The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Warren Buffett and his business partner Charlie Munger are by far the most quoted people in investing and finance. They regularly give insightful interviews and Buffett has written a letter to Berkshire Hathaway shareholders every year since 1977. Trawling through his missives is a great way to learn about investing.

It is less well known that Munger often talks about how to enjoy a happy and fulfilling life, despite his many personal setbacks. At the age of 31, Munger was divorced, his young son had died of leukemia and he had no money. He rebuilt his life, and as well as becoming one of the world's most successful investors, he focusses on the essentials of happiness. He will soon turn 100 and he seems as enthusiastic as ever. He says:

"Generally speaking, envy, resentment, revenge, and self-pity are disastrous modes of thought. Self-pity gets pretty close to paranoia…Every time you find you're drifting into self-pity, I don’t care what the cause, your child could be dying from cancer, self-pity is not going to improve the situation. It’s a ridiculous way to behave."

There are many articles on Munger's rules for a happy life, but here are a few from various sources, some with relevance for investing:

1. Manage expectations. “The first rule of a happy life is low expectations. That’s one you can easily arrange. And if you have unrealistic expectations, you’re going to be miserable all your life."

2. Avoid envy. Envy not only makes people miserable, but turns them into lousy investors.

3. Eliminate resentment. Wallowing in resentment leads to more misery, and it's better to think of things to be grateful for.

4. Stay cheerful despite adversity. Life does not follow a predetermined path. “Life will have terrible blows in it, horrible blows, unfair blows. It doesn’t matter. And some people recover and others don’t.”

5. Be reliable and surround yourself with reliable people. Reliability is about being predictable and reasonable but don't spend too much time worrying about what other people do. “If you’re unreliable, it doesn’t matter what your virtues are. Doing what you’ve faithfully engaged to do should be an automatic part of your conduct. You want to avoid sloth and unreliability.”

6. Follow your natural drift towards something that excites you. “If you can’t somehow find yourself very interested in something, I don’t think you’ll succeed very much, even if you’re fairly smart.”

7. Read and study constantly. Learn from past mistakes and become as educated as possible.

What is the relevance of happiness to investing? It's a stretch to argue happier people make better investors, but if the daily volatility of the market and share prices make you tense and losses create anxiety, then you're not living your best life. It would be better to diversify your investments across a range of funds (active or passive) according to your risk appetite, and leave the asset management to someone else (even if it's in an index) while you get on with something that gives you more pleasure, while trying to ignore the market noise.

If a portfolio is constantly adjusted due to the worries of staring at a screen all day, the results are likely to be inferior versus staying invested for the long term. A recent global funds management survey by EY concludes:

"Australian clients appear more actively aware of declines in their portfolios than those in other markets, with the vast majority (97%) saying they change investment behaviour due to declines in portfolio value, significantly above the global average of 73%."

But if you enjoy investing for yourself, then go with it, although this quotation from Thomas Kennedy, the Chief Investment Officer at Trafalgar Partners, a US hedge fund, when asked if he likes his job, shows an extreme:

"Absolutely. Best job ever but you have to love it, otherwise the volatility will kill you. My team and I work 85 hours a week on average. The stress is offset by the money we make and spend when we are not working. My work week runs from 3pm on Sunday until 1pm on Friday here in San Francisco so I get about 50 hours off a week to relax with my wife, kids, and 5 dogs ... there is such a rush standing in the center of the markets as they swirl about, that is the most exciting thing about my life and feeds my passion. If you aren’t geared for it though it will kill you."

Take Munger's advice and look for rules that make you happy rather than worrying day and night about your investments. There's no point spending your time trading and investing if it kills you.

***

Regardless of the commitment and disposition of a fund manager, nobody is happy losing money for their clients, and investors in many regional US banks have taken a hit. Morningstar analysed local portfolios to show Australians are not immune, and with billions of dollars of losses, Sweden's largest pension fund, Alectra, has dismissed its CEO and suffered a massive impact on its reputation and performance.

Don't be mistaken in thinking that all investors have been protected by the Federal Deposit Insurance Corporation, because shareholders and bondholders have been wiped out by the demise of First Republic, whose staff are now employed by JPMorgan. First Republic held US$230 billion in assets, making its fall the second-largest in US history and the biggest since 2008. This is serious. US bank regulators do not want the big banks to grow by acquisition, but circumstances are so desperate that there are few other choices. The deal was announced at 4:30am on a Monday morning which shows bankers and regulators had worked all weekend on the terms. Jamie Dimon of JP Morgan held the aces. In this crisis of confidence, many other major U.S. regional banks are losing deposits and their share prices are falling, wiping out hundreds of billions of value.

Australia is often criticised for the dominance of its large banks but the US is heading the same way, with JP Morgan now holding over 10% of all US deposits and the top 10 banks controlling 65%. Here is a graphic of market concentration in US financial services. It represents the market value of each sector (banks, insurance, asset management, etc) and the values of the companies in that sector (for example, JPM is JP Morgan, BAC is Bank of America and WFC is Wells Fargo). The number is the overnight price movement:

***

It's reached the stage where the cash rate leads the news every few weeks. I spoke on ABC Radio in Brisbane last week about the Reserve Bank Review. After this week's increase in the cash rate to 3.85%, the 11th in a year, it's not difficult to conclude that Governor Philip Lowe will use the remaining four months of his term to quash inflation, even if the consequences for some borrowers are dire. Although he is no doubt an honourable person with the best interests to do his job well, criticisms in the Review would have stung him. One reason why his time will not be extended is that while the Government has accepted all 51 recommendations, he disagrees with many claims in the Review. Putting aside that he has been at the RBA for 43 years and ‘CEO’ since 2016, how can he implement the changes when he does not agree with them, or at least the supporting evidence that led to them?

The most revealing comment in the Review is that he did not advise the Board before he started making his long-term predictions on cash rates staying at 0.1% for many years, and that meant he was setting policy without Board input. In fact, the Board had previously received a paper warning against long-term forward guidance.

***

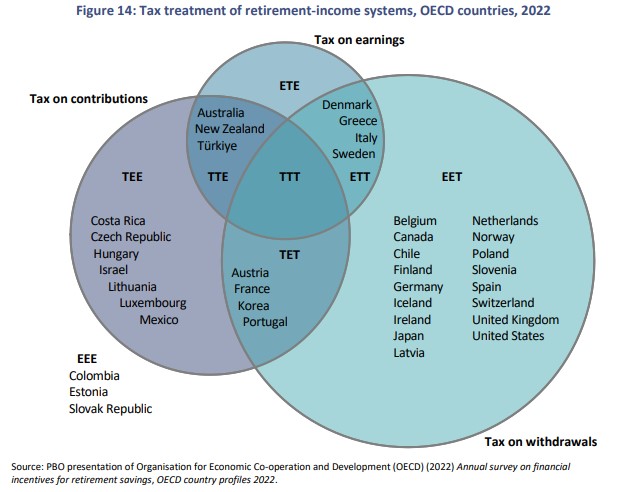

The Parliamentary Budget Office (PBO) has taken a close look at how super is taxed, and we summarise the major points. It may give hints to future targets for a government looking to cut concessions. Among many good charts is this one below comparing super taxation in all OECD countries, and Australia's 'TTE' system is unusual.

Superannuation can be taxed at three different points:

- When contributions are made into a super fund

- When super fund assets earn investment returns (earnings)

- When withdrawals are made from a super fund.

If each taxing point is denoted as either ‘T’ for Taxed or ‘E’ for Exempt, Australia is said to have a ‘TTE’ super tax system. No country uses a TTT. Anyone complaining about how lightly our super pensions are taxed should consider how many countries are EET, with no taxing of contributions or earnings.

Firstlinks does not normally focus on stock selections but this week's edition has plenty of ideas from leading stock pickers.

We have three fund manager interviews. Eric Marais of Orbis explains why active managers often need to tolerate underperformance versus an index in the interests of long-term results, while Simon Mawhinney of Allan Gray describes how he is positioning his portfolio with some examples of stocks he likes, even if it takes the market a while to recognise the value. That's life for a contrarian fund manager.

Then Emma Fisher of Airlie Funds Management speaks about a recent international research tour which has increased her confidence in three stocks in her portfolio. She is especially keen on companies that can thrive if economic conditions sour.

Graham Hand

Also in this week's edition ...

Brendan Ryan from Later Life Advice looks at the recent increase in the aged pension, which he says presents both challenges and opportunities. One issue is a change in aged care costs, and another is that it's not just pensioners impacted by the changes, but non-pensioners too.

Kelli Meagher of Sage Capital says that with increasing economic uncertainty and markets near all-time highs, now's the time to focus on quality stocks. Quality being those companies that are insulated from any economic downturn. Kelli thinks CSL and Corporate Travel Management fit the bill and are poised to outperform.

The telecommunications industry in Australia has seen a seemingly never-ending price war, though Lucas Goode of IML believes that's now at an end. To play the industry turnaround, Lucas likes dominant market player, Telstra. He says improved pricing power for the company combined with continued volume growth, along with aggressive cost cutting targets, should assure several years of strong earnings growth.

Thanks for the hundreds of comments in last week's short survey on why Australians and French react differently to pension eligibility ages, as well as your reaction to the level of JobSeeker paid to the unemployed. Leisa has extracted some highlights in her summary article, as well as attaching the majority of the comments.

Two extra articles from Morningstar for the weekend. Joshua Peach writes of five ASX stocks to avoid at current prices and James Gruber asks whether the shae prices of office REITs have bottomed.

This week's White Paper from Resolution Capital examines the effect recent bank collapses might have on global commercial real estate markets.

***

Weekend market update

Stocks in the US stormed higher on Friday to wrap up a choppy week as the S&P 500 logged a near 2% advance to sit higher by 8.3% so far this year. Meanwhile, while Treasurys came under pressure with the US long bond rising three basis points to 3.76% and the two-year yield vaulting to 3.92% from 3.75% Thursday. WTI crude rebounded above $71 a barrel, gold pulled back to $2,025 per ounce and the VIX sank nearly three points to about 17.

From AAP Netdesk:

On Friday on the ASX, the local market bounced back after the week's jitters from US banking failures. The benchmark S&P/ASX200 index finished Friday up 26.9 points, or 0.37%, to 7,220. The broader All Ordinaries rose by 24.9 points, or 0.34%, to 7,413.

The financials sector has turned around in the afternoon, with the major banks finishing in the green.

ANZ announced on Friday its half-year net interest income increased by 20% to $8.5 billion from a year ago, driven by higher average net loans. Its deposits and other borrowings increased by 8% to $843 billion. The banking group was up 1.45% to $23.80.

Among the other banks, Westpac by 0.47% to $21.35, and CBA gained 0.4% to $96.13. NAB and Macquarie continued moving lower despite reporting positive net profits this week, with NAB down 0.5% to $26.58 and Macquarie down 0.2% to $177.35.

Meanwhile, the materials sector finished up 0.52% despite iron ore price economic data coming out of China putting major miners under pressure. BHP was up 0.2% to $44.05 and Newcrest Mining improving by 2.19% to $29.80. Rio Tinto was down 0.7% to $109.37, and Fortescue Metals by 0.15% to $20.25.

Of other large caps, blood products giant CSL was up 0.32% to $301.05 in health care while warehouse owner Goodman Group rose 3.04% to $20.

From Shane Oliver, AMP:

Global share markets mostly fell over the last week with further rate hikes and ongoing concerns about US banks and the US debt ceiling. Despite strong rallies on Friday as US banks bounced and as solid US payrolls tempered recession fears a bit, for the week US shares lost 0.8% and Eurozone shares fell 0.5%. Chinese shares fell 0.3% and Japanese shares rose 1%. Australian shares fell by another 1.2% not helped by the surprise RBA rate hike and the weak global lead with financials, resources and telcos leading the falls. Bond yields were mixed and little changed. Oil and iron ore prices fell but metal prices were flat. The $A rose though as the $US fell.

Sell in May and go away? Shares entering a rougher patch. After a strong start to the year - supported by hopes that rates will soon peak enabling a soft landing and better than feared profits - shares are increasingly vulnerable to a rough patch ahead. While the Fed is toning down its hawkishness – it along with the ECB and RBA continued to raise interest rates over the last week adding to recession risks. This is despite ongoing issues with banking stress in the US.

The RBA raised its cash rate by another 0.25% taking it to 3.85%, surprising most economists including ourselves and the money market. We had thought that the decline in inflation and the absence of much new information since the last meeting would have seen the RBA pause for longer than one month. The RBA’s Statement on Monetary Policy didn’t make any major changes to its forecasts, but it did revise its forecasts for this year a bit to show: slightly lower GDP growth of 1.25% reflecting slower consumer spending and business investment; slightly higher unemployment of 4% partly due to stronger population growth; and lower inflation of 4.5% and trimmed mean inflation of 4% partly reflecting lower than expected inflation in the March quarter. In fact, its forecasts imply that trimmed mean inflation on a quarterly annualised basis will be back at the top of the target range next year. All of which could be interpreted as consistent with a less hawkish stance by the RBA than its currently communicating.

As a result, we remain of the view that the RBA has done enough and that rates have peaked. However, so far we have been wrongly too optimistic on this and the risk of a further increase in rates remains very high given the RBA’s concerns about sticky services inflation (partly based on overseas experience), wages growth flowing from the tight labour market (not helped by the coming 15% rise in aged care wages), stronger population growth boosting housing related inflation (including for property prices which would reverse the negative wealth effect of falling prices) and the lower $A.

Our concern though is that the jobs market and inflation are lagging indicators and the RBA is not paying enough attention to the way interest rate hikes hit the economy with a lag. This in turn runs the rising risk of knocking the economy into a recession. Interestingly, the money market (which was well ahead of most economists in anticipating rate hikes for last year) is pricing in close to a zero chance of another hike and a 100% chance of a cut by year end.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Allan Gray and Orbis Investments will host their 2023 Investment Forum in person in many parts of Australia over late May and into June. More information about the event can be found here.

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website