The Weekend Edition includes a market update plus Morningstar adds links to two highlights from the week.

Weekend market update

On Friday in the US, the S&P500 rose 0.2% while the NASDAQ was a little stronger after its recent heavy falls, up 1.4%.

From AAP Netdesk: The local stock exchange suffered its sixth straight losing session and worst week since the beginning of the pandemic in March 2020. After falling by as much as 2.7% in morning trade, the ASX200 on Friday managed to claw back some of its losses in the afternoon but still finished down 116 points, or 1.7%, at a 19-month low of 6,475. The index followed last week's 4.2% drop, its worst weekly loss since October 2020, with an even bigger 6.6% fall. It's now down 10.2% for the month, 13% for the year and 15% from last year's all-time high.

Among the companies whose shares hit their lowest levels in over a year on Friday were retail banks Commonwealth, ANZ, Westpac and Bank of Queensland; tech companies Xero and Megaport; retailers Breville, JB Hi-Fi, Harvey Norman, Kogan.com, Super Retail Group, Temple & Webster; City Chic Collective, Nick Scali, Collins Foods and Adairs; help-wanted site Seek; glovemaker Ansell; Bluescope Steel; building products companies CSR and James Hardie; and property groups Goodman, GPT and Dexus. Airtasker, non-bank lender Pepper Money, wealth manager Magellan Global, United Malt Group and tech company Nuix all fell to all-time nadirs.

From Shane Oliver, AMP Capital: Share markets tumbled again over the last week as markets moved to anticipate even more aggressive rate hikes from central banks after the release of higher than expected US inflation data. For the week, US shares fell 5.8%, Eurozone shares fell 4.6%, Japanese shares fell 6.7% and Australian shares fell 6.6%.

The fall in the Australian share market was led by IT stocks which have been under pressure all year but also resources, retailers and financials as worries increased about the economic outlook. The rising risk of global recession also led to falls in oil, metal and iron ore prices. Bond yields generally rose to new highs with the Australian 10-year bond yield rising above 4% for the first time since 2014. The $A fell to around $US0.69 as the $US rose.

From their all-time highs last year or early this year to their lows in the past week US shares have now fallen 24%, global shares have fallen 21% and Australian shares have fallen 15%.

As always the most speculative 'assets' are getting hit the hardest including the pandemic winners of tech stocks (with Nasdaq now down 34%) and crypto currencies (with Bitcoin down 70% from its high last year). Crypto currencies surged with semi religious fervour around the marvels of blockchain, decentralised finance, NFTs, freedom from government, promises that its an inflation hedge, etc, only to become a bandwagon fuelled by speculative extrapolation on the back of easy money and low interest rates. Trying to disentangle its true fundamental value from the speculative mania become next to impossible. And now the easy money and low rates are reversing, pulling the rug out from under the mania.

***

"Bring it on!" That's what many investors looking for income are thinking. Although media coverage focusses on the coming plight of borrowers who entered the property market in recent years (and relied on the misleading guidance from the Reserve Bank), millions of investors will welcome higher interest rates. Conservative retirees intent on protecting capital have reduced their standards of living for years while relying on poor returns from cash and term deposit interest rates. All the signs point to a better future income, at least in nominal if not real terms.

In fact, while the focus is on the cash rate 'soaring' to 0.85% (yes, many of us remember the 17% days back in 1990) and heading to 3% this year, fixed rate markets are well ahead of the game. The five-year bank swap rate is 4.5%, and with spreads on some securities better than 2%, it is not difficult to achieve rates where bond income compares favourably with equities for the first time in years.

Last night (Wednesday), the US Federal Reserve raised the Fed Funds rate by 0.75% taking it to 1.75%. It was the biggest increase in almost 30 years, although both equity and bond markets rallied. The Fed indicated that rates will head to 3.4% by year end and to between 3.5% and 4.0% next year to "tighten" the impact on the economy before easing in 2024.

And yet, what will be achieved? We are about to find out how blunt monetary policy is. The Reserve Bank will increase rates to slow domestic demand, in a cumbersome transmission mechanism that feeds into the inability of businesses to pass on higher prices. Many of the inflation forces, such as supply shortages and energy prices, are due to overseas factors. Only one-third of Australian households have mortgages, and the pain inflicted on borrowers will be offset by greater income for savers.

We don't hear much about Modern Monetary Theory (MMT) these days and the Reserve Bank is stunned by the severity of the rising prices. Leading economist Stephen Koukoulas is unimpressed by the theory, tweeting this week:

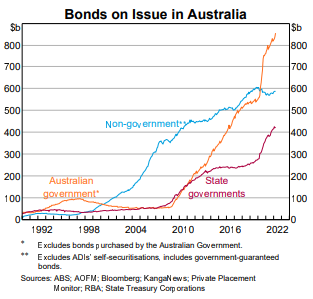

Did the government and central bank think we could issue a trillion dollars of debt without any negative consequences? (Source: RBA Chart Pack)

We were warned in these pages. Of all the people who we published in Firstlinks on this subject, it was Professor Tim Congdon, Chairman of the Institute of International Monetary Research at the University of Buckingham in England who best articulated the inflation consequences of money printing. His first article in April 2020 was called "Money printing and the reality of inflation". He warned:

"What is wrong with the supposed ‘magic money tree’? The trouble is this. When new money is fabricated ‘out of thin air’ by money printing or the electronic addition of balance sheet entries, the value of that money is not necessarily given for all time. The laws of economics are just as unforgiving as the laws of physics. If too much money is created, the real value of a unit of money goes down."

That's inflation. Just in case we missed the point, he wrote here again in June 2021, called "How long will the bad inflation news last?". He said about Jerome Powell, the US Fed Chair:

"Further, his research staff have evidently failed to explain to him that a monetary explanation of national income and the price level – in which inflation is determined mostly by the excess of money growth over the increase in real output – has a long and distinguished pedigree in macroeconomics."

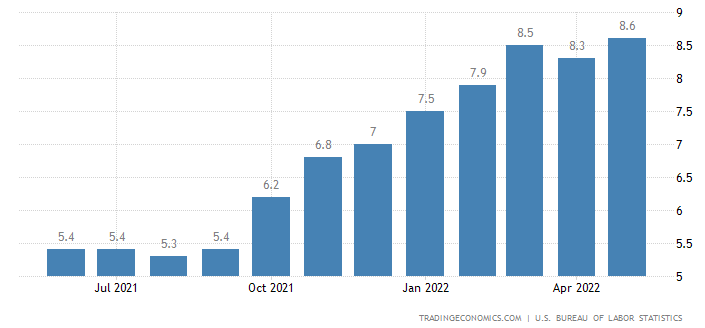

The inflation genie is out of the bottle. In the US, there was hope that last month's 8.3% was the start of more falls, but the latest at 8.6% shattered that illusion, and bond rates rose and stockmarkets fell in reaction to the highest inflation rate for 40 years.

On Tuesday this week, on the ABC's 7.30, Governor Philip Lowe conceded:

On Tuesday this week, on the ABC's 7.30, Governor Philip Lowe conceded:

" ... the emergency is over and it's time to remove the emergency settings and move to more normal settings of monetary policy. The other consideration was that inflation is high, it's too high. At the moment, it's 5% and by the end of the year, I expect inflation to get to 7%. That's a very high number and we need to be able to chart a course back to 2 to 3% inflation."

How quickly that will happen, nobody knows, including Lowe. He went on:

"So for most of the past two years, we thought that growth would be slow to recover, that inflation would stay fairly low, that there'd be a long tail from the pandemic and given that, we thought interest rates would need to stay where they were until 2024."

And two other prominent forecasters, fund manager Chris Joye and economics editor John Kehoe, were also struggling with forecasts last week, expecting a 0.25% rate rise, even when - apparently - Kehoe somehow had the inside knowledge from the Reserve Bank. Joye wrote in the AFR:

"The RBA will hike by 25 basis points tomorrow, according to the Australian Financial Review's economics editor, John Kehoe, bringing the target overnight cash rate to 60bps. Kehoe further asserts that the RBA will continue in 25bps increments until it reaches 110bps in August, following which it will reassess. This all seems like very sensible stuff. It is also the second time in the past few days that Kehoe has delivered what appears to be a message on behalf of Martin Place to actively recalibrate expectations."

It's highly doubtful Kehoe has some sort of magical insider knowledge and there are not many analysts now expecting the Reserve Bank to stop at 1.1%. Chart your own course.

We received this email from the owner of a cafe, saying he needs to increase his prices for the third time this year:

"The cost of food is rising at an unprecedented rate eg: lettuce has gone from $25/Box to $110/Box and it’s across the board. As inflation is at 5%, our rent and other outgoings have jumped the most in the past five years. Electricity and gas are poised to go crazy. Albo is going to bump up wages. Super has gone up to 10.5% and we have to pay it on more employees than in the past."

So while we know that the share of national income going to company profits has risen from 22% of GDP in the 1990s to 28% in March 2022 and lower-paid workers need some respite, remember that measures that seem reasonable on wages and superannuation also hit small business people who themselves are struggling to survive.

Graham Hand

Articles this week ...

The media focus on the cash rate rising to 0.85% with moves higher in coming months overlooks the extent to which fixed rates are so far ahead already, giving investors income opportunities not seen for many years.

At the top of the equity market, investors consistently stop caring whether a company is profitable or not. The fact that this behaviour has changed signals the end of a long bull run. As the US officially enters a bear market, Daniel Moore writes about companies expected to regain investor interest.

Steve Johnson has never seen a market this forward-looking and explores the impact of investors' fixation on a looming recession, with a focus on a few companies he sees offering excellent value.

Eric Souders believes rising yields present opportunities across different types of global fixed interest. On an absolute and relative basis, there are compelling reasons to invest in fixed interest instead of equities in the current climate.

For those looking to find the next Barry Lambert, the clues are sprinkled in his recollections. Lawrence Lam’s interview with Barry uncovers the behavioural tendencies that permeated through Count Financial’s culture and how sound business decision-making demonstrates the unrelenting heartbeat of a founder.

Manny Pohl writes that by drilling down into a company’s financials and growth plans and finding competitieve advantages, it is possible to identify the quality growth stocks that will prosper over the long-term.

On-road vehicles are responsible for the majority of transportation-related greenhouse gas emissions. Daniel Hanson believes the transportation sector will play a critical role in achieving the goal of the Paris Climate Change Agreement to keep global temperature rise to well below 2 degrees Celsius above pre-industrial levels.

Morningstar weighs in after a tough week for markets. Morningstar's Director of Equity Research Matthew Hodge looks at 7 lessons when navigating turbulent markets. Mark LaMonica writes that markets don't look normal yet and may have further to fall.

And finally, congratulations to the Socceroos on their qualification for the 2022 World Cup. As a Foundation Member of Sydney FC who rarely misses a home game, I was delighted to see our goalkeeper, Andrew Redmayne, become a national hero. 'Redders' has made the Sydney keeper position his own for many years after a shaky start to his career, and he's always been fantastic with the kids at games. We have been watching his 'Wiggles' action at penalties since around 2019 so it was no surprise. Bring on the new season in the new stadium!

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website