The Weekend Edition includes a market update plus Morningstar adds links to two highlights from the week.

Weekend market update

From AAP Netdesk: The Australian share market closed at a three-week high after enjoying its best performance all week on Friday. The benchmark S&P/ASX 200 index finished up 77 points, or 1.1%, and for the week the index was up 0.5% to its highest level since May 5.

Every sector was up except for consumer staples, which was flat. The energy sector was the top performer, rising 2.3% as Brent crude prices lingered near a two-month high. Consumer discretionary shares rose 2%, bouncing back from four days of losses, with sentiment boosted by strong retail trade figures for April. Wesfarmers was up 1.6% and JB HiFi climbed 2.5%. The tech sector rose 1.2% but Appen gave back most of Thursday's gains after Canadian tech conglomerate Telus International revoked its takeover offer. The heavyweight mining sector was up 1.5% and all the big banks rose.

From Shane Oliver, AMP Capital: Share markets increased in the past week, bouncing off oversold lows helped by less hawkish than feared comments from the ECB and the Fed, a pullback in US bond yields, improved outlooks from some US retailers and airlines and M&A activity. The US share market delivered its first weekly gain after seven weeks of falls, and European, Japanese and Australian shares also rose. In Australia, gains in resources and financials offset falls in telcos, consumer staples and IT stocks. Oil and copper prices rose, but iron ore prices fell.

On Friday in the US, the S&P was up a strong 2.5% while NASDAQ rose an even better 3.3%.

At the hawkish end, the RBNZ raised its cash rate by 0.5% taking it to 2% and significantly revised up its forecasts for the cash rate to a peak of 3.9% next year. ECB President Lagarde pre-announced the end of quantitative easing early next quarter, a rate hike in July and the end of negative rates by September. The minutes from the Fed’s last meeting indicated that after two more 0.5% hikes it would be well positioned to assess the impact and need for more policy moves later this year. The market interpreted this as opening the possibility of a pause later this year.

***

When fund managers report investment returns, they all make a simple assumption. They calculate what is called 'time-weighted returns', comparing the value of an investment at the beginning of the reporting period with the value at the end. It assumes no additions or withdrawals over the term, and therefore ignores the actual experience of many investors.

Unfortunately, such reporting fails to send an important message. When the alternative of 'dollar-weighted returns' are calculated, based on when people actually invest or withdraw, numerous studies show the investor experience is far worse. The best-known study is DALBAR's QAIB report (Quantitative Analysis of Investor Behavior) and in its latest 2022 report for the 30 years since 1/1/1992, it shows annualised returns in the US of:

- Average equity fund investors, 7.13%

- S&P500 index, 10.65%

Morningstar research for the last 10 years suggests investors earned about 1.7% less per year compared with reported total returns on their funds, again due to timing of buys and sells. Many years ago in a public presentation, Platinum's Kerr Neilson said a study of his clients found entry and exit timing was costing 6% a year. A report on Cathie Wood's famous ARKK Fund in 2021 (which has tanked in the last 12 months, down 61%) showed her clients had done worse than the fund's returns by 8%.

Whichever number is correct, it's a sobering reminder for those looking to time the current threatening market conditions. Investment results depend on behaviour as well as fund selection and performance.

I was reminded of this in a recent chat with a friend who buys and holds stocks and funds for decades without regularly checking prices. Some of his investments have reached the stage where the annual dividends are more than his entry price. Many of us (including me) try to time the market and falling markets are a behaviour test. Two people may have started 2022 with identical portfolios, but what they do in the current market conditions will determine not only their returns over this year but many years to come. My guess is the sellers will do better in the next 12 months but worse over the medium to long term.

And the market is completely dispassionate. It does not know who you are or care about you. If you have taken too much risk to meet your long-term plan, potentially jeopardising your retirement, the market has no emotion. Ultimately, it's down to you and with the best will in the world, nobody knows what the future will bring, although fund managers will try, as shown by their high holdings of cash at the moment (Source, Bank of America Fund Manager Survey (FMS)).

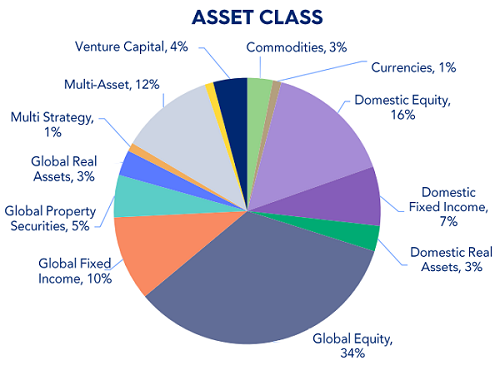

Whatever markets are doing, new products will be launched. This week, Equity Trustees reported on the most recent 100 funds it has been involved in across the industry. It includes many structures (managed funds, ETFs, LICs, etc), managers from all over the world, and multiple asset classes. Here are the asset classes fund managers have been focussing on.

***

The election results were fascinating with the Australian people voting for action on gender issues, integrity and climate change. Labor comes to power at a difficult time where it needs to balance spending with austerity. Cheap money, world peace and low inflation are ending. But we take a more positive look at the excellence of our election process. We can rightly criticise our politicians and our media, but there's something special about the way Australians vote and even the unique democracy sausage, regardless of your political affiliations.

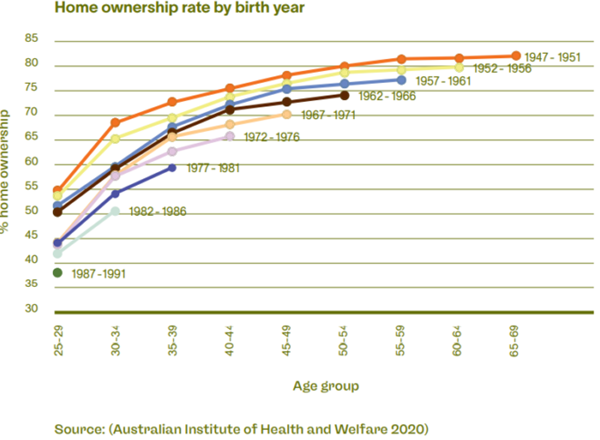

In the wake of the election, and a political environment showing early signs of a less combative and divisive change, two articles this week focus on inter-generational fairness. Australia has many age-related policies to reconsider, none more important than home ownership. At almost any age, your birth year influences how likely you are to own a home.

Generational conflict played out throughout the election campaign, topped by the 'super for houses' Coalition policy which is now back on the shelf. Peter Abelson says a study of the data across nine dimensions of well-being used by the OECD show which generations - Baby Boomers, Gen-X, Millennials - have done best. It's not all bad news for younger folk.

Then Terry Rawnsley and Asaf Cohen show the results of a KPMG survey called 'When Will I Retire?', checking the impact of an ageing population across many factors.

Regardless of the dubious merit of the 10,000 cryptocurrencies on issue, they continue to grab headlines. Just this week, the President of the European Central Bank (ECB), Christine Lagarde, said of crypto in an interview on Dutch television:

“My very humble assessment is that it is worth nothing. It’s based on nothing, there is no underlying assets to act as an anchor of safety ... I’ve said all along that crypto-assets are highly speculative, very risky assets. If you want to invest there, it’s your choice. But what I’m really concerned about when it comes to crypto-assets is that those investments be made by people who have their eyes wide open about the fact that they can lose it all.”

Paul Mazzola and Mitchell Goroch delve inside the arcane world of crypto and stable coins to see if there is any value in these so-called investments which thousands of people have created and sold to an adoring audience.

Two articles from senior fund managers on their views on current market conditions. Tom Stevenson ponders whether 'This Time Is Different' by looking at a Goldman Sachs report on four major market changes, while Robert M Almeida says we should have a new appreciation for cash after spending a couple of years chasing the elusive bird in the bush. The bird is better in the hand.

Then John West reviews Catherine Belton's book on Vladmir Putin by examining how his rise to power and desire to stay top dog guided his awful decision to invade Ukraine. Coming back to our first article on democracy, it's far from perfect but many autocracies make life miserable for their people and neighbours.

This week's White Paper from Perpetual Private looks at what value opportunities are emerging as market volatility increases.

Two bonus articles from Morningstar for the weekend as selected by Mark LaMonica.

Is it time to back up the truck on Meta? Facebook's parent is trading for half of what Morningstar's analyst thinks the company is worth writes Ali Mogharabi. In local markets, Lewis Jackson writes that companies across financial services, healthcare and real estate are trading at double digit discounts to fair value.

Latest updates

Attention financial advisers: Morningstar Investment Conference, 1–2 June 2022. Click here to register your attendance, either in-person at the ICC Sydney on 2 June or as a digital experience over one or both days. Complimentary for financial advice professionals. CPD accredited.

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Monthly Funds Report from Cboe Australia

Plus updates and announcements on the Sponsor Noticeboard on our website