The Weekend Edition includes a market update plus Morningstar adds links to two highlights from the week.

Apologies for some technical issues on our website last week due to heavy volumes.

Weekend market update

On Friday in the US, the S&P500 rose 1.1% while the NASDAQ was up 0.9%.

From AAP Netdesk: A broader sell-off in mining and energy stocks late in the Friday session pushed the Australian share market into the red, as investors remain jittery over prospects of a slowdown in global growth. The benchmark S&P/ASX200 index dropped 28 points, or 0.4% on Friday. The index edged 0.6% lower for the week.

Investors earlier shrugged off an overnight decline on Wall Street and weaker US consumer spending that indicated price pressures were still strong. But demand-tracking commodities such as oil and copper remained under pressure, resulting in broader losses in the mining and energy sectors. Sector leaders Woodside and Santos slid 4.4% and 2.8% respectively, while Beach Energy and refiner Ampol lost more than 1% each. Mining stocks weighed down the market further as iron ore prices continued to slip amid top steel producer China's demand constraints.

Financial stocks gave up some of their early gains amid the uncertainty over the extent of the rate hike the Reserve Bank will announce after its board meeting next week. Only two of the big four banks - CBA and NAB - ended slightly higher. Technology stocks recovered some ground after a three-day losing streak.

From Shane Oliver, AMP Capital: Recession fears dominated over the last week pushing US, European and Japanese shares down, although Chinese shares (having already had a 35% bear market) rose. Recession fears also pushed down long-term bond yields, oil prices and metal prices with the iron ore price falling about 10% on Friday. And this also pushed the $A down to near $US0.68 as the $US continued to rise.

It was a rough financial year. Thanks to central bank monetary tightening on the back of the worst inflation break out in decades not helped by the invasion of Ukraine, bond yields surged over the last financial year (resulting in an 8-10% loss for bonds) and shares fell (with Australian shares returning -6.5% and global shares returning around -10%). As a result, balanced growth superannuation funds are estimated to have seen a negative return of around -3 to -5% over the last financial year.

Until there is clear evidence inflation is falling, central banks will continue tightening, keeping recession risk high. And if a recession eventuates shares likely have more downside as earnings start to fall, because the falls in markets so far mainly reflect a valuation adjustment (ie lower PE’s) in response to higher bond yields. The September quarter is traditionally weak for shares which suggests shares could make a bottom around September or October.

Slowing economic data globally and a continuing decline in our Pipeline Inflation Indicator are positive signs in that they suggest pressure may come off central banks later this year enabling them to ease up on the interest rate brake in time to avoid a recession. There is a fair way to go though.

***

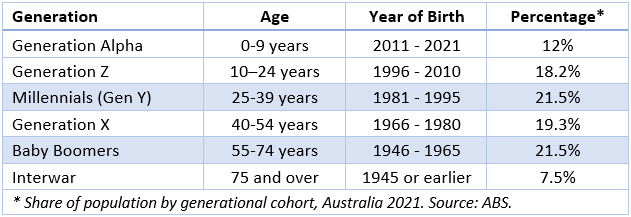

OK Boomers, it's happened. The 2021 Census of Population and Housing reports that the Millennials (or Gen Ys) have overtaken the Baby Boomers as the largest generational group in Australia. Each generation has over 5.4 million people, but over the last decade, Millennials have increased from 20.4% to 21.5% of the population, while Baby Boomers have decreased from 25.4% to 21.5%. In 1966, 38.5% were Boomers. Generation Z is at 18.2%. The Census has been conducted every five years since 1961, and less frequently since 1911. Here are the Census definitions. Yikes, the youngest Boomer is 55!

Yes, Gen X and Gen Y, we know Boomers had it good for many years and whereas in 1996, 42% of homeowners had no mortgage, this was down to 31% in 2021. At least the younger generations will inherit billions in wealth in coming decades although the Boomers will live longer, even if they need care. Dr David Gruen, Australian Statistician, said:

“We see that an increasing number of Baby Boomers are needing assistance with core activities with 7.4% reporting a need for assistance, compared to 2.8% across the younger generations. This information will help frame policy that delivers positive outcomes for our communities.”

Around one in eight, or 13%, of Baby Boomers are caring for other peoples’ children (usually their grandies), and Boomers are most likely to volunteer and provide unpaid assistance. Maybe they can afford to with houses paid off, free education and access to superannuation.

Since the Baby Boomers are now 55 to 74, many are either in retirement or thinking about the date. We'd like to find out more about this experience. For those who have reached this stage of their lives, please share the lessons in our short survey, and we will publish your insights next week. Is retirement the golden years or a struggle? Hundreds of great responses in already, we greatly appreciate your honesty and candour.

The Census also found that 48% of Australians have a parent born overseas and 28% of people were born overseas. We rely on immigration to grow our population, and with it comes a welcome cultural diversity. The largest increase in country of birth since 2016, outside Australia, was India with 220,000, which has moved past China and New Zealand to become the third largest country of birth behind Australia and England. The number of people who used a language other than English at home has increased to over 5.5 million people. Mandarin is the most common language other than English, and the Census reported over 250 ancestries and 350 languages.

Leading demographer, Bernard Salt, writing on the Census this week in The Australian, concluded optimistically:

"The lesson for business and government is that there will be no return to normal. The lesson is to read the market, to read the electorate, to understand the drivers of modern Australian thinking. Even from yesterday’s high-level data release it is evident to me at least that Australia is being reshaped not so much by individual events but by the quiet determination of the Australian people to create what they consider to be a better version of their nation for the 2020s and beyond."

Another revealing statistic is that the proportion of Australians who selected 'No religion' has risen to 39%, up significantly from 30% in 2016. It is now the second-largest group after Christians, who have fallen from 52% to 44% over the same period. Australia is increasingly secular, and there will be profound implications for our laws and regulations. A Senior Lecturer on law and religion at the University of Western Australia, Renae Barker, said of the Census:

"In the five years between the 2016 census and 2021 census, Australia saw a monumental shift in what might broadly be considered moral laws."

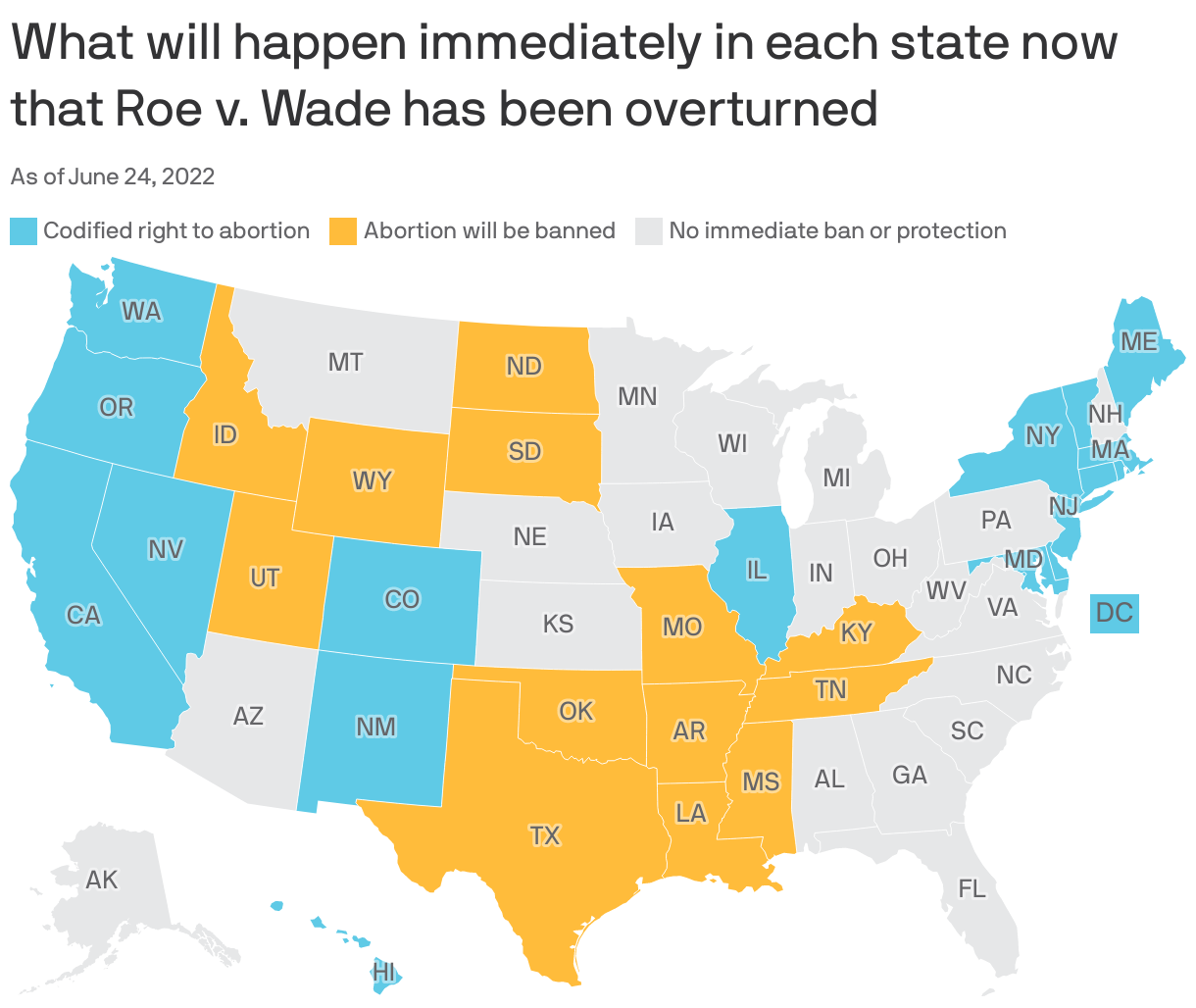

This is not an academic point. We can see how divisive moral issues can become, leading to civil rights protests and conflict as people take sides. For example, after the Roe v Wade decision by the US Supreme Court this week, abortion rights (and potentially contraception and same-sex marriage) will change in many states and the national divide is similar to the red/blue of US party politics. Many commentators are questioning the impact on US democracy of having conservative Supreme Court judges appointed for life, with three of them nominated by Donald Trump. He remains the first choice of Republican voters for reelection in 2024. His actions at the 6 January storming of the Capitol look increasingly dangerous and deliberate, as the blog from The New York Times describes:

"Ms. Hutchinson said Mr. Trump knew of the threat of violence by his supporters but was unconcerned by it, since they were not targeting him; and that he sympathized with them as they chanted for the execution of Vice President Mike Pence, who had refused his entreaties to overturn the election. And she testified that senior aides had tried in vain to persuade Mr. Trump to call off the mob, but he resisted for hours. Her testimony was replete with stunning revelations."

Data: Axios research; Cartogram: Sara Wise and Oriana Gonzalez/Axios

***

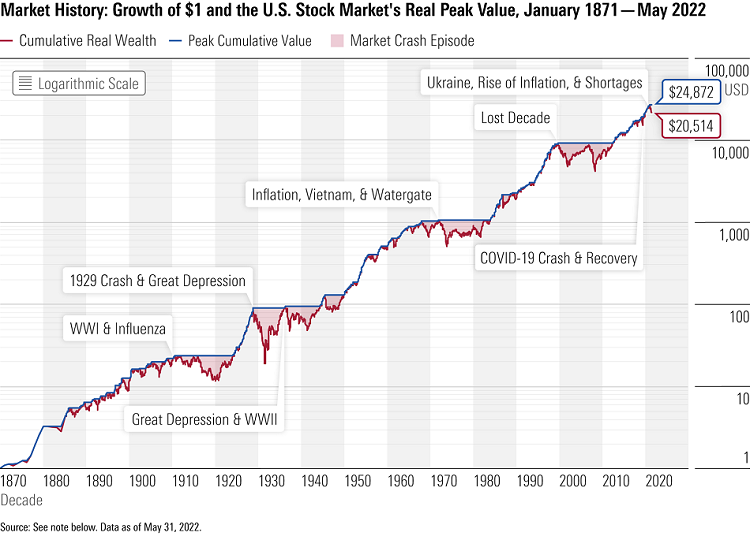

There are always reasons not to invest in shares, but there's no doubt geopolitical risk is on high alert. Optimism about the end of the Ukraine war has been shattered by Russia's attacks on Kyiv this week, and there's little prospect of shipping desperately-needed agricultural products. The first half of 2022 saw NASDAQ lose 29.5% while the broader S&P500 was down 20.6%. It's the worst first half since 1970.

This chart (log scale, real returns adjusted for inflation) by Morningstar on the US market since 1871 shows the recent fall in context. The 152-year record is littered with bear markets but for the patient investor, the market eventually recovers and goes on to new highs, although sometimes it can take a decade. It's as difficult to pick a top as it is to find a good re-entry level.

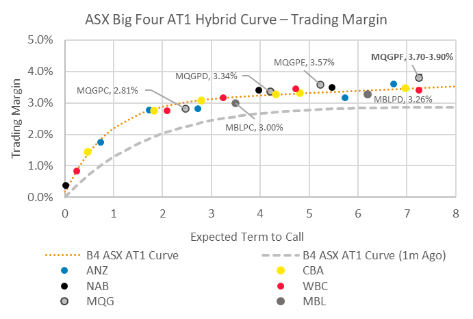

We wrote two weeks ago about the fixed and floating bond opportunities and new bank hybrids continue to come to the market. This week, Macquarie is offering its sixth ASX-listed note, with an indicative range of 3.7% to 3.9% over the bank bill rate. Showing how spreads have widened, the previous hybrid in March 2021 raised $725 million at a 2.9% margin. New issues usually include a small extra premium to compensate for the pricing risk between launch and settlement. The chart below shows where this new note (ASX:MQGPF) ranks against the current trading margins of the Big Four banks and Macquarie's existing issues. There are plenty of hybrids available at these better rates listed on the ASX, but it remains annoying that the new DDO rules deny the opportunity for retail investors to participate at primary issuance stage. It achieves nothing when any retail investor can acquire the same securities on-market.

Source: BondAdvisor

Graham Hand

In our articles this week ...

Last Friday, 1 July 2022, was the 30th anniversary of the introduction of compulsory super and the Superannuation Guarantee. Noel Whittaker draws on his extensive memory and records to show how we ended up with a complex retirement savings system, and the journey is revealing.

Paul Keating is not only called the 'Father of Superannuation' but he continues to fly the flag, jumping into the debate whenever a politician tampers with his policy. We highlight extracts from three articles written in Firstlinks in 2013, plus a couple of interviews with him in recent years.

Remember we have published two pieces to check on tax for FY21 and changes for FY22.

Our interview this week is with Eric Marais from the San Francisco office of Orbis Investments, a $A27 billion fund manager specialising in global equities. Eric welcomes the end of companies making profitless promises but it can be a long slog looking for diamonds in the rough.

Catchy phrases like the ‘death of 60/40’ are easy to remember, require little explanation, and may even seem to have a ring of truth in difficult market environments. Roger Aliaga-Diaz writes that such statements ignore basic facts of investing, focus on short-term performance and create a dangerous disincentive for investors to remain disciplined about their long-term goals.

Arian Neiron provides Australian context while refuting the criticism that is often directed at passive investing and ETFs. Is all the talk really just much ado about nothing?

Mark Mitchell invests in investment grade bonds and he explains what has happened to credit spreads and rates and whether it's time to jump in after a bond sell off. Another source in the money markets tells me funding conditions for banks have been tight in the run up to 30 June which may have increased upward pressure on rates. However:

" ... from 1 July onwards period where tight financial conditions will ease when a flood of Federal Government budget appropriations flow and probably $30b of tax refunds drop into Australian bank accounts in the first 60 days of July/August and household savings may ratchet up from $280b to >$300b."

So he sees funding relief ahead for banks, which may temper their desire to pass rising rates to retail investors.

Morningstar weighs in with Nicola Chand exploring how Treasury Wine Estates has lessoned its reliance on China. Lauren Solberg identies five semi-conductor suppliers that are undervalued.

This week's White Paper from the Franklin Templeton Institute discusses the importance of casting a wider net for income generating assets in the current financial and economic environment.

Farewell Leigh Sales from ABC's 7.30 after 12 years of dedicated reporting. Leigh and 7.30 were not only part of my nightly routine but I have seen her working in budget lockups where she was doing her own research and writing notes for hours. There has been a team supporting her but she is a talented professional journalist and presenter and I look forward to seeing her in other programmes. Well done on a top innings, Leigh, and welcome Sarah Ferguson.

And repeating, please check our retirement survey and share your experiences.

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website