At around 10.30pm on Saturday night, Scott Morrison called Anthony Albanese to concede defeat in the 2022 election. As voting continued the next day, it became likely that Labor would reach the magic number of 76 seats to form a majority government. The last time the same Prime Minister won consecutive elections was 2004, 18 years ago.

Scott Morrison resigned as Liberal leader but said he would stay on as the member for Cook.

While PM-elect Albanese and his supporters are rightly delighted by the results, Labor gained only 32% of the primary vote compared with 43% for Kevin Rudd in 2007. The difference has moved to independents and the Greens, in a major shift towards a third force in Australian politics.

Swings from Liberals in teal seats include Goldstein 13.1%, Kooyong 6.4% (where Treasurer Josh Frydenberg is likely to lose), Wentworth 6.6% and Curtin 13.4%. In my own seat of North Sydney, the swing will be about 14% on the back of a well-organised, grass roots, volunteer campaign for Kylea Tink. A major story of the night was the role of women, both in winning many seats but also voting for the type of candidates they want. Here are the Tink volunteers waiting for the results at the Kirribilli Club near my place after spending the day on the booths.

During the ABC's coverage, commenting on the inner city Sydney losses, Liberal Senator Simon Birmingham said his party needed to elect more women and it was paying the price for choosing Katherine Deves in Warringah with her views on trans issues.

“Every seat that the Liberal Party lost was lost to a female candidate, and so there is a real challenge there for us ... I think it sends a message about what Australians believe when it comes to issues of respect, of inclusion, of diversity."

After the champagne stops flowing, the challenges of managing the economy and foreign policy will soon hit Albanese and the new Treasurer, Jim Chalmers. The latter said he is facing the “trickiest economic conditions inherited by an incoming government since the Second World War”.

Let’s run a quick checklist of issues the new cabinet will confront:

- Central banks late to the game in raising interest rates to control inflation, with the Reserve Bank likely to increase rates by 0.25% most months of 2022.

- Gross debt expected to reach $1.2 trillion with structural deficits up to $80 billion a year, and spending promises from the election not matched by new revenue sources.

- The likelihood of falling house prices and ongoing problems in the construction industry due to supply shortages.

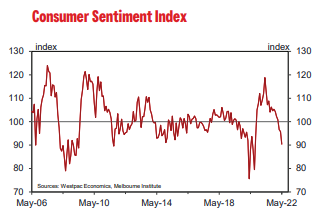

- Fears of a recession, especially in the US, with consumer confidence in Australia falling rapidly (see later chart).

- China is a focus on many fronts, including its economic slowdown and move into the Pacific.

- Shortage of labour due to low levels of immigration and a jobs boost from pandemic spending such as the overly-generous HomeBuilder scheme.

- Rising energy and food prices, although conditions in Australia are not as bad as parts of Europe (UK inflation is at 9%).

While the official 3.9% unemployment rate announced last week was good news, wages growth not matching inflation means many households have not reaped the benefits of greater job availability.

On the positive side, the Australian government spends over $600 billion a year, and it should be possible for a new government to find cost savings. Labor has already announced a big pull back in the billions spent on consultants each year. The Morrison Government’s reputation for spending on projects favouring certain electorates which were not supported by Infrastructure Australia suggests there are significant savings there.

And Australia is benefitting from demand for commodities at high prices, with conservative numbers in the budget likely to mean tax revenues are underestimated.

In his victory speech before the party faithful at the Canterbury-Hurlstone Park RSL Club, not far from his Marrickville home, Albanese highlighted that “the son of a single mum disability pensioner who grew up in public housing down the road could stand in front of you as Prime Minister”. In a wonderfully optimistic note, he added, "No matter where you live or where you come from in Australia the doors of opportunity are open to everyone.”

The millions who voted for him are expecting a significant change from the 'bulldozer' style of Scott Morrision. Although Albanese ran a small target campaign, two major policy differences will be on climate and an anti-corruption commission.

***

Wednesday's wages growth of only 0.65% for the March 2022 quarter was below analyst expectations of 0.8%. Gareth Aird of CBA said:

"Today’s data is consistent with our expectation that the RBA will deliver another ‘business as usual’ rate hike of 25bp at the June Board meeting – the Q1 22 WPI has certainly not made the case for a larger rate hike in June."

We all know cash rates will rise further. That is old news. The dilemma for the Reserve Bank is called 'threading the needle'. The hole for the thread is small and easy to miss. The central bank needs to raise rates enough to reduce economic activity to control inflation while not causing a recession. It knows Australians are especially vulnerable to rate rises due to heavily-indebted households, making each rate rise more powerful than in other countries. At the same time, election-drunk politicians are making spending promises and pushing fiscal policy in the other direction.

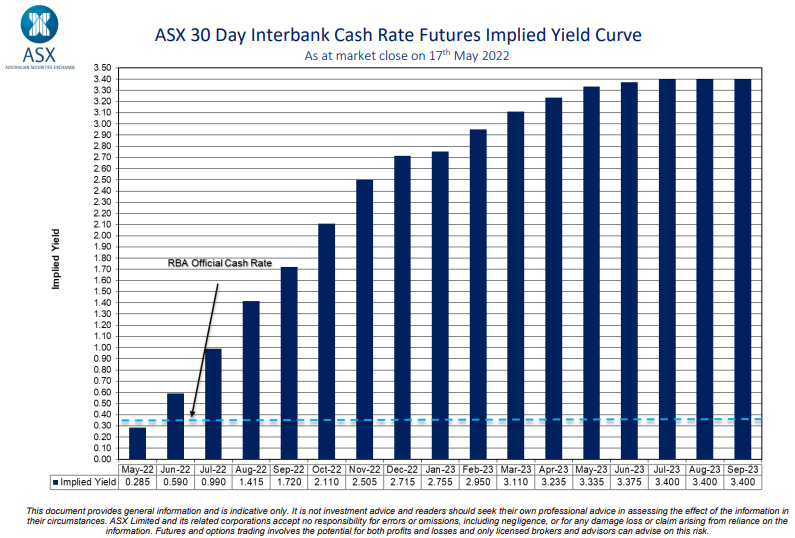

With these constraints in mind, the current pricing on cash rate futures would drive a recession and unaffordable additional mortgage repayments. Governor Philip Lowe knows how much impact falling house prices has on consumer sentiment, and the following rate levels would derail the economy.

That's 3.3% within a year, taking mortgages to around 5.5%. Here are the major bank economist forecasts for where the cash rate will peak in this coming cycle.

- CBA: 1.6%

- Westpac: 2.25%

- NAB: 2.6%

- ANZ: 3%

CBA's official position, also quoted by CEO Matt Comyn, is that cash rates will rise to 1.35% by the end of this year and settle at 1.6% next year. He even welcomed modest falls in house prices for "affordability and stability". Comyn said at the release of his bank's quarterly update last week:

"We anticipate as we've seen in prior cycles that the Australian economy and consumer will be quite sensitive and responsive to changes in the cash rate, so therefore we think that the rate of inflation will be slowed by those cash rate increases, which will reduce demand in the domestic economy."

While I believe Comyn and his economists are a tad optimistic, moving cash 0.25% every month for the rest of 2022 would significantly dampen demand, with sentiment already falling. As shown below, the Westpac-Melbourne Institute Index of Consumer Sentiment fell by 5.6% to 90.4 in May.

There's an excellent short video by my old mate (I sat next to him for a couple of years) Bill Evans of Westpac on Twitter.

***

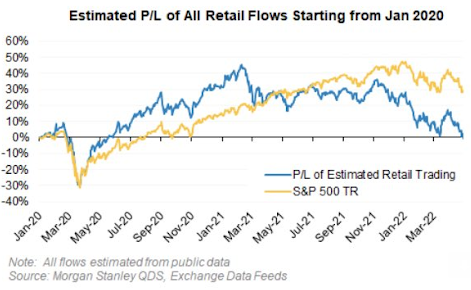

Anyone holding a share portfolio with allocations to tech and small companies knows their investments have taken a hit. Morgan Stanley estimates that the millions of amateur and first-time investors who came into the market in pandemic 2020 and enjoyed a stellar start are now facing losses greater than their gains. The calculation is based on US trades by new entrants since the start of 2020, when they initially outperformed the S&P500 Total Return index.

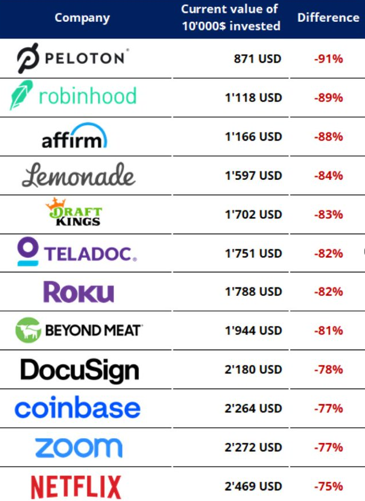

More startling are the individual stock losses, as shown below (prices as at last week, unsourced). The incredible growth stories of each of these stocks are now gathering dust. We were riding Peloton equipment, watching Netflix day and night, Zoom became a common verb, documents were using DocuSign, Coinbase was delivering the world of crypto, and we were eating Beyond Meat burgers. What could go wrong?

Australia has dozens of its own examples of rapid rises and falls, especially in BNPL, online retail (Kogan, Cettire, Temple & Webster, BWX), tech (Nuix, Xero, Audinate, Freelancer, Airtasker, Bluebet) and asset managers (Magellan, Platinum, Australian Ethical, Pinnacle, Janus Henderson). Some of these are good businesses but prices ran too far ahead of revenues.

In the fund space, the best local example is the Crypto Innovators ETF (ASX:CRYP), which traded a record volume on Day 1 (3 November 2021 where $8 million was invested in the first 45 minutes). It looks like the worst timing possible, as it quickly peaked at $12.41 and has been as low as $2.75. Those who jumped on this narrow thematic are facing an expensive reality check.

We warned in February 2022 that crypto was no place for retirement savings:

"Firstlinks has been criticised for not understanding the potential of cryptocurrencies, which is fair enough, but it is too volatile and unpredictable for a major role in retirement investment."

Graham Hand

Weekend market update

From AAP Netdesk: The Australian sharemarket rallied to snap a four-week losing streak, with nearly every sector up after China took measures to prop up its economy. The benchmark S&P/ASX200 index finished on Friday up 81 points to 7,145.6, a 1.2% gain. For the week the index was up 1%, its best performance since the week ending 1 April.

Tech stocks were the biggest gainers on Friday, with the sector rising 4.6% to top a 5% weekly gain. Afterpay owner Block added 9.9%, Altium advanced 6% and 3D dataset company Pointerra soared 20% to a five-week high of 26.5c. MyDeal.com.au soared 56% after Woolworths bailed out shareholders by agreeing to acquire the online marketplace for $1.05 a share, or $243 million.

The materials sector was also up strongly, by 2.2%, with BHP advancing 2.1% to $47.18, Rio Tinto climbing 1.5% to $108.35 and Fortescue adding 3.9% to $20.15. Gold miners were up as the US dollar weakened against the Aussie.

All four big banks gained ground, with CBA climbing 0.8% to $104.60, NAB up 0.7% to $31.07, ANZ adding 0.9% to $25.50 and Westpac advancing 0.5% to $23.57. AMP was down 2.2% after Chief Executive Alexis George made no promises to shareholders at the Annual General Meeting about when regular dividends would resume. Property was the only other sector losing ground, falling 0.2% on losses for shopping mall owners Unibail-Rodamco-Westfield, Vicinity Centres and Scentre Group.

From Shane Oliver, AMP: It was another volatile weak in share markets with worries that rate hikes, cost pressures and Chinese supply disruptions would hit profits after downgrades from some US retailers and tech stocks. This left US and Eurozone shares down, but Japanese, Chinese and Australian shares rose.

From their bull market highs, US shares are down 19% led by Nasdaq which is down 29%, Eurozone shares are down 17%, Japanese shares are down 13%, global shares are down 16% and Australian shares are down 6%. Australian shares remain a relative outperformer thanks to their commodity exposure despite the plunge in Chinese growth and their low exposure to tech stocks.

The inflation and rate hike drumbeat continued to reverberate over the last week with more concern about a flow on to growth and profits. US Fed Chair Powell indicated that the Fed needs “clear and convincing” evidence that inflation is falling, 0.5% rate hikes remain on the table and there “could be some pain” in getting inflation down.

In New York, Bloomberg reported "Wall Street is as baffled by stocks as it has ever been" with a gap in analysts' highest and lowest S&P500 targets of 37%. On Friday, the S&P closed flat, and Nasdaq fell a modest 0.3% amid swings in specific tech stocks. Consumer staples continued their weakness.

Also in this week's edition ...

Our first article is on the proposed Coalition policies for access to superannuation and the widening of the eligibility for downsizer contributions. We are leaving it up as it debates the merits of early access to super, the value of home ownership and intergenerational equity, although Labor did not support the early access. However, the downsizer policy was backed by Labor and should become policy.

In an exploration of the value of versatility, Andrew Macken explores the power of being a multidisciplinary generalist when it comes to investment returns and life.

A recent poll of financial advisers and accountants by Accurium shows the reduction in the minimum pension requirements by 50% since 2020 (and now extended to FY2023) is a popular change. Almost 75% of responses indicated clients had reduced pension drawdowns. Jon Kalkman makes the case for a permanent change in this policy to add greater certainty to retirement planning.

With the sell-off in many stock markets has come a widening of discounts to the Net Tangible Assets of the share prices of many Listed Investment Companies (LICs). Hayden Nicholson shows the extra returns possible if some of these managers return to more normal levels.

There is a tall wall of worry that has stood forebodingly in front of investors recently. Yet many of these issues such as the war in Ukraine, monetary tightening, inflation, (or its more feared cousin, stagflation) vary in their degree of severity across regions. Randal Jenneke explores the impact to Australia.

Max Cappetta says investors should keep an eye out for opportunities in the next two months as ASX-listed companies try to manage shareholder expectations ahead of the August reporting season and as the RBA's cash rate normalises. He also highlights three companies mispriced by the market.

Continuing with the macro theme, Peter Moussa delivers the case for bonds as recession risk bears down on global markets.

Two bonus articles from Morningstar for the weekend.

Local investors were spooked after US retail giants Target and Walmart plummeted overnight as rising prices hit margins and inventory. Lewis Jackson speaks with retail analyst Johannes Faul And Tom Lauricella delivers investors lessons from 2022's tech stock collapse.

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website