US equity market has performed better than Australia in recent years, mainly due to the success of its tech giants, but the price correlation between the markets is obvious. For example, the chart below shows two index ETFs by the same provider, iShares, with the blue representing the S&P/ASX200 (ASX:IOZ) and the red the S&P500 (ASX:IHVV) over the last five years. If the US market falls in 2022, Australia would surely follow, regardless of conditions in the domestic economy.

Source: Morningstar

It would be dangerous in the current market to assume the 'Fed put' would save investors in 2022. Inflation was reported at 7.5% annual this week in the US, giving the Fed a bigger problem that it did not face in prior years. It is now committed to tightening and is already considered by most economists to be 'behind the curve' and acting too slowly.

This is one of the many points made by Hamish Douglass in his last interview before taking medical leave as Chairman and CIO of Magellan. The discussion focusses on the way he invests rather than the background relating to his personal life and staff changes at Magellan, which have been covered extensively elsewhere. We also discussed wins and losses in his portfolio and how he reacts to market falls.

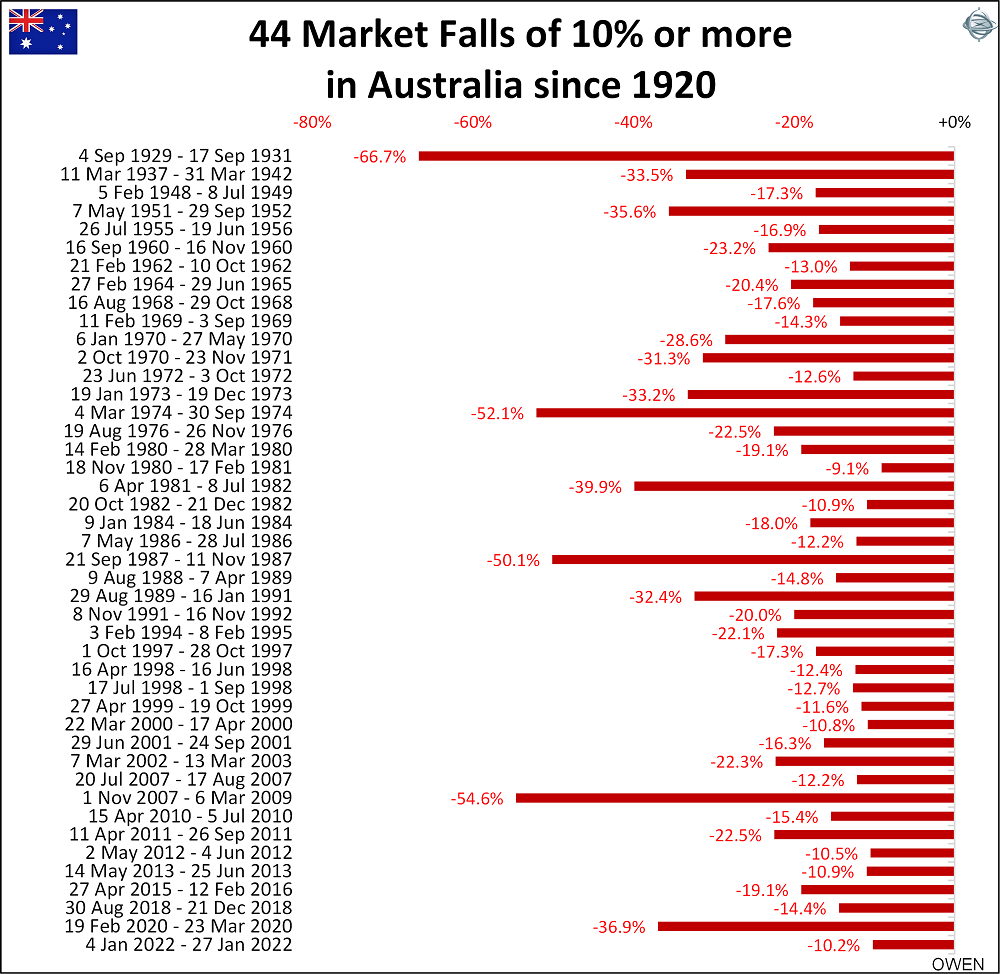

The chart in my article last week surprised some people, judging by the feedback. It is repeated here because it is a vital lesson for all investors. The data shows the reality of sharemarket investing, which every investor should write at the top of their portfolio or screen, and which I repeat regularly at presentations:

Share prices will fall by at least 10% every two or three years, by 20% a couple of times each decade, and by 30% to 50% every generation. Nobody is immune if they hold stocks, so accept it if you want the long-term rewards from equities.

Along the way, there will be winners and losers, but the best approach is not to bet the house but rely on the slow compounding of wealth in quality companies. In the most recent tech fall out, the criticisms of Warren Buffett for his old-world values have reduced as he has caught up with the 2020 and 2021 success of the tech flagship, ARK Innovation Fund.

Before we leave Magellan, here are the latest thoughts of Shaun Ler, the leading Morningstar analyst on the stock:

"Chairman and CIO Hamish Douglass' indefinite leave from narrow-moat Magellan surprised us. But we don't believe this is overly value-destructive for shareholders. In the interim, Chris Mackay and Nikki Thomas will work with Magellan's investment team to manage its flagship Global Equity strategies. The strategies are in good hands. Mackay is Magellan's co-founder, and was its chairman and CIO until 2012. He is currently managing director and portfolio manager of MFF Capital, a listed investment company of Magellan's, whose investment style is parallel to Magellan Global. A Magellan alumni, Thomas was recently portfolio manager at Alphinity, and her tenure saw the Alphinity Global Equity strategy achieve consistent top-quartile performance.

Despite our conviction in Magellan, our concern is not all investors may be willing to ride out this storm. We lower our fair value estimate to AUD34.50 per share from AUD38, after factoring in 3% more net outflows than before and further trimming our retail fee forecasts. Douglass' leave could add to the list of reasons for consultants and advisors to consider redeeming or haggle lower fees. This follows Brett Cairn's resignation, news of Douglass' family issues, and concerns of underperformance as its holdings Netflix and Meta de-rated in recent weeks. All are immaterial in isolation, but some could view the culmination of them as a sign of firm instability. Long-time client St James's Place's recent redemption is evidence of this."

In our other profile this week, we also interview Mike Murray of Australian Ethical, who describes why they have launched their first active ETF, a high conviction version of their long-term equity strategy. He also reveals some long-term holdings in companies he especially likes, and a stock he expects to hold for 10 years.

Steve Johnson is a fund manager who looks outside the large companies for the best opportunities, and he thinks small caps are the place where active managers can do best.

Two articles on the impact of inflation of real assets. Steve Bennett and Sasanka Liyanage check how commercial real estate has performed during periods of inflation, while Gerald Stack and Ofer Karliner respond to a reader question on the impact of rising prices on infrastructure assets. They also delve into the relative merits of listed versus unlisted assets in this space.

Family trusts are highly popular investment vehicles for Australians, and Stebin Sam shows how they give tax and ownership advantages while acknowledging they are not for everyone due to a few disadvantages.

And Chris Gibson says the country's future prosperity should not rely on digging up rocks, exporting animals and servicing tourists, but with the right incentives, growth in businesses in technology and health can improve the ongoing chances of success.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Investors willing to take the long view and look past this week’s modest trading updates from ANZ Bank and Westpac could be rewarded as the two cheaper banks cut costs and resolve the execution issues hampering performance, writes Lewis Jackson. And Vikram Barhat looks at 3 leading chipmakers that are well-positioned to benefit as the easing of supply chain pressures, robust global demand, and improved pricing power boost profitability,

This week's White Paper from Fidelity International reports on the retirement intentions of Australians, including the emotional journey, why some prefer to continue working and satisfaction in retirement.

The Comment of the Week comes from Howard Coleman, on the article on risk tolerance and loss aversion:

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website