There are many apt analogies explaining the ways central banks supported financial markets all the way back to the GFC until last year and how that process is reversing. We can choose from removing the punchbowl, hitting the brakes or taking the wind out of the market’s sails, but I’ll go with a reference to one of the best series of all time and say winter is coming (if not already here).

There have not been many safe havens in the traditional asset classes over the last 12 months, but where does that leave us today? Is the worst behind us or is there more to come?

What are credit spreads?

As an unconstrained investment grade bond fund manager, most of the risk in our portfolios is driven by the change in the general level of credit spreads. Credit assets (ie non-government) trade at a margin above the risk-free (government) rate. This margin compensates investors for the increased risk associated with lending to an institution with greater default risk than the government. The difference between government risk pricing and corporate risk pricing is referred to as the credit spread. Generally speaking, the riskier the borrower the wider the spread demanded over the risk-free rate. For example, in the current market five-year A-rated assets are trading around 1.50% above the government bond curve while BBB-rated assets are trading about 2.10% higher (or 0.6% more).

From an investment perspective, when markets get nervous or more pessimistic about the outlook, the credit spread or risk premium demanded tends to increase. This is similar to equity markets selling off to compensate for lower expected earnings or a reduction in the multiple investors are willing to pay for a dollar of earnings.

These wider credit spreads in bond markets push down prices and can result in short-term losses. However, there is a critical difference between a correction in the bond market and those in the equity markets. Bonds are a contractual obligation to pay money back at a certain time at an agreed price. Equities have no such contractual obligation, so when equity markets go down there is no guarantee you will recover those losses. However, any near-term loss in performance of fixed income assets is contractually guaranteed to be recovered as long as the issuer doesn’t default.

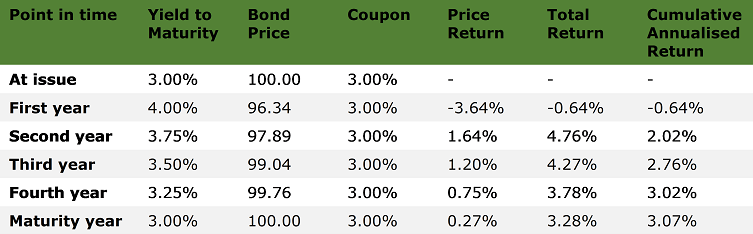

The following table provides an example of this. A near-term selloff results in short-term losses but then a higher forward expected return over the life of the bond. This example applies to bond funds as well. For example, the Daintree Core Income Fund has had multiple negative monthly returns due to the credit spread widening. However, if we were to reset the portfolio to normal risk-on positioning today the forward expected return on the fund would be much higher.

In this example, a five-year bond is bought at issue for 100 with a 3% annual coupon. At the end of the first year, rates have risen to 4% and the price has fallen to 96.34. The price loss is 3.64% less the 3% coupon to give an annualised return of -0.64%. But importantly from that point forward, the expected return of the bond is much higher resulting in an attractive entry level. Over the life of the bond, rates and prices change but the bond delivers the expected return (compounded to reflect the semi-annual coupon).

Source: Daintree. Modelled price and returns of a five-year semi-annual coupon bond through its life. Coupons are re-invested at the average of the yield at the start of the period and the yield at the end of the period.

Where are credit spreads likely to peak?

There are lots of academic studies which show that humans are usually terrible at forecasting. We suffer from all sorts of biases and are often overconfident in our conclusions when we have a little bit of knowledge or experience. At Daintree, we remain humble about our ability to forecast. The future is unknowable, but at the same time we must make investment decisions today with imperfect and incomplete information. Therefore, we need to have a view but also allow for a wide margin of error.

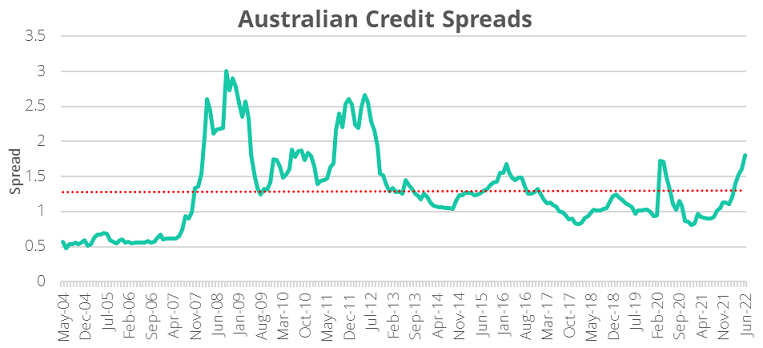

Consider the chart below which looks at the average Australian investment grade credit spread going back to 2004:

- While spreads have widened over the past 16 months, they are only modestly wider than the average level over this period.

- Spreads are still well below the levels reached during the GFC crisis in 2008-2009 and the European sovereign debt crisis in 2011-2012.

- Spreads are now just slightly above the levels seen during 2015-2016 commodity weakness as well as the COVID crisis in March 2020.

Source: Bloomberg

So, this begs the question, how much further could they widen? It seems reasonable to conclude that short of a large tail event (such as Russia expanding its aggression into Europe) that spreads are not likely to reach the wide levels seen in the GFC or the European sovereign debt crisis.

Our justification for this view is based in-part on increased financial system resilience and improvements in corporate balance sheets:

- Despite the fact that monetary accommodation is being reduced, global central banks remain much more supportive of financial stability than during the GFC. Structurally, liquidity in credit markets is significantly better than it was then and banks are much better capitalized

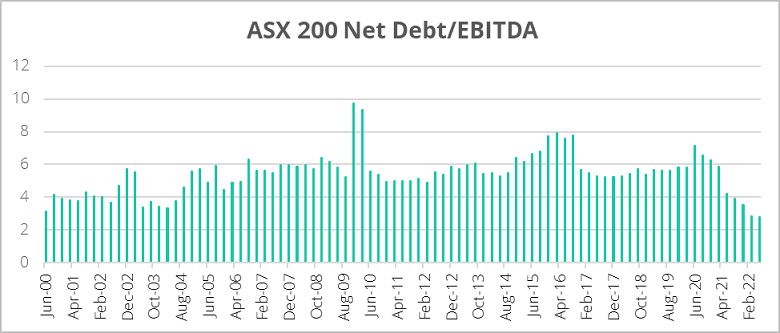

- Australian corporations in general have done a good job improving their financial position over the last few years. The chart below shows a material improvement in the average amount of net debt of companies in the ASX200 index relative to cashflow (approximated by EBITDA).

Source: Bloomberg

On the flip side, markets have not had to contend with the extraordinary levels of inflation we are now seeing for many decades. There will be pain as central banks begin to remove accommodation and work to reduce inflation. We have been expecting a correction in Australian credit spreads toward a range of 1.75% to 2.25%. The market is currently around the low end of our estimated range, and therefore on balance we believe there could be more spread widening to come but we do feel the vast majority of the repricing has already occurred.

What about interest rates?

Most people in the market have been telling us they have been underweight interest rate duration (that is, not investing in long-term fixed rate bonds) for a long period of time and given the increase in government bond yields, they are now wondering if this a good opportunity to start adding duration back into their portfolios.

There are three things to consider.

First, in a high-inflation environment, historically the correlation between government bonds and equities has tended to be positive, meaning they sell off at the same time. Adding government duration to hedge out modest equity corrections may lead to disappointing results.

Second, adding long duration government bonds purely as a hedge against significant tail events (such a world war) does make sense in our view. Our suggestion would be to find the cheapest long duration government bond index fund for a portion of a diversified portfolio.

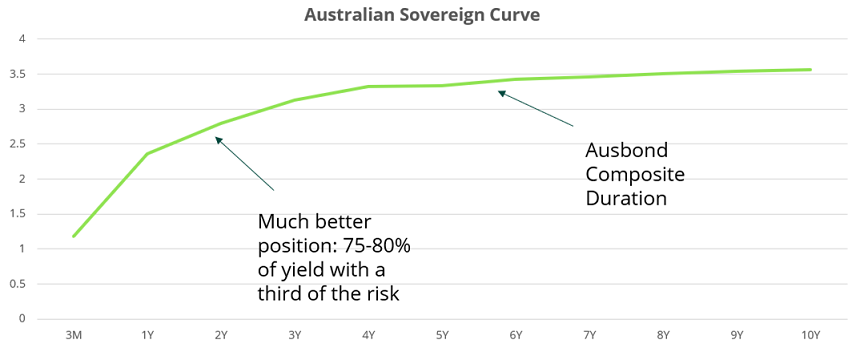

However, thirdly, if fixed income is viewed purely as a defensive allocation which earns a modest income and minimises capital volatility, allocating to a fund that mirrors a simple index such as the Ausbond Composite index is sub-optimal. To illustrate why, consider the chart below which shows the shape of the Australian government bond curve.

Source: Bloomberg

By buying longer-dated assets, expected returns are increased but there is no free lunch. These assets come with greater interest rate risk, meaning changes in underlying interest rates result in larger changes in bond prices. We believe a focus on the 1.5-2.0-year part of the curve makes more sense. Investors can pick up about 75-80% of the yield available while only taking on about a third of the interest rate risk embedded in traditional Ausbond Index-type products. Investors should either target shorter-duration funds or choose funds that have flexible mandates to increase interest rate duration in a more optimal way when it makes sense to do so.

In the danger zone?

Where does all this leave us in the current environment? Is it time to load up on risk or sit on the sidelines? We are in the latter camp for now. While risk asset markets have corrected a fair bit, on balance it feels like there is still more to come. Central banks are still early in the process of removing accommodation and even they don’t know how far they are going to have to go. If inflation proves challenging to tame and central banks err on the side of dampening inflation at the expense of growth, there could be a rough period ahead for financial markets.

Mark Mitchell is Managing Director of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation.