The cash rate is on the path to normalisation following the Reserve Bank of Australia’s May rate rise. Governor Philip Lowe indicated that 2.5% was a more “normal level” but left scope to take a more nuanced path based on “evidence and data”. Key areas of interest are inflation – entrenched versus transitory – and whether high employment will result in wage increases.

Has this changed anything for equity investors? Not really

From a local perspective, our economy is strong with low unemployment and household spending power (including more than $250 billion of extra savings since the pandemic arose). This is a good environment for corporations and their profitability, driving future shareholder dividends.

What remains under pressure is equity pricing as higher interest rates impact the valuation of shares. Notwithstanding such headwinds, there are still some areas of the market which are expected to fare better than average, and these include:

- Commodities – continued high cash flow on elevated prices and continuing long-term demand trends.

- Financials - improvement in net interest margin. We expect mortgage rates to increase alongside the RBA cash rate while interest on deposits will lag. Insurers will start to roll short-term investments to higher rates.

- Dividends – ANZ Bank’s results delivered an interim dividend of $0.72 per share (2.6% cash, 3.8% grossed up) for the half-year. Whether or not the banks pass-through rate rises to deposit holders, investors can still find good yields across a range of Australian equity market sectors. Share prices are volatile but they provide long-term growth to counter the effects of inflation while bank deposits and term deposits simply do not.

What should investors be on the lookout for?

Look for companies that are going to miss expectations when they provide an update for investors ahead of any formal results announcements in the August reporting season.

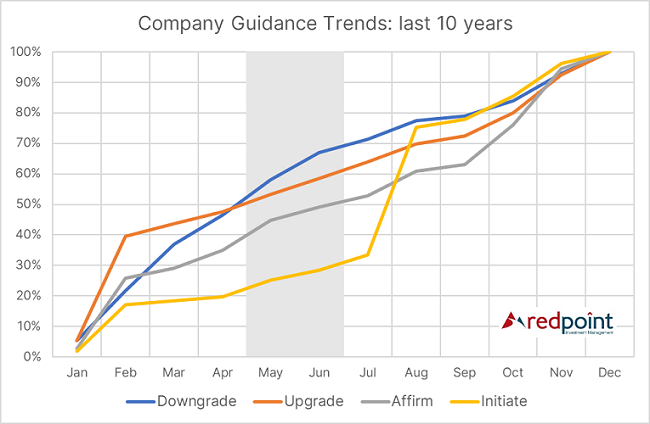

Companies tend to pre-position weak results in the two months to June 30, leading to a slew of downgrades. The next two months will be critical for investors as a shift from ‘great expectations’ to ‘clear explanations’ gets underway. The chart below shows that, on average, 70% of all downgrades in a calendar year at announced before the end of the financial year. It will be these events that investors need to be on the watch for in the coming weeks.

Specific issues facing Australian companies are inflation, increased costs for businesses - especially from energy and wage pressure - and the ongoing pandemic lockdowns in China resulting in supply chain disruptions with our biggest trading partner.

The recent US reporting season is a good case in point. It saw approximately every three out of four companies meet or beat expectations, but the high growth names still struggled as their results were lackluster. High valuation, high expectation stocks in Australia are at risk of price falls if they fail to meet their targets.

Concerns and opportunities

The good (Wisetech and Altium) and the bad (Tyro Payments, Megaport and Zip Co).

Revenue growth in the technology sector is on track but profitability on incremental growth continues to disappoint. TYR, MP1 and ZIP have been significantly de-rated and will need a major catalyst to revert in the near term. Low prices could make them takeover targets, but profitability still seems a long way off.

We prefer global logistics giant Wisetech and circuit board design software firm Altium. Both companies have de-rated since January but nowhere near the falls which have beset Tyro Payments TYR, Megaport MP1 and Zip Co ZIP. Our metrics point to potential upside in their next results, which should at least provide support for their current price.

Altium is now back to where the company had originally been bid for in mid-2021. There is still room for growth, as the design of appliances evolves, requiring a redesign of internal circuit boards. Altium’s software is a market leader in this area, and we see the potential for incremental improvements in profitability: an expected 25% increase in revenue over the next two years is expected to grow earnings-per-share (eps) by 50%.

When it comes to discretionary spending and travel, tighter purse strings may well flow through to a cutback in spending. Here we like JB Hi-Fi.

We see concerns with Domino’s Pizza DMP as the consumer seeks to reengage outside of home dining, and some uncertainty still lingers over travel demand which will impact Flight Centre FLT, Qantas QAN and Corporate Travel CTD.

We still like JB Hi-Fi and believe that its valuation is factoring in too large a contraction in revenues. Pre-Covid-19, the stock traded at a high of $45. Even with earnings contracting in the next two years, the company is still set to deliver 50% higher profitability, but its share price is only 10% higher than its pre-Covid peak. JBH gave a Q3 sales update on 4 May, highlighting heightened customer demand and strong sales growth which were up 11.1% year-on-year. There are potential short-term headwinds with no guidance being provided with their latest sales update, due to ongoing global supply chain uncertainties, but there is a solid, profitable underlying business here with a strong market presence.

Beware the ‘gap’

Rising equity market volatility is typically a ‘down-side’ phenomenon. If we consider the market price when the number of large 1-day moves (plus or minus 1%) increases, we note the market is almost always off its highs. We are seeing this now; the ASX200 has moved by 1% or more in 15 of the past 60 days, and the local market is 3% off its highs. If we continue to see more frequent large daily moves, we expect that this will coincide with the marketing drifting lower overall.

That said, the Australian equity market is well placed with its commodities exposures, financials and lower (against the US) exposure to stretched growth valuations. A focus on better valuation stocks in favoured sectors, which have a strong market position and solid profit margins, are likely to weather volatility well. This is also aligned with companies that have strong cash flow to support dividend payments, and in 2022, a focus on this type of yield stock has outperformed.

Successful equity investing has much to do with buying well. Investors should be increasing their focus on the market over the rest of 2022 and avoid being turned away by the volatility. History has shown over and over that share prices are far more volatile than the underlying profits and dividend payments of companies. The normalising of interest rates across the globe is an event that also raises uncertainty which will play out as higher share price volatility and, most likely, lower prices overall. This will lead to good investment opportunities today and as monetary and fiscal settings are reset over the next year.

Max Cappetta is a Portfolio Manager and CEO at Redpoint Investment Management. Redpoint is a specialist investment manager partner of GSFM Funds Management, a sponsor of Firstlinks. The information in this article is provided for informational purposes only. Any opinions expressed in this material reflect, as at the date of publication, the views of Tribeca and Redpoint and should not be relied upon as the basis of your investment decisions.

For more articles and papers from GSFM and partners, click here.